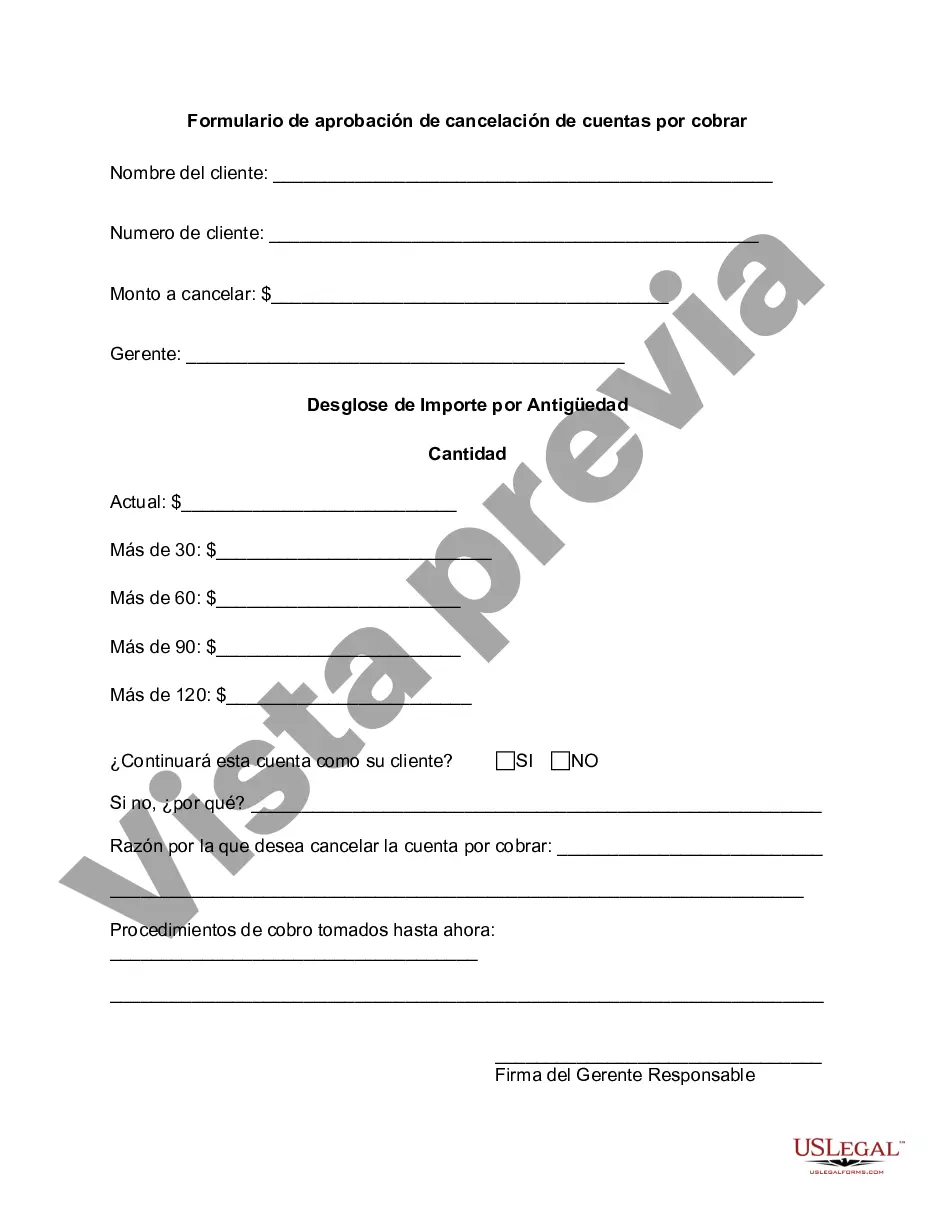

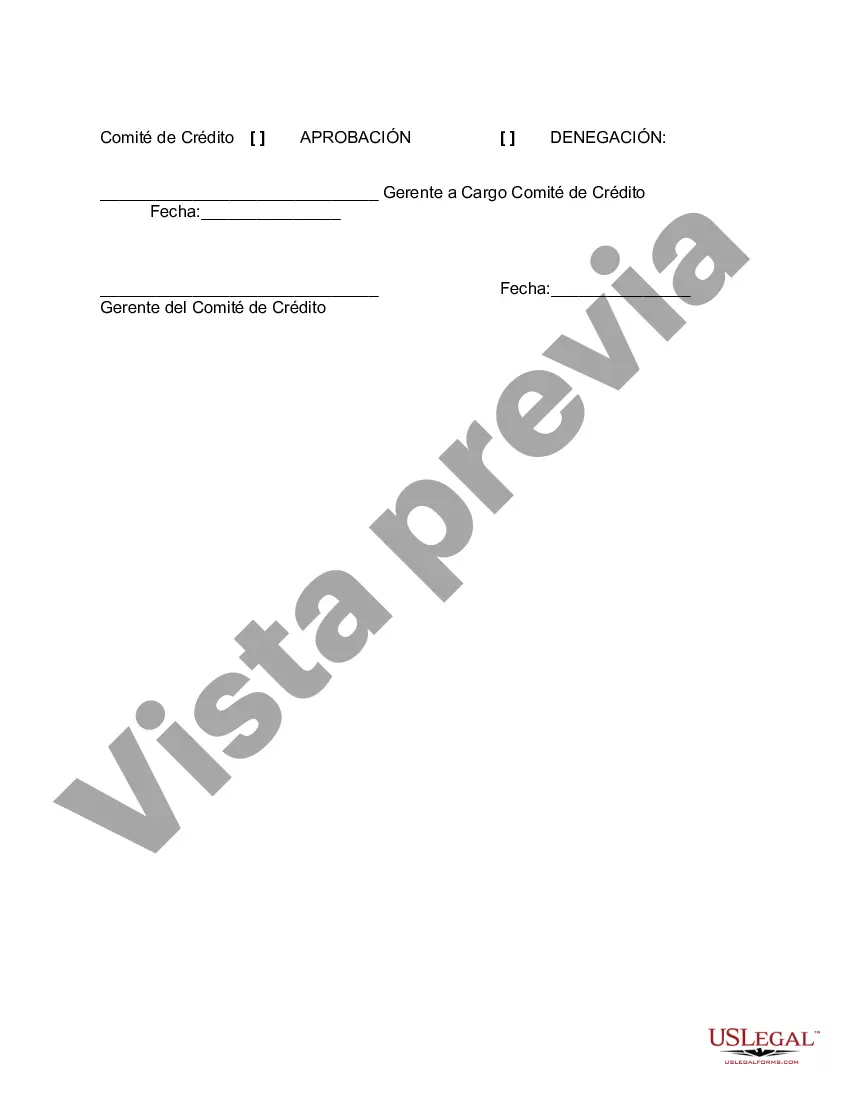

Description: Montgomery Maryland Accounts Receivable Write-Off Approval Form The Montgomery Maryland Accounts Receivable Write-Off Approval Form is a vital document used by businesses and organizations to request approval for the write-off of unpaid accounts receivable. This document provides a structured process for reviewing and authorizing the removal of delinquent amounts from a company's financial records. The purpose of the Accounts Receivable Write-Off Approval Form is to ensure transparency, accountability, and proper documentation when dealing with uncollectible debts. It enables businesses to maintain accurate financial records and safeguard their financial health. This form offers multiple variations to accommodate different scenarios that may arise regarding outstanding accounts. Keywords: Montgomery, Maryland, accounts receivable, write-off, approval form, unpaid debts, delinquent amounts, financial records, transparency, accountability, documentation, uncollectible debts, accurate, financial health. Types of Montgomery Maryland Accounts Receivable Write-Off Approval Forms: 1. Standard Write-Off Approval Form: This is the primary and most commonly used version of the form. It allows businesses to seek approval for write-offs on unpaid accounts receivable within a predetermined limit. This version ensures consistency and efficiency in managing uncollectible debts. 2. Exceptional Write-Off Approval Form: This type of form is used for cases that require individual consideration, such as high-value accounts or unique circumstances. It involves a more detailed review process and higher levels of authorization before approving the write-off. 3. Small Claims Write-Off Approval Form: Designed specifically for low-value or small outstanding accounts, this form streamlines the approval process by offering a simplified approach for write-offs that fall below a predetermined threshold. It allows for quicker resolution of smaller debts and minimizes administrative efforts. 4. Write-Off Reversal Form: In certain cases, businesses may need to reverse previously approved write-offs due to recoveries or errors. This form enables companies to request the cancellation or modification of previously authorized write-offs, ensuring accurate and up-to-date financial reporting. 5. Audit Write-Off Approval Form: Used during internal or external audits, this specialized form allows businesses to provide detailed justifications and supporting documentation for any accounts receivable write-offs. It helps maintain transparency and compliance during the auditing process. Keywords: Montgomery, Maryland, accounts receivable, write-off, approval form, standard, exceptional, small claims, write-off reversal, audit, uncollectible debts, financial records, transparency.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Formulario de aprobación de cancelación de cuentas por cobrar - Accounts Receivable Write-Off Approval Form

Description

How to fill out Montgomery Maryland Formulario De Aprobación De Cancelación De Cuentas Por Cobrar?

Are you looking to quickly draft a legally-binding Montgomery Accounts Receivable Write-Off Approval Form or probably any other document to handle your own or corporate affairs? You can go with two options: hire a legal advisor to draft a legal document for you or draft it completely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you receive neatly written legal paperwork without paying sky-high fees for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-specific document templates, including Montgomery Accounts Receivable Write-Off Approval Form and form packages. We offer templates for an array of life circumstances: from divorce papers to real estate documents. We've been out there for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra troubles.

- First and foremost, double-check if the Montgomery Accounts Receivable Write-Off Approval Form is tailored to your state's or county's regulations.

- If the document comes with a desciption, make sure to check what it's suitable for.

- Start the search over if the form isn’t what you were hoping to find by utilizing the search bar in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Montgomery Accounts Receivable Write-Off Approval Form template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Additionally, the templates we offer are updated by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!