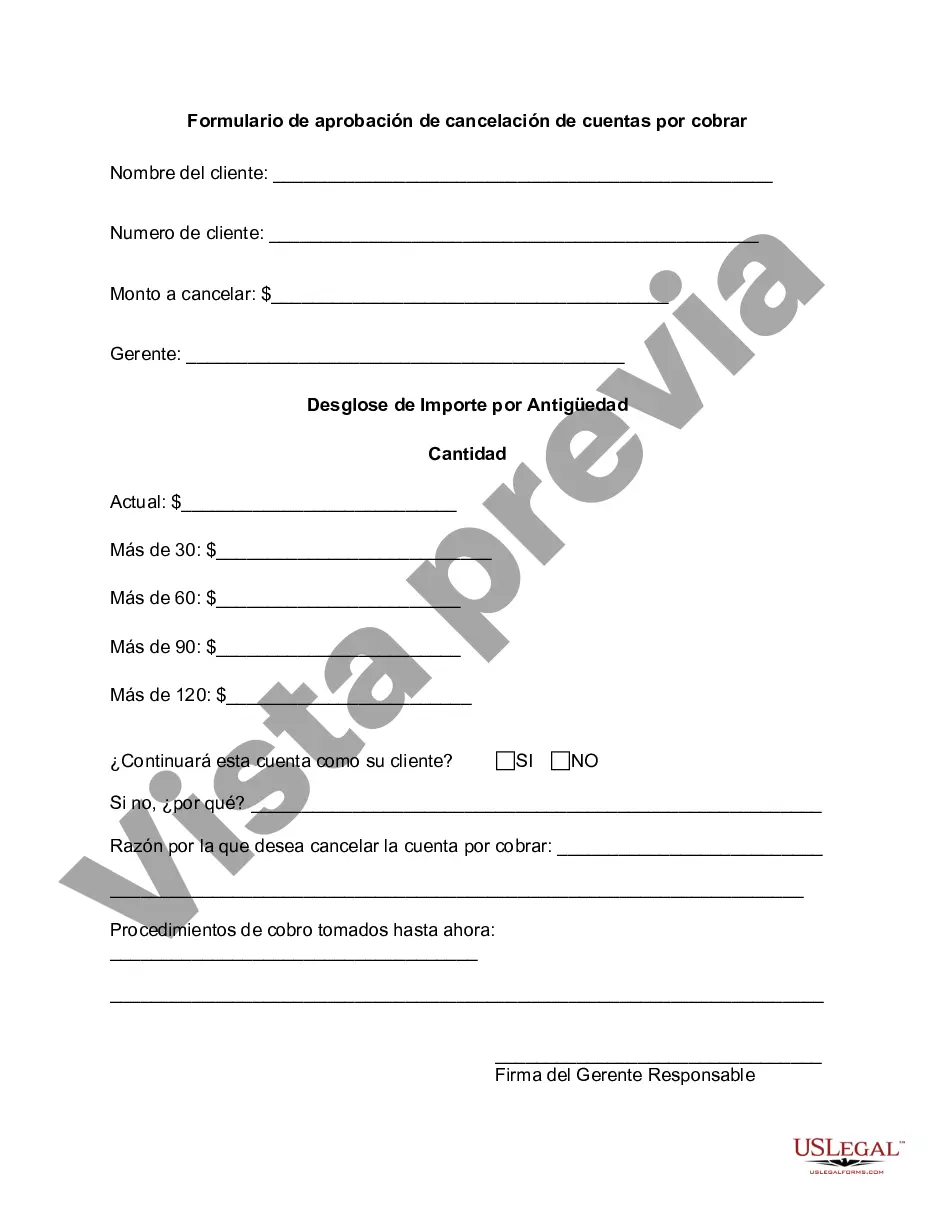

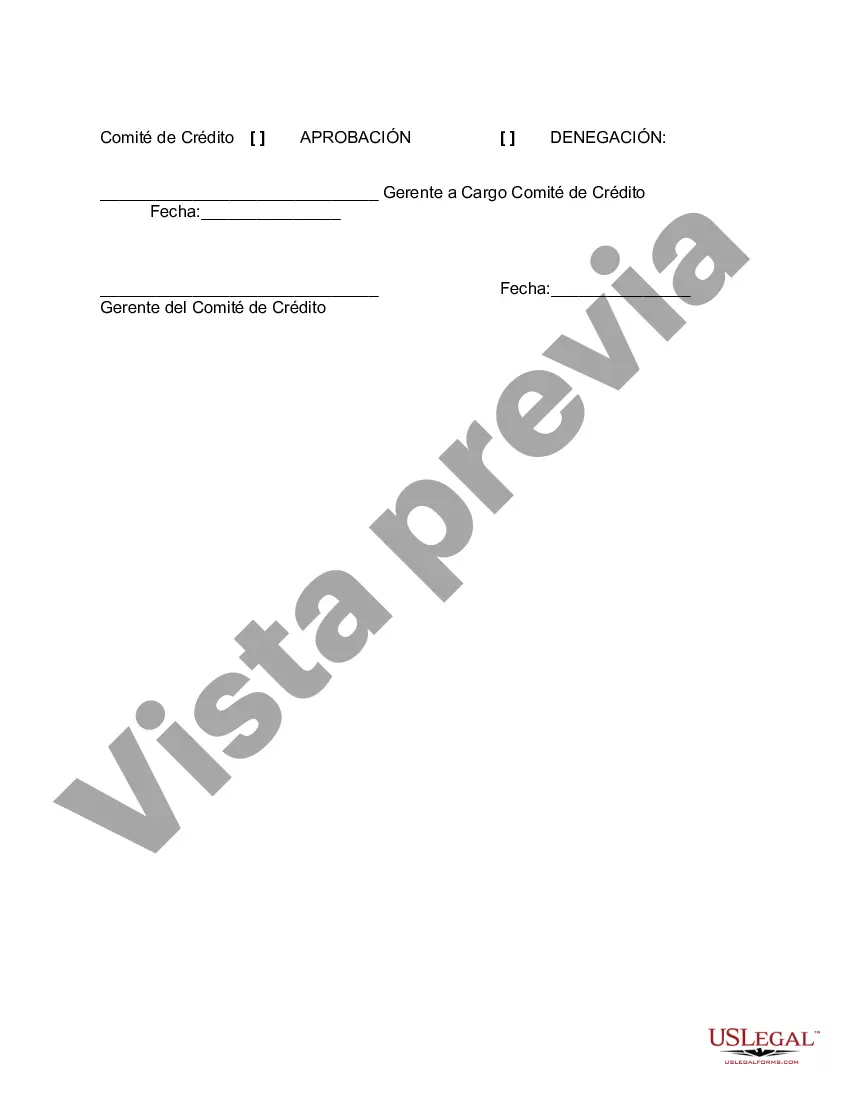

The Tarrant Texas Accounts Receivable Write-Off Approval Form is a document used in financial management to record and authorize the cancellation or write-off of unpaid customer invoices. This form helps businesses streamline their accounts receivable process and ensures that write-offs are done in a controlled and accountable manner. A crucial tool for maintaining accurate financial records, the Tarrant Texas Accounts Receivable Write-Off Approval Form captures essential information such as the customer name, invoice number, amount to be written off, and the reason for write-off. This form serves as an internal authorization document, ensuring that all write-offs are approved by the appropriate personnel. Different types of Tarrant Texas Accounts Receivable Write-Off Approval Forms may exist depending on the specific requirements of the business or industry. These may include: 1. Standard Tarrant Texas Accounts Receivable Write-Off Approval Form: This is the most common type of form used by businesses in Tarrant, Texas. It follows a standardized format and includes all necessary fields to document and approve write-offs. 2. Department-Specific Tarrant Texas Accounts Receivable Write-Off Approval Form: In larger organizations, different departments may have their own write-off approval forms to streamline the process. These forms may include additional fields specific to the department's requirements. 3. Electronic Tarrant Texas Accounts Receivable Write-Off Approval Form: With the advancement of technology, businesses may opt for electronic forms that can be filled out and submitted online. Electronic forms can enhance efficiency and provide a digital trail of the approval process. Having a Tarrant Texas Accounts Receivable Write-Off Approval Form in place helps businesses maintain control over their accounts receivable write-offs, prevent fraud or unauthorized write-offs, and ensure accurate financial reporting. It enables businesses to assess their bad debt and make informed decisions about their credit and collection policies. By implementing this form, businesses in Tarrant, Texas can manage their accounts receivable effectively and maintain strong financial health.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tarrant Texas Formulario de aprobación de cancelación de cuentas por cobrar - Accounts Receivable Write-Off Approval Form

Description

How to fill out Tarrant Texas Formulario De Aprobación De Cancelación De Cuentas Por Cobrar?

Preparing legal documentation can be burdensome. Besides, if you decide to ask an attorney to draft a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Tarrant Accounts Receivable Write-Off Approval Form, it may cost you a fortune. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case gathered all in one place. Therefore, if you need the current version of the Tarrant Accounts Receivable Write-Off Approval Form, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Tarrant Accounts Receivable Write-Off Approval Form:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Tarrant Accounts Receivable Write-Off Approval Form and save it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Give it a try now!