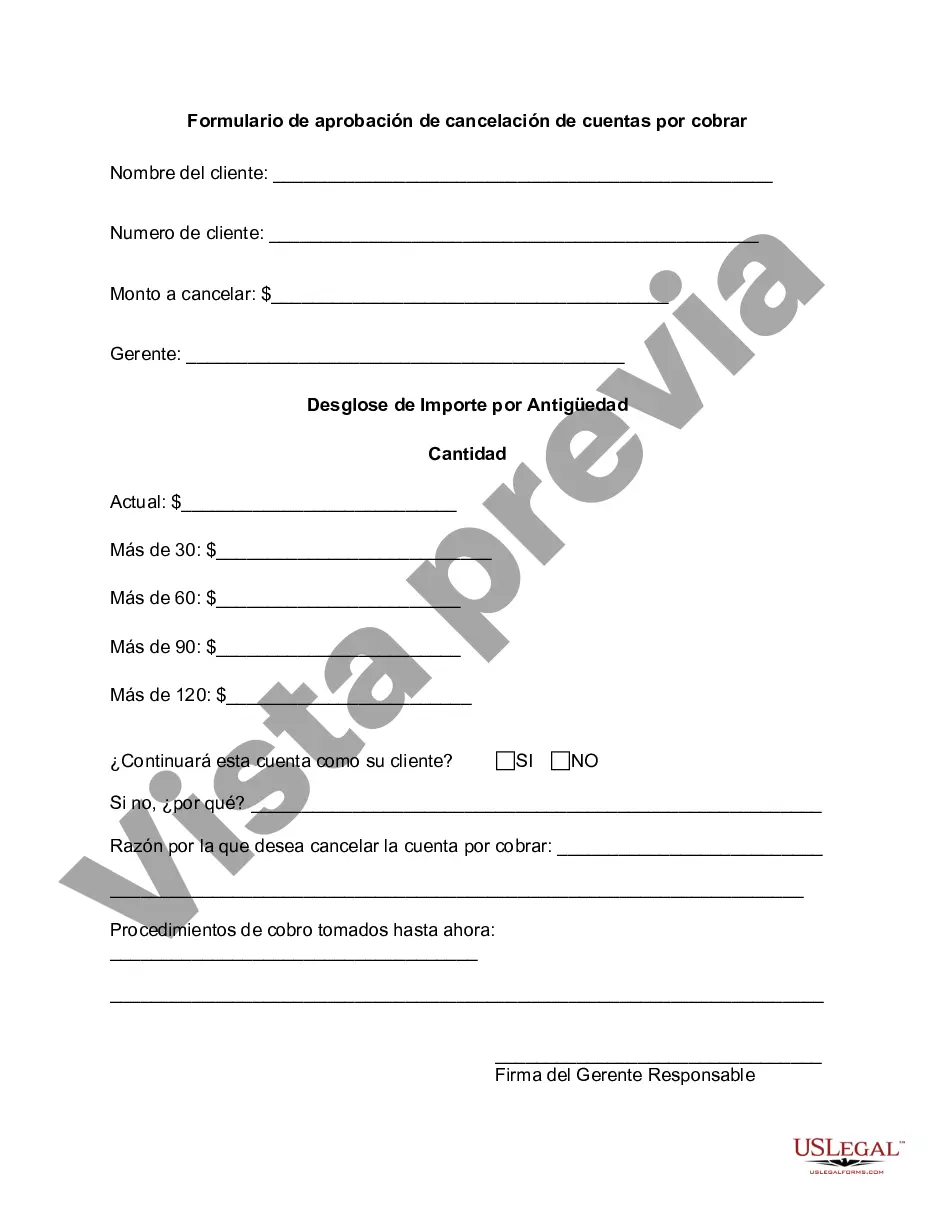

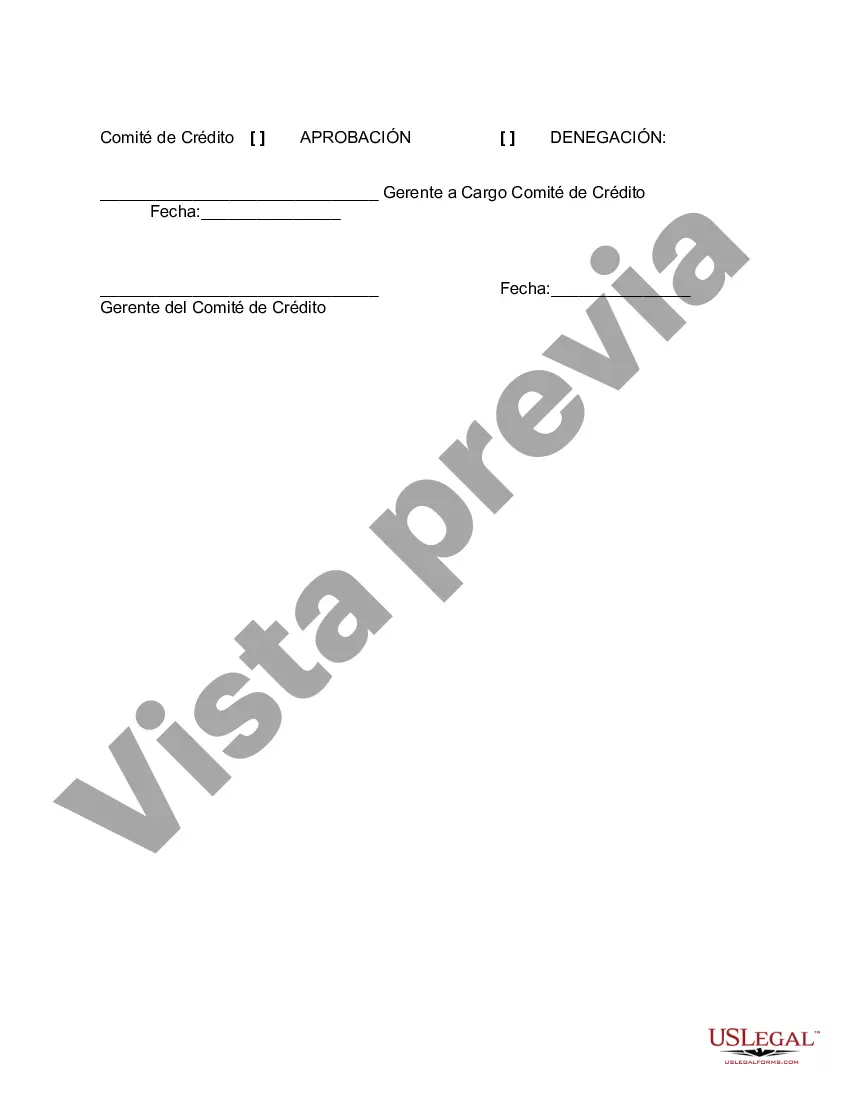

The Salt Lake Utah Accounts Receivable Write-Off Approval Form is an essential document used in financial management to authorize the write-off of outstanding invoices or debts within the Salt Lake City, Utah area. This form provides a systematic procedure for businesses to account for uncollectible or bad debts and ensure proper financial reporting. In Salt Lake City, Utah, there are different types of Accounts Receivable Write-Off Approval Forms tailored to specific industries or sectors. These forms may include: 1. Salt Lake Utah Accounts Receivable Write-Off Approval Form for Retail Businesses: This form is designed for retail businesses operating within Salt Lake City, Utah. It outlines the necessary details required to write off uncollectible debts owed by customers in the retail sector. 2. Salt Lake Utah Accounts Receivable Write-Off Approval Form for B2B (Business-to-Business) Companies: This specific form caters to B2B companies in Salt Lake City, Utah, enabling them to write off delinquent accounts related to transactions made between businesses. 3. Salt Lake Utah Accounts Receivable Write-Off Approval Form for Service-Based Industries: This form is crafted for service-based companies operating in Salt Lake City, Utah. It grants authorization to write off unpaid debts incurred for services rendered, such as consulting, maintenance, or professional services. Regardless of the specific type of form, all Salt Lake Utah Accounts Receivable Write-Off Approval Forms typically include the following relevant sections: 1. Company Details: This section captures the essential information about the company initiating the write-off, including its name, address, contact information, and account or invoice number. 2. Customer Details: This segment requires the client's information, such as their name, address, contact details, and outstanding invoice amount. 3. Reason for Write-Off: Here, the form prompts the user to provide a detailed explanation justifying the write-off. This could include customer bankruptcy, closure, insolvency, or other valid reasons for the account being deemed uncollectible. 4. Approval Process: This section outlines the authorization chain for approving the write-off request. It typically involves the signature and designation of relevant personnel, such as the accounts receivable manager, finance manager, and senior management. 5. Supporting Documentation: The form also requires attaching relevant documents, such as copies of invoices, customer correspondence, credit memos, or collection efforts made. These documents provide evidence for the legitimacy of the write-off and support financial record-keeping. Completing a Salt Lake Utah Accounts Receivable Write-Off Approval Form is crucial for businesses to maintain accurate financial statements and ensure compliance with accounting principles. This form plays a vital role in allowing companies to clear uncollectible debts from their accounts, facilitating transparency in financial reporting and decision-making processes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Salt Lake Utah Formulario de aprobación de cancelación de cuentas por cobrar - Accounts Receivable Write-Off Approval Form

Description

How to fill out Salt Lake Utah Formulario De Aprobación De Cancelación De Cuentas Por Cobrar?

Creating paperwork, like Salt Lake Accounts Receivable Write-Off Approval Form, to take care of your legal matters is a difficult and time-consumming task. A lot of cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can get your legal affairs into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents crafted for various cases and life circumstances. We make sure each document is compliant with the laws of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Salt Lake Accounts Receivable Write-Off Approval Form template. Simply log in to your account, download the form, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new customers is fairly straightforward! Here’s what you need to do before downloading Salt Lake Accounts Receivable Write-Off Approval Form:

- Make sure that your form is compliant with your state/county since the regulations for creating legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or reading a brief description. If the Salt Lake Accounts Receivable Write-Off Approval Form isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to start using our service and download the form.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment information.

- Your form is ready to go. You can try and download it.

It’s easy to locate and purchase the needed document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!