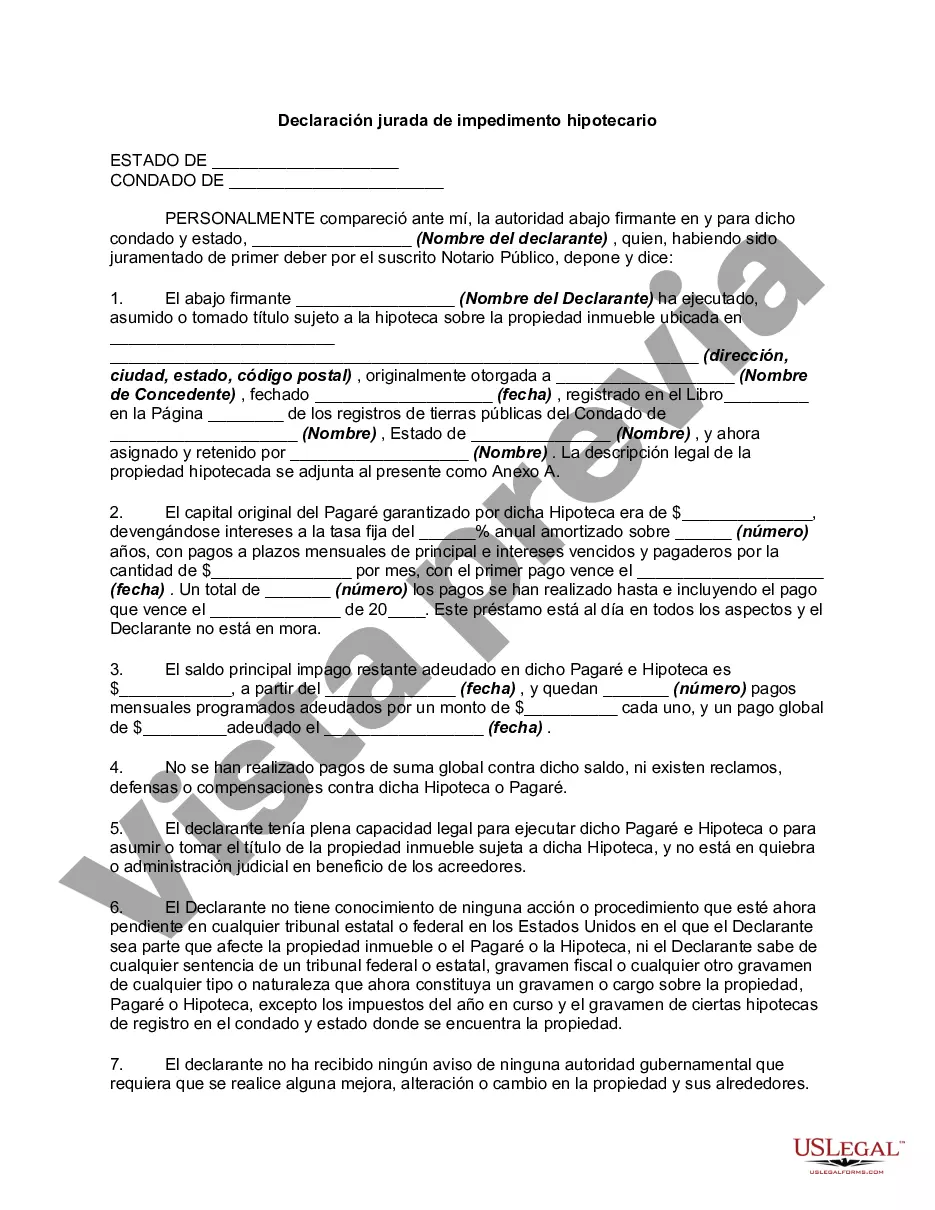

A Cuyahoga Ohio Estoppel Affidavit of Mortgagor is an important legal document used in real estate transactions, specifically in the Cuyahoga County area of Ohio. It serves as a written statement by the mortgagor (borrower) in a mortgage agreement, declaring the current status of the mortgage. This affidavit helps verify the legal rights and privileges of the mortgagor, as well as any existing claims or encumbrances on the property. The Cuyahoga Ohio Estoppel Affidavit of Mortgagor contains vital information about the mortgage loan, including the loan amount, interest rate, repayment terms, and any outstanding balances. This document also mentions the dates of the loan origination, modifications, or any relevant updates that could affect the mortgage agreement. By signing the Cuyahoga Ohio Estoppel Affidavit of Mortgagor, the borrower confirms the accuracy of the loan terms and the balance owed. They also assert that there have been no undisclosed modifications, assignments, or transfers related to the mortgage. Different types of Cuyahoga Ohio Estoppel Affidavit of Mortgagor include: 1. Commercial Estoppel Affidavit: Used for commercial or business-related properties, this affidavit is relevant in cases where the mortgagor owns or uses the property for commercial purposes. 2. Residential Estoppel Affidavit: Designed for residential properties, this affidavit is commonly used when the mortgagor's dwelling serves as their primary residence. 3. Partial Estoppel Affidavit: This type of affidavit is used when the borrower wishes to declare only specific information or aspects related to the mortgage, rather than the entire mortgage agreement. 4. Full Estoppel Affidavit: Unlike the partial affidavit, the full estoppel affidavit encompasses all relevant information and details of the mortgage agreement, leaving no aspect undisclosed. 5. Joint Estoppel Affidavit: This affidavit involves multiple mortgagors, typically referring to married couples or co-owners, who jointly provide information and statements regarding the mortgage loan. Overall, a Cuyahoga Ohio Estoppel Affidavit of Mortgagor is an essential legal document that helps ensure transparency and clarity in mortgage transactions. It protects both the borrower and lender by accurately documenting the terms and current status of the mortgage, which is crucial for any future legal actions or property transfers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Declaración jurada de impedimento hipotecario - Estoppel Affidavit of Mortgagor

Description

How to fill out Cuyahoga Ohio Declaración Jurada De Impedimento Hipotecario?

If you need to find a trustworthy legal paperwork supplier to get the Cuyahoga Estoppel Affidavit of Mortgagor, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can search from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of supporting resources, and dedicated support make it simple to locate and complete various documents.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply type to look for or browse Cuyahoga Estoppel Affidavit of Mortgagor, either by a keyword or by the state/county the document is intended for. After finding the needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Cuyahoga Estoppel Affidavit of Mortgagor template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Create an account and choose a subscription plan. The template will be immediately available for download as soon as the payment is completed. Now you can complete the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes this experience less pricey and more affordable. Set up your first company, organize your advance care planning, draft a real estate contract, or complete the Cuyahoga Estoppel Affidavit of Mortgagor - all from the convenience of your home.

Sign up for US Legal Forms now!