Wake North Carolina Extended Date for Performance is an extension granted to individuals or businesses in Wake County, North Carolina, allowing them additional time to meet their performance obligations, such as filing documents, paying fees, or completing projects. This extension is usually provided due to certain circumstances or events that hinder the timely completion of tasks. One type of Wake North Carolina Extended Date for Performance is related to tax obligations. Taxpayers may be granted an extended deadline to file their state income tax returns or make tax payments due to unforeseen situations such as natural disasters, personal emergencies, or system failures. Another type of Wake North Carolina Extended Date for Performance is granted in the context of legal proceedings. Parties involved in a lawsuit or legal dispute may receive an extension on deadlines for filing motions, responding to pleadings, or completing certain actions required by the court. This extension helps ensure that all parties have reasonable opportunities to fulfill their obligations in a fair and just manner. Additionally, Wake North Carolina Extended Date for Performance can also apply to business activities. For instance, companies pursuing construction or development projects may be eligible for an extension to complete their work due to unexpected circumstances like inclement weather, labor strikes, or material shortages. Overall, Wake North Carolina Extended Date for Performance serves as a mechanism to provide flexibility and relieve pressure for individuals and entities facing difficulties in meeting their obligations within the given time frames. It is important to note that specific eligibility criteria, procedures, and limitations for obtaining extensions may vary depending on the type of performance, the need for an extension, and relevant governing laws and regulations.

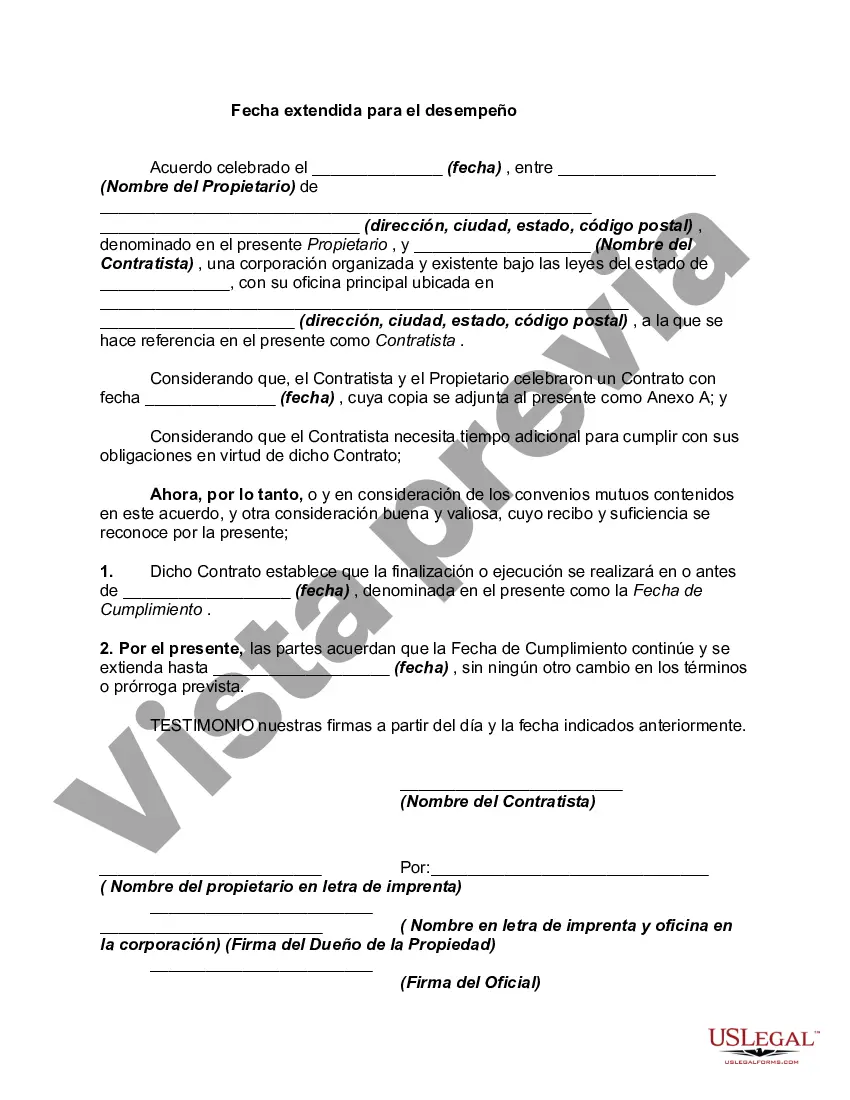

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Fecha extendida para el rendimiento - Extended Date for Performance

Description

How to fill out Wake North Carolina Fecha Extendida Para El Rendimiento?

How much time does it usually take you to draw up a legal document? Because every state has its laws and regulations for every life situation, finding a Wake Extended Date for Performance suiting all regional requirements can be tiring, and ordering it from a professional attorney is often expensive. Many online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online collection of templates, collected by states and areas of use. In addition to the Wake Extended Date for Performance, here you can find any specific form to run your business or personal deeds, complying with your county requirements. Experts verify all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can get the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be a few more actions to complete before you obtain your Wake Extended Date for Performance:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Wake Extended Date for Performance.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!