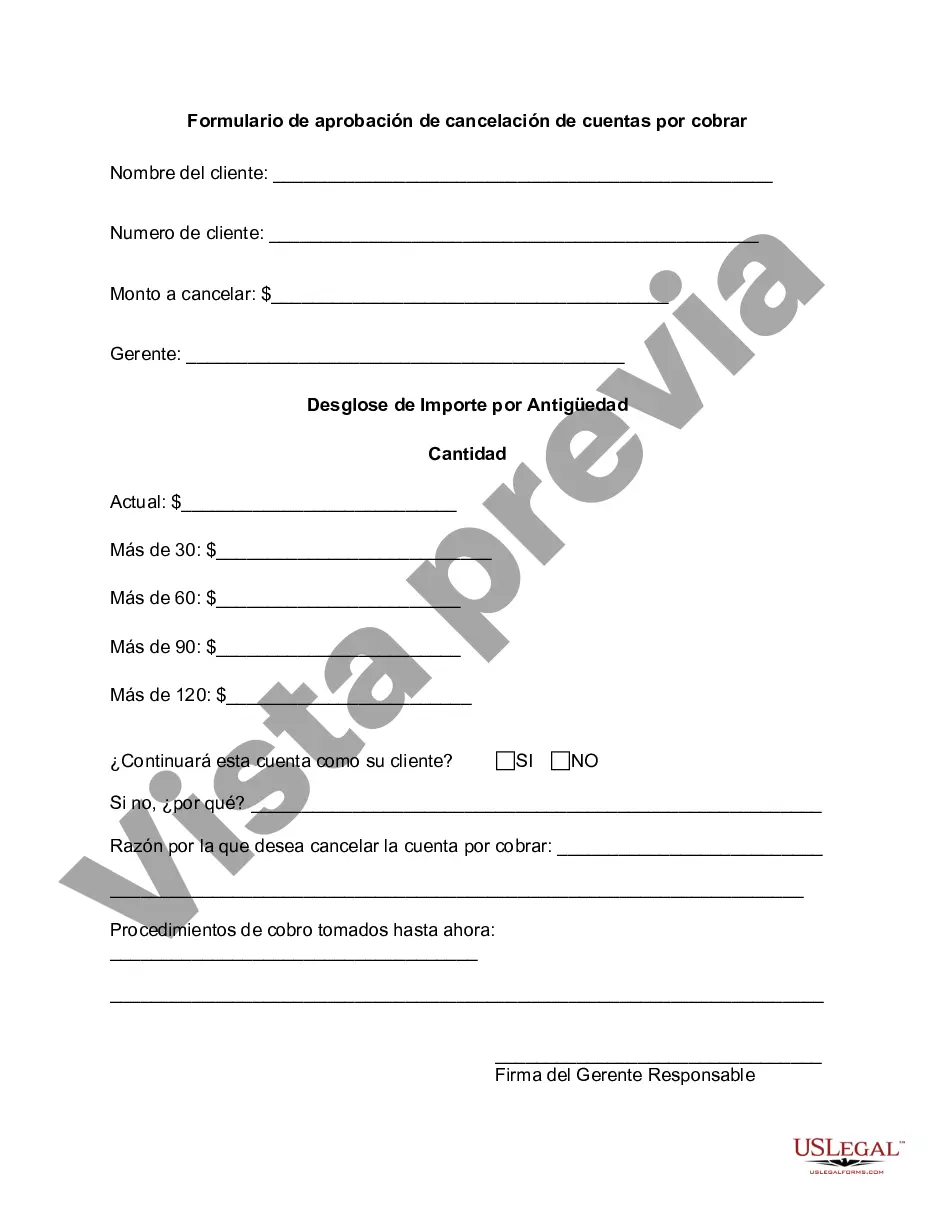

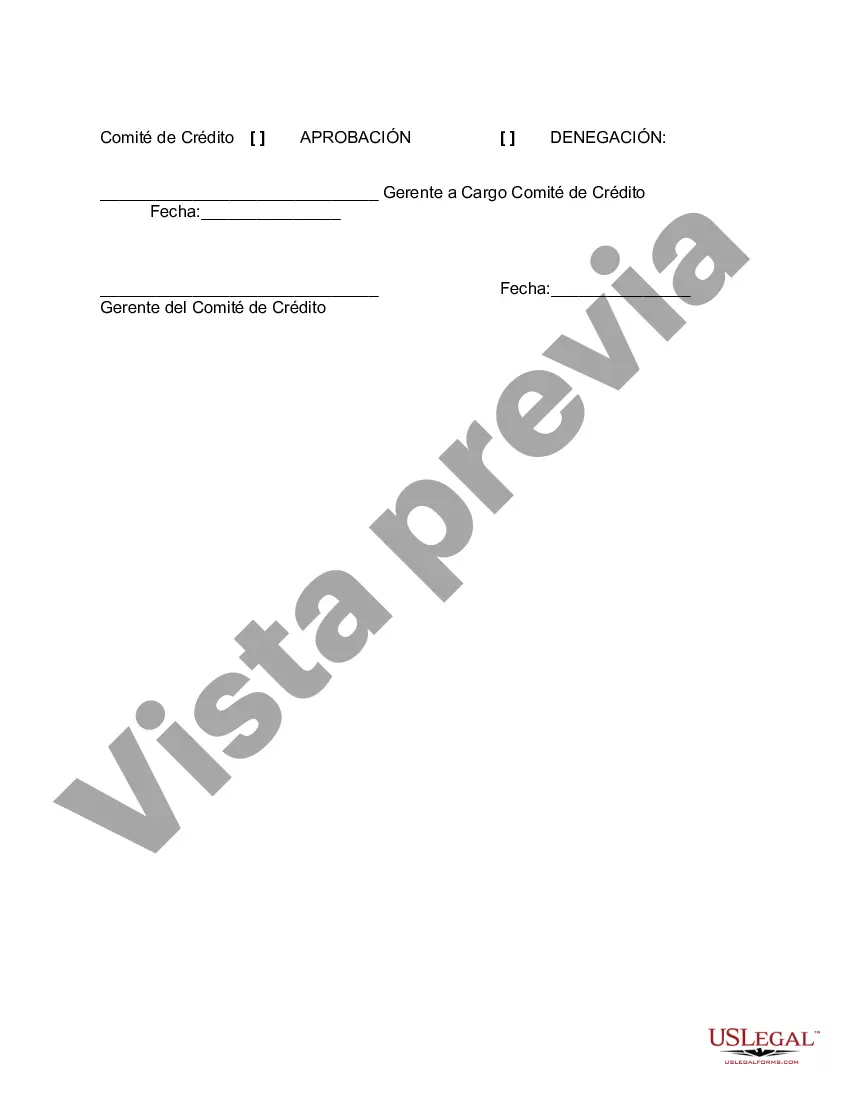

Philadelphia Pennsylvania Accounts Receivable Write-Off Approval Form is an essential document used to formally request the approval for the write-off of unpaid customer accounts in Philadelphia, Pennsylvania. This form plays a crucial role in maintaining accurate financial records and ensuring proper accounting practices within the organization. The Philadelphia Pennsylvania Accounts Receivable Write-Off Approval Form consists of several sections that capture important details and enable the proper review and authorization process to take place. Required information typically includes the customer's name, account number, outstanding amount, reasons for seeking a write-off, and any supporting documentation that justifies the request. By submitting this form, finance or accounts receivable personnel seek approval from relevant authorities, such as supervisors or managers, to write off the unpaid balances of delinquent customer accounts. This process ensures that the write-off decision is not made unilaterally but rather undergoes a thorough review to determine if it aligns with established policies and guidelines. Different types or variations of Philadelphia Pennsylvania Accounts Receivable Write-Off Approval Forms may exist depending on the specific organization or industry. Some forms may have additional sections tailored to capture unique information for certain sectors or to comply with specific regulatory requirements. Moreover, different departments within an organization may have their own customized forms to suit their operational needs. Common variations of Philadelphia Pennsylvania Accounts Receivable Write-Off Approval Forms may include: 1. Standard Accounts Receivable Write-Off Approval Form: This is the basic version of the form that encompasses all necessary fields to request write-off approval for unpaid customer accounts. 2. Department-Specific Write-Off Approval Forms: Certain departments within an organization may require a modified version of the form to capture specific details relevant to their operations. For example, a sales department may include additional sections related to salesperson feedback or efforts made to collect the outstanding amount. 3. Industry-Specific Write-Off Approval Forms: In some industries, such as healthcare or manufacturing, there might be specific requirements or regulations that necessitate the creation of customized write-off approval forms. These forms may include additional sections to gather industry-specific information or comply with regulatory guidelines. In any case, a comprehensive Philadelphia Pennsylvania Accounts Receivable Write-Off Approval Form is crucial to maintain proper financial integrity and ensure transparency in the write-off process. Employing this form helps organizations adhere to their internal policies, accounting standards, and legal obligations while managing their accounts receivable efficiently.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Formulario de aprobación de cancelación de cuentas por cobrar - Accounts Receivable Write-Off Approval Form

Description

How to fill out Philadelphia Pennsylvania Formulario De Aprobación De Cancelación De Cuentas Por Cobrar?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask an attorney to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Philadelphia Accounts Receivable Write-Off Approval Form, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario gathered all in one place. Therefore, if you need the current version of the Philadelphia Accounts Receivable Write-Off Approval Form, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Philadelphia Accounts Receivable Write-Off Approval Form:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Philadelphia Accounts Receivable Write-Off Approval Form and save it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!