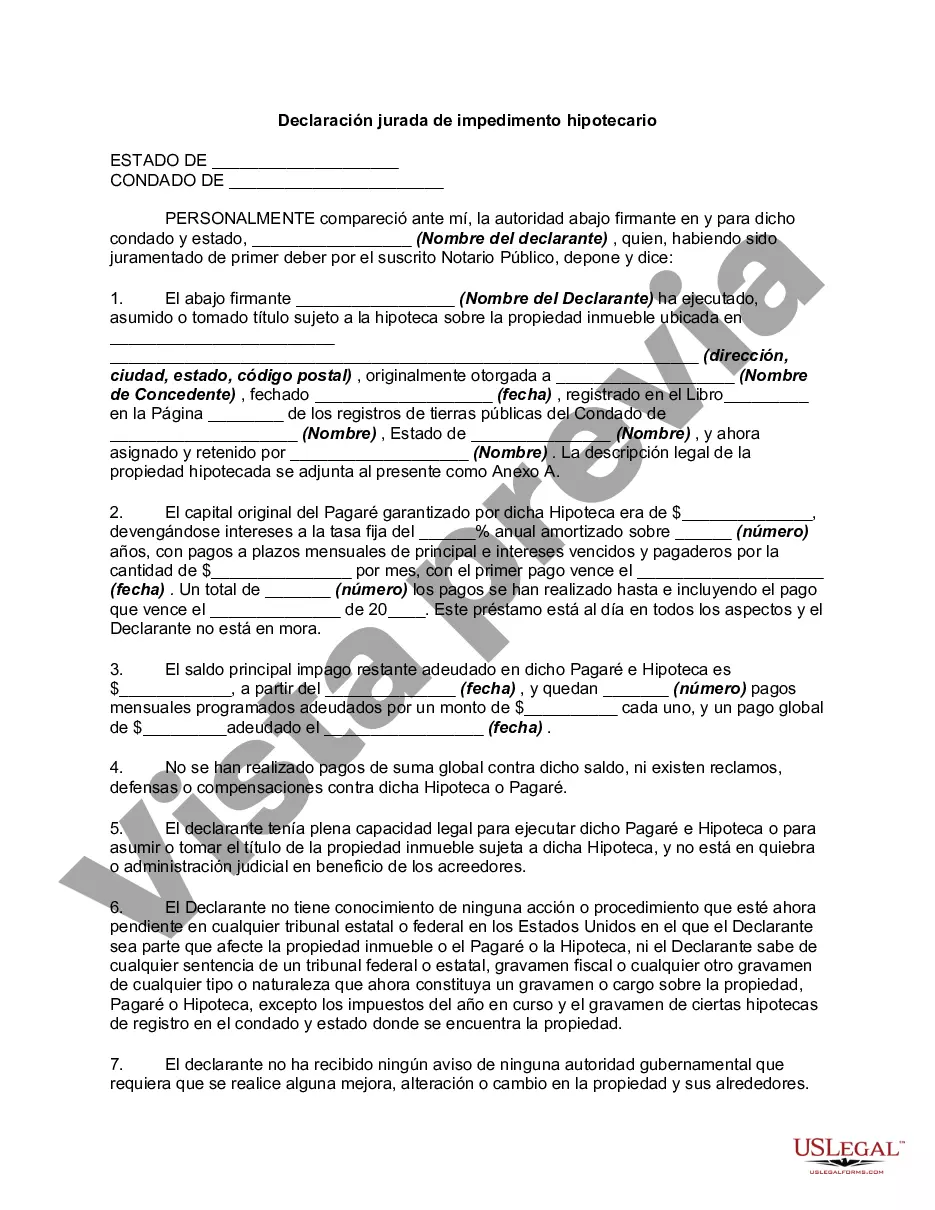

Fairfax, Virginia Estoppel Affidavit of Mortgagor is a legal document that holds significant importance in the real estate industry. This affidavit serves as a declaration by the mortgagor, the party who has granted a mortgage, confirming certain facts related to the property and mortgage. It creates a legally binding statement that prevents the mortgagor from making any contradictory claims in the future, protecting the interests of both the mortgagee (lender) and any potential buyers or investors. To understand the various types of Estoppel Affidavit of Mortgagor in Fairfax, Virginia, let's explore a few key examples: 1. Residential Estoppel Affidavit of Mortgagor: This type of affidavit pertains to residential properties, such as single-family houses, townhouses, or condominiums, within Fairfax, Virginia. It confirms details like the property address, outstanding mortgage balance, prior liens, encumbrances, and any pending legal actions or disputes. 2. Commercial Estoppel Affidavit of Mortgagor: Commercial properties, including office buildings, retail spaces, and industrial facilities, require this type of affidavit. It verifies important information such as the property's legal description, current tenant leases, financial obligations, lease assignments or subleases, and any ongoing zoning or building code compliance issues. 3. Estoppel Affidavit of Mortgagor for Refinancing: When a homeowner decides to refinance their mortgage, they may need to submit this type of affidavit to the new lender. It validates information regarding the existing mortgage, such as the loan balance, interest rate, payment history, and any late fees or penalties associated with the current mortgage. 4. Estoppel Affidavit of Mortgagor for Assumption: In cases where a property's mortgage is being assumed by a new buyer, the Estoppel Affidavit of Mortgagor ensures an accurate disclosure of the existing mortgage terms, including remaining payments, interest rates, amortization schedules, and any potential adjustments or prepayment penalties. 5. Judicial Estoppel Affidavit of Mortgagor: This specific type of affidavit may be required in scenarios involving litigation related to the mortgage. It confirms the mortgagor's legal position, outlines any claims made during the legal proceedings, and prevents them from asserting contradictory or inconsistent statements in other court cases. In summary, the Fairfax, Virginia Estoppel Affidavit of Mortgagor is a critical legal document that establishes the truth of various details and prevents the mortgagor from denying or altering them in the future. Different types include residential, commercial, refinancing, assumption, and judicial affidavits, each serving a specific purpose within the real estate and mortgage industry.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Declaración jurada de impedimento hipotecario - Estoppel Affidavit of Mortgagor

Description

How to fill out Fairfax Virginia Declaración Jurada De Impedimento Hipotecario?

How much time does it usually take you to create a legal document? Because every state has its laws and regulations for every life sphere, locating a Fairfax Estoppel Affidavit of Mortgagor suiting all regional requirements can be tiring, and ordering it from a professional attorney is often expensive. Many online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. In addition to the Fairfax Estoppel Affidavit of Mortgagor, here you can get any specific document to run your business or individual affairs, complying with your regional requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed sample, and download it. You can retain the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Fairfax Estoppel Affidavit of Mortgagor:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Fairfax Estoppel Affidavit of Mortgagor.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!