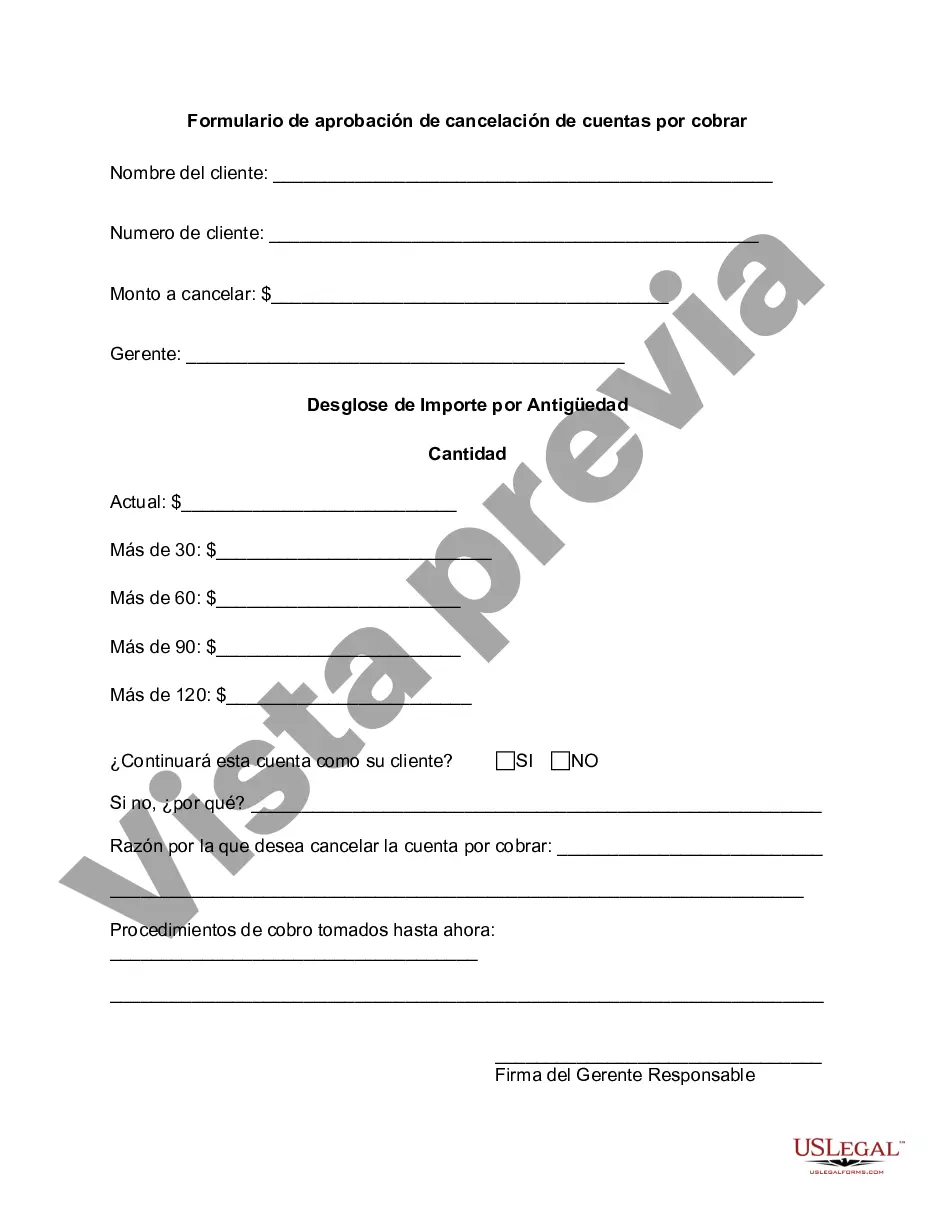

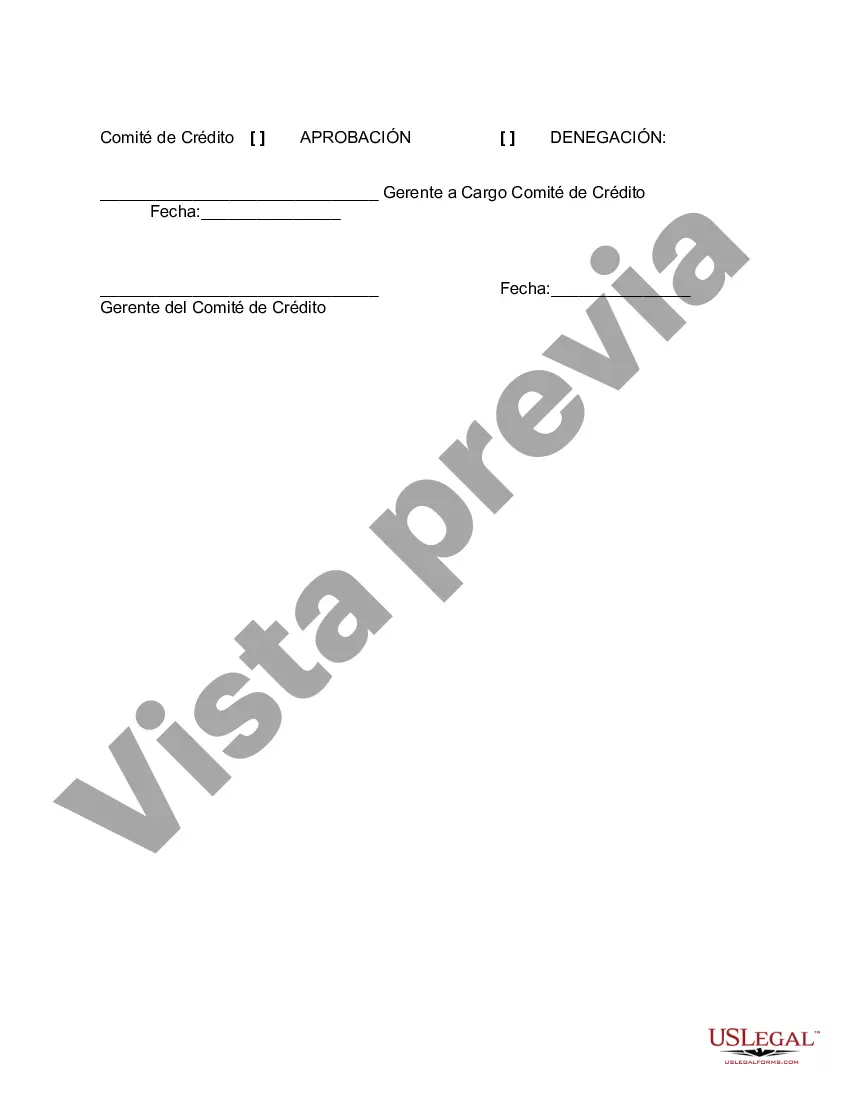

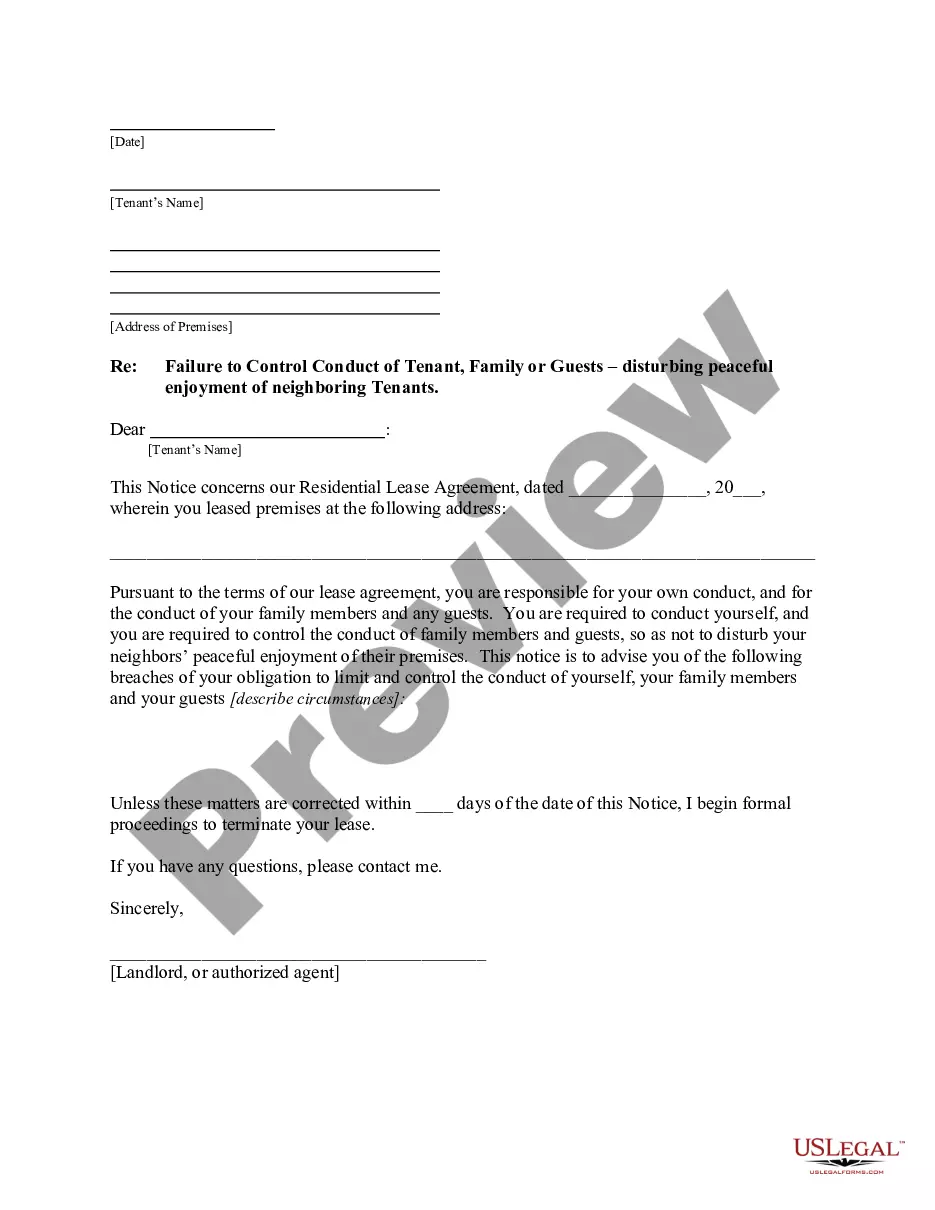

The Travis Texas Accounts Receivable Write-Off Approval Form is an essential document used to authorize the write-off of unpaid accounts receivable in Travis, Texas. This form outlines the necessary information and approvals required for the write-off process, ensuring compliance with local regulations and organizational policies. The Travis Texas Accounts Receivable Write-Off Approval Form serves as a means to document and track the write-off decisions made for outstanding debts. It helps maintain transparency and accountability in the process while safeguarding the financial health of the organization. The form typically includes the following details: 1. Organization Information: The name, address, and contact details of the company initiating the write-off process. 2. Debtor Details: The name and the outstanding balance of the debtor whose account is being considered for write-off. This information helps identify the specific receivable that needs to be written off. 3. Justification: A concise explanation of the circumstances leading to the decision to write off the account. This includes factors such as bankruptcy, insolvency, uncollectible debts, or legal complications. An explanation is critical for internal review and auditing purposes. 4. Approval Signatures: The form requires signatures from relevant individuals within the organization authorized to approve write-offs, such as department heads, financial managers, or senior executives. These signatures ensure that the write-off decision has been duly evaluated and authorized. 5. Supporting Documentation: The form may require attachment of supporting documents, like records of collection efforts, communication logs, legal documents, or bankruptcy filings, to substantiate the write-off request. Different types of Travis Texas Accounts Receivable Write-Off Approval Forms may exist depending on the specific policies and guidelines set forth by individual organizations. Some examples include: 1. Small Business Accounts Receivable Write-Off Approval Form: Designed for small businesses, this form may have simplified sections and approvals to comply with the unique context and requirements of smaller enterprises. 2. Corporate Accounts Receivable Write-Off Approval Form: Created for larger corporations, this form might include additional layers of review and approval, involving multiple stakeholders and departments. 3. Government Accounts Receivable Write-Off Approval Form: Structured to meet the legal requirements and regulations governing government entities, this form may have specific sections or documentation requirements aligned with government accounting practices. In conclusion, the Travis Texas Accounts Receivable Write-Off Approval Form is a comprehensive document that facilitates the necessary approvals and documentation for writing off outstanding accounts receivable in Travis, Texas. It ensures adherence to internal controls, compliance with regulations, and transparency in the financial management process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Formulario de aprobación de cancelación de cuentas por cobrar - Accounts Receivable Write-Off Approval Form

Description

How to fill out Travis Texas Formulario De Aprobación De Cancelación De Cuentas Por Cobrar?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from the ground up, including Travis Accounts Receivable Write-Off Approval Form, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various categories ranging from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching experience less overwhelming. You can also find information resources and tutorials on the website to make any tasks related to document completion simple.

Here's how to find and download Travis Accounts Receivable Write-Off Approval Form.

- Take a look at the document's preview and outline (if available) to get a basic information on what you’ll get after downloading the form.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can impact the legality of some records.

- Examine the related forms or start the search over to locate the correct file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment method, and purchase Travis Accounts Receivable Write-Off Approval Form.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Travis Accounts Receivable Write-Off Approval Form, log in to your account, and download it. Needless to say, our website can’t replace a legal professional entirely. If you need to cope with an extremely difficult situation, we advise getting an attorney to review your form before executing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Become one of them today and purchase your state-specific paperwork with ease!