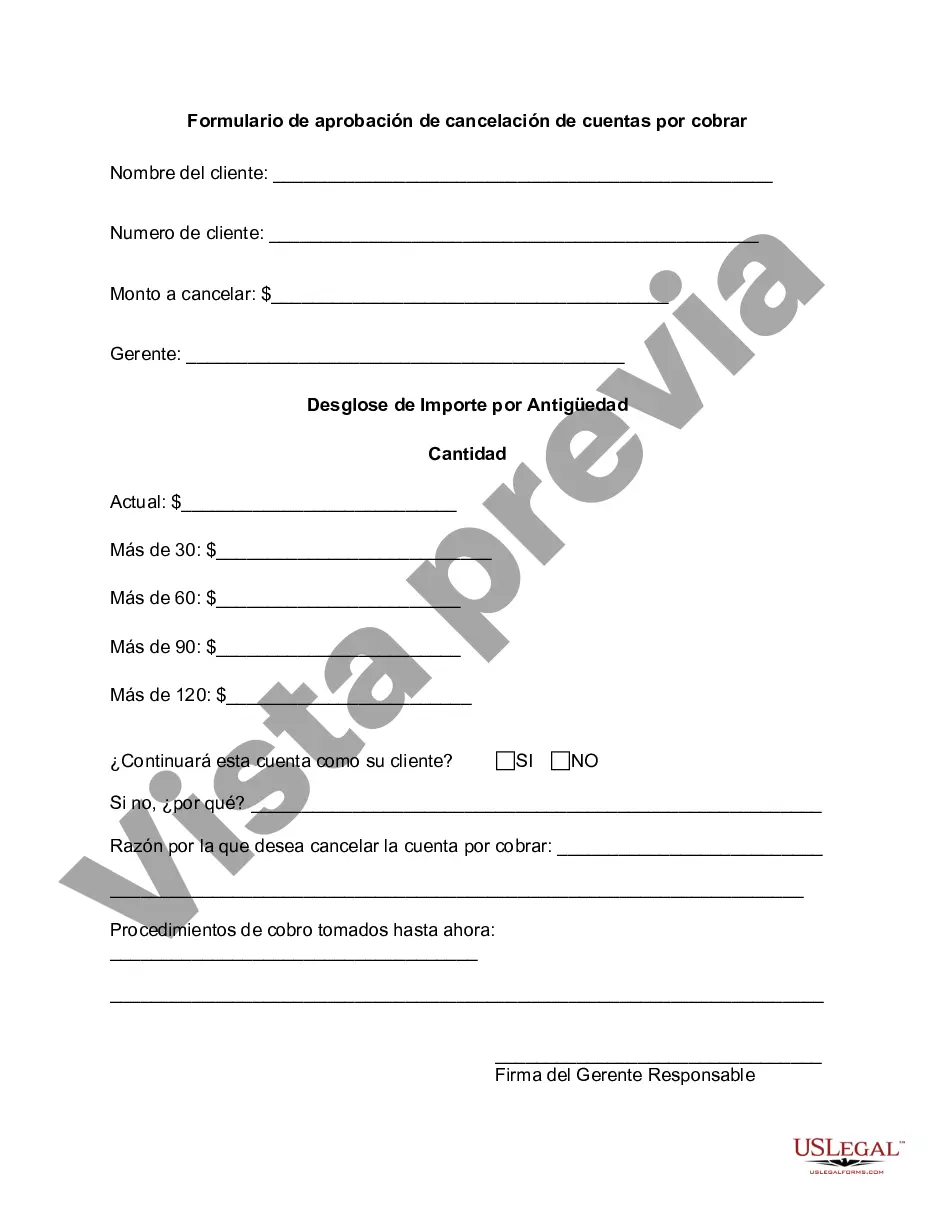

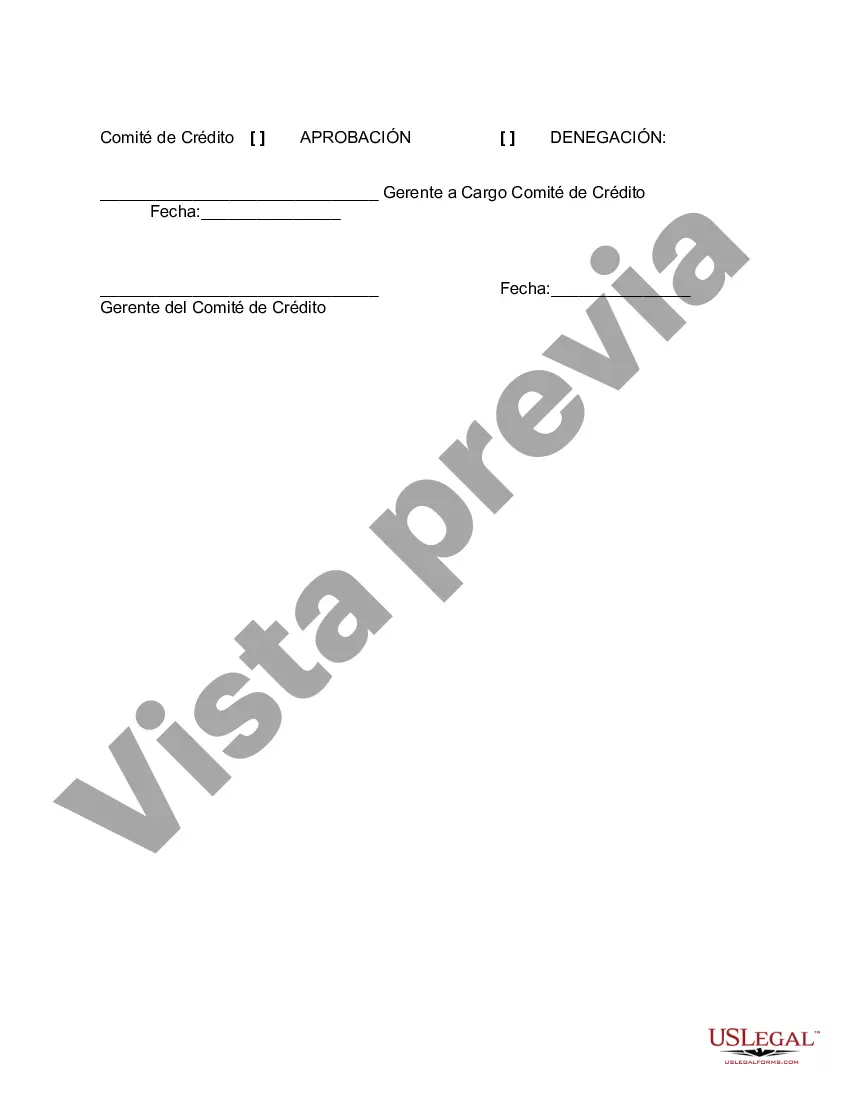

Middlesex Massachusetts Accounts Receivable Write-Off Approval Form is a document used by businesses in Middlesex County, Massachusetts, to authorize the write-off of outstanding accounts receivable. This form serves as an official approval for the cancellation or deletion of delinquent or uncollectible debts owed to the company. The Middlesex Massachusetts Accounts Receivable Write-Off Approval Form includes various sections that gather crucial information. It typically starts with the company's name, address, and contact details. The form often requires the creditor's name, account number, and an explanation of the debt in question. This form may also include fields for the date when the debt was first incurred, the invoice number(s) associated with the debt, and the original amount owed. It is essential to provide these details accurately to ensure proper tracking and assessment of the account write-off. The Middlesex Massachusetts Accounts Receivable Write-Off Approval Form further requests the reason for requesting the write-off. This reason should be well-substantiated to demonstrate due diligence in attempting to collect the debt and to justify the need for write-off approval. Adequate documentation, such as communication records, collection letters, or evidence of the debtor's inability to pay, might be required to support the claim. It's worth noting that there might be different versions or variations of the Middlesex Massachusetts Accounts Receivable Write-Off Approval Form, depending on the specific requirements or preferences of each organization. Some businesses might have customized templates tailored to their internal processes and policies. However, regardless of the format, the overall purpose remains consistent: to obtain official authorization for the write-off of delinquent accounts receivable. Using a standardized Middlesex Massachusetts Accounts Receivable Write-Off Approval Form helps streamline the write-off process, ensuring adherence to proper accounting practices, and facilitating internal control measures. By documenting the approval, companies can maintain accurate financial records and provide transparency in their financial reporting. In conclusion, the Middlesex Massachusetts Accounts Receivable Write-Off Approval Form is a vital document for businesses operating in Middlesex County. It enables companies to properly write off bad debts and maintain accurate financial records, ensuring compliance with accounting standards and internal control procedures while providing transparency in financial reporting.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Middlesex Massachusetts Formulario de aprobación de cancelación de cuentas por cobrar - Accounts Receivable Write-Off Approval Form

Description

How to fill out Middlesex Massachusetts Formulario De Aprobación De Cancelación De Cuentas Por Cobrar?

Preparing legal paperwork can be difficult. In addition, if you decide to ask a legal professional to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Middlesex Accounts Receivable Write-Off Approval Form, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case gathered all in one place. Consequently, if you need the recent version of the Middlesex Accounts Receivable Write-Off Approval Form, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Middlesex Accounts Receivable Write-Off Approval Form:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Middlesex Accounts Receivable Write-Off Approval Form and download it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!