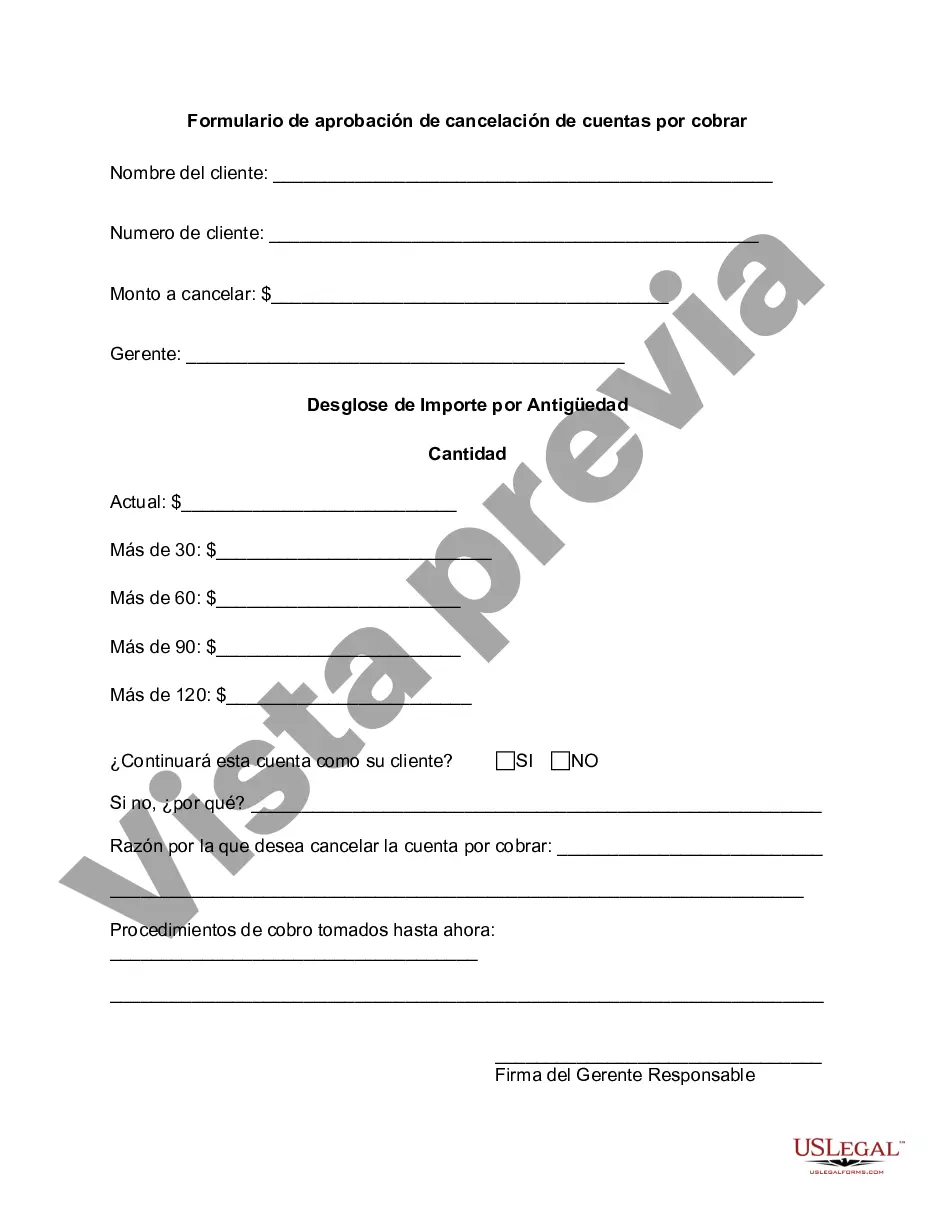

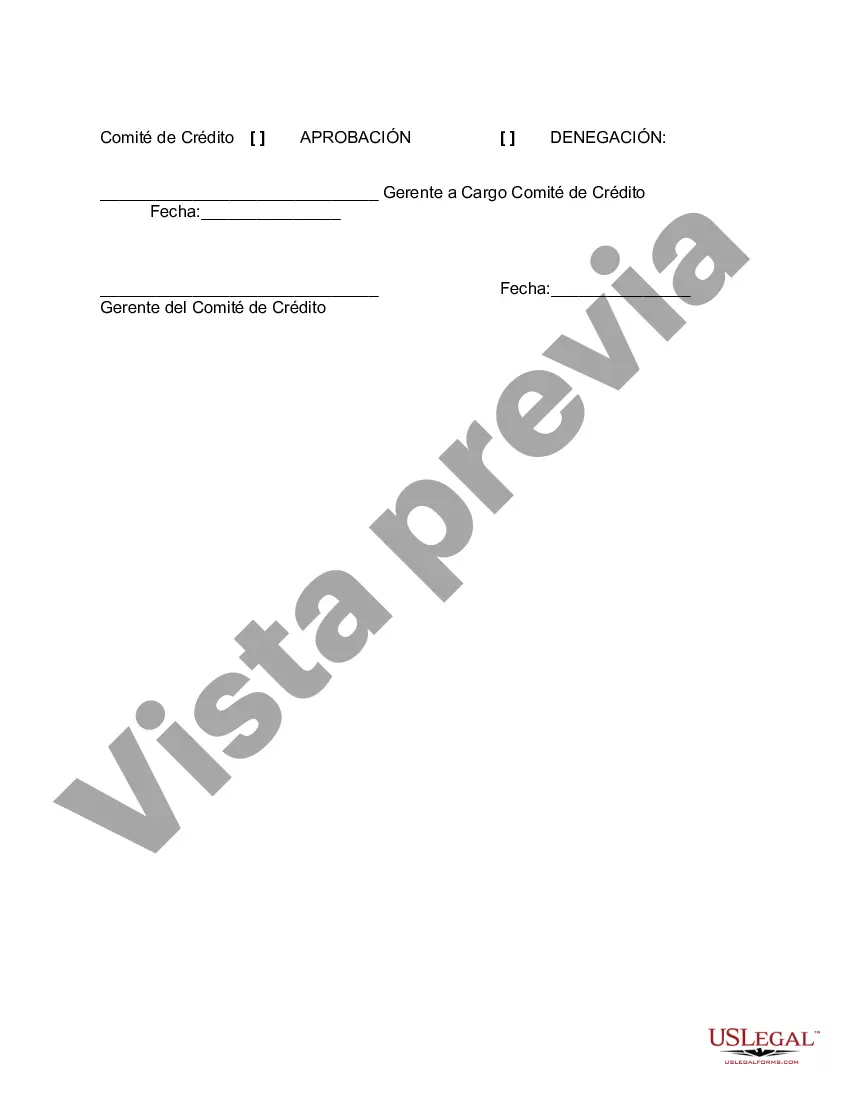

A Santa Clara California Accounts Receivable Write-Off Approval Form is a document that enables businesses and organizations in Santa Clara, California to record and authorize the write-off of unpaid accounts receivable. This form serves as an official record and helps maintain accuracy in financial statements by providing a system for approving the removal of bad debts from the accounts receivable balance. The Santa Clara California Accounts Receivable Write-Off Approval Form includes various sections that capture essential information for proper documentation. These sections typically include: 1. Contact Information: This part of the form requires the name, job title, department, and contact details of the person responsible for initiating the write-off request. 2. Customer Details: Here, the form collects relevant information about the customer, such as their name, account number, address, and outstanding balance. This section helps identify the specific account that needs to be written off. 3. Reason for Write-Off: The form requires a detailed explanation of the reason for the write-off request. Common reasons may include customer bankruptcies, uncollectible accounts, or disputes settled in court. 4. Supporting Documentation: This section provides an attachment option to include any supporting documentation, such as correspondence, legal judgments, or bankruptcy filings, that substantiates the need for the write-off. 5. Approval Signatures: The Santa Clara California Accounts Receivable Write-Off Approval Form includes designated spaces for appropriate personnel to sign and date the document, indicating their approval. These signatures often involve individuals from the credit department, finance department, and management team. It is important to note that while there may not be specific variations of the Santa Clara California Accounts Receivable Write-Off Approval Form, businesses and organizations might customize the form based on their unique requirements. Such customizations may involve additional fields to capture specific information relevant to their industry or internal processes. Using relevant keywords for this topic could include: Santa Clara, California, accounts receivable, write-off approval form, customer details, contact information, supporting documentation, approval signatures, unpaid accounts, bad debts, financial statements, credit department, finance department, management, customization.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Formulario de aprobación de cancelación de cuentas por cobrar - Accounts Receivable Write-Off Approval Form

Description

How to fill out Santa Clara California Formulario De Aprobación De Cancelación De Cuentas Por Cobrar?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to create some of them from the ground up, including Santa Clara Accounts Receivable Write-Off Approval Form, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in different types varying from living wills to real estate paperwork to divorce papers. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find information materials and guides on the website to make any tasks related to paperwork completion simple.

Here's how to find and download Santa Clara Accounts Receivable Write-Off Approval Form.

- Take a look at the document's preview and description (if provided) to get a basic information on what you’ll get after downloading the form.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can affect the validity of some records.

- Check the related forms or start the search over to locate the appropriate file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment method, and buy Santa Clara Accounts Receivable Write-Off Approval Form.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Santa Clara Accounts Receivable Write-Off Approval Form, log in to your account, and download it. Needless to say, our platform can’t replace a legal professional entirely. If you have to deal with an extremely difficult case, we advise getting an attorney to check your document before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Join them today and get your state-specific paperwork with ease!