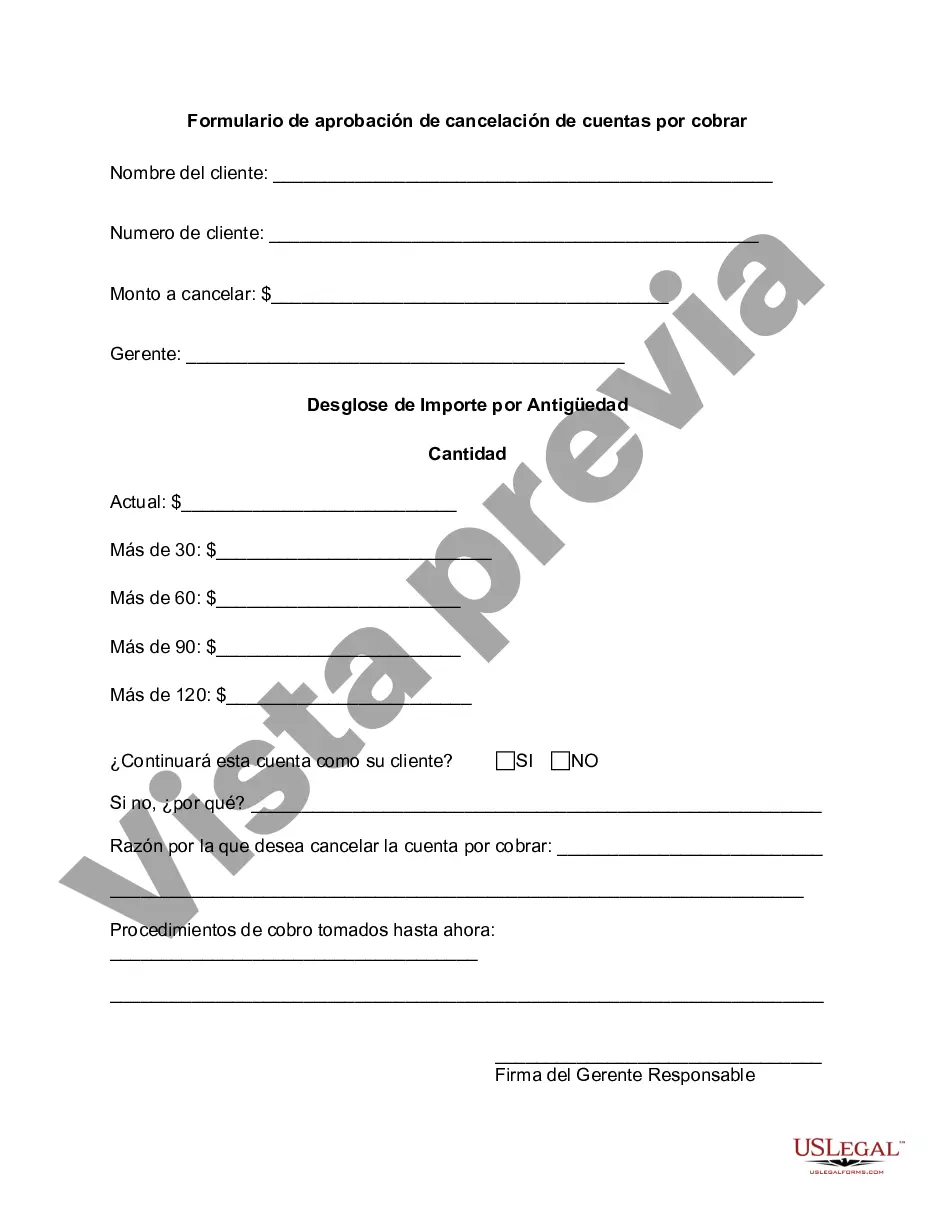

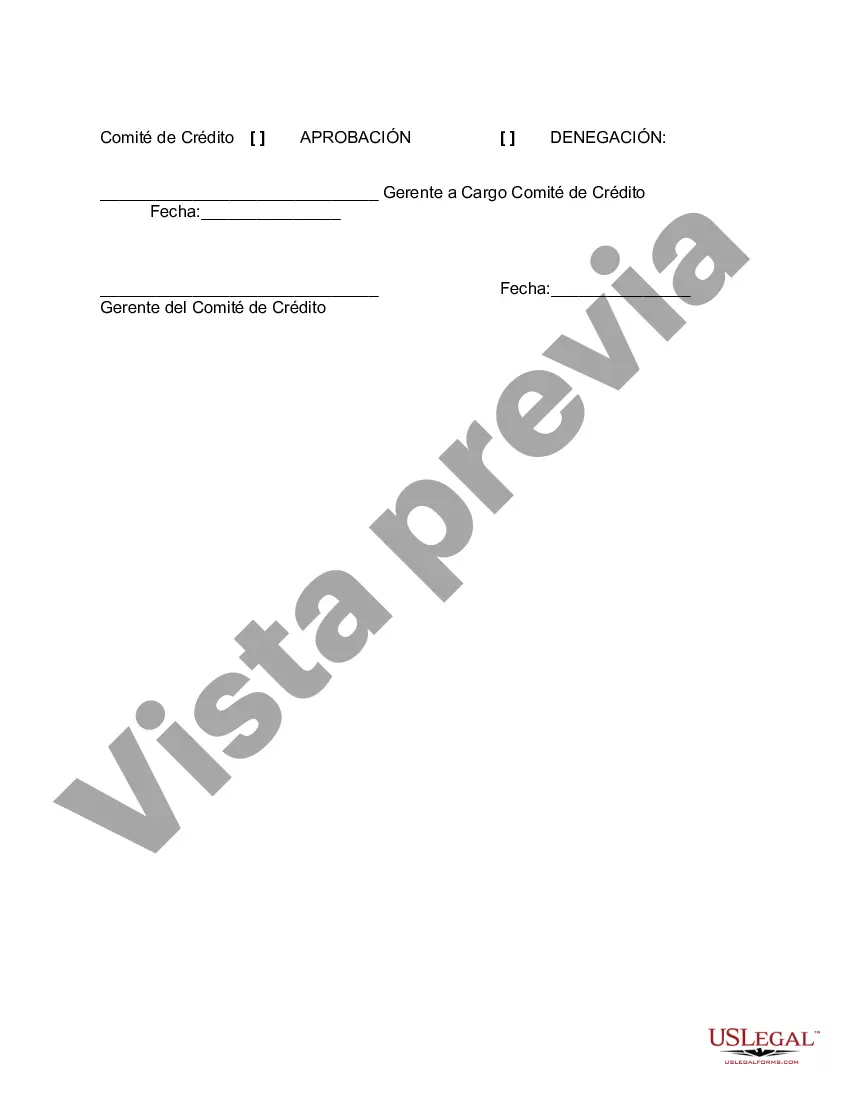

The Oakland Michigan Accounts Receivable Write-Off Approval Form is a crucial financial document used by businesses and organizations in the region to manage their accounts receivable process. This form enables companies to write off outstanding unpaid invoices or bad debts, ensuring accurate financial records and keeping their books in order. The form serves as an authorization for the write-off process to be initiated and requires proper approval from relevant parties. The Oakland Michigan Accounts Receivable Write-Off Approval Form streamlines the write-off procedure by including specific sections and details related to the write-off transaction. It includes fields for the company name, contact information, and essential identification numbers. Moreover, it contains sections for the write-off amount, the reason for write-off, and supporting documentation required for validation. This form allows for efficient tracking and monitoring of write-offs while also maintaining accountability within the organization. It helps to combat fraudulent activities, prevents unauthorized write-offs, and ensures proper audit trails. By utilizing this form, businesses and organizations in Oakland Michigan can uphold financial integrity and accuracy. Types of Oakland Michigan Accounts Receivable Write-Off Approval Forms may include: 1. Standard Write-Off Approval Form: This form is used for general write-offs of accounts receivable that meet predetermined criteria or threshold. 2. Bad Debt Write-Off Approval Form: Specifically designed for write-offs related to bad debts, this form requires additional documentation and explanation for internal evaluation and approval. 3. Exceptional Write-Off Approval Form: Occasionally, there may be exceptional cases that deviate from standard procedures. An exceptional write-off form caters to such unique scenarios, requiring higher-level authorization and comprehensive justification for the write-off. The Oakland Michigan Accounts Receivable Write-Off Approval Form, in its various types, ensures proper documentation, accountability, and compliance with financial processes. By utilizing these forms, businesses in Oakland Michigan can effectively manage their bottom line, prevent financial discrepancies, and maintain accurate financial records.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Formulario de aprobación de cancelación de cuentas por cobrar - Accounts Receivable Write-Off Approval Form

Description

How to fill out Oakland Michigan Formulario De Aprobación De Cancelación De Cuentas Por Cobrar?

Drafting documents for the business or individual needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the particular region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to create Oakland Accounts Receivable Write-Off Approval Form without expert help.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Oakland Accounts Receivable Write-Off Approval Form on your own, using the US Legal Forms online library. It is the biggest online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to get the Oakland Accounts Receivable Write-Off Approval Form:

- Examine the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To find the one that fits your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any situation with just a few clicks!