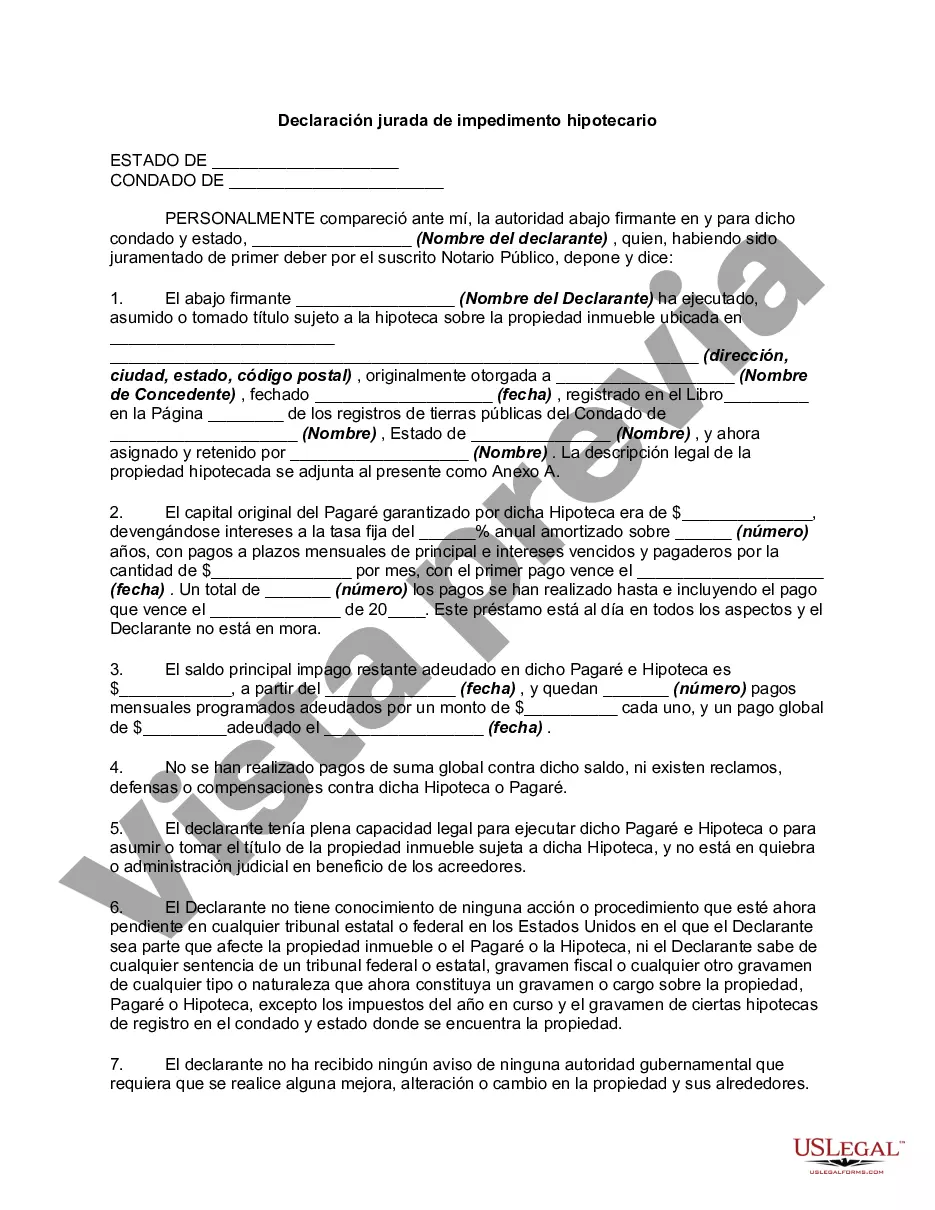

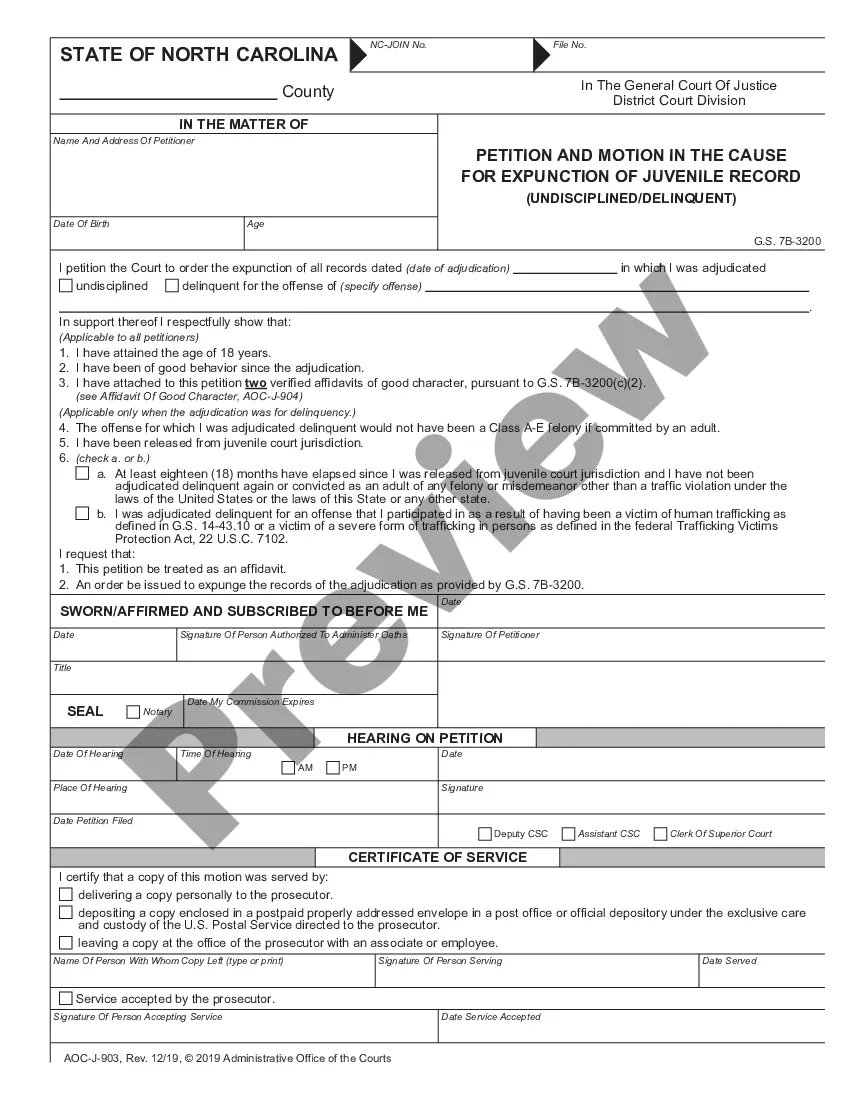

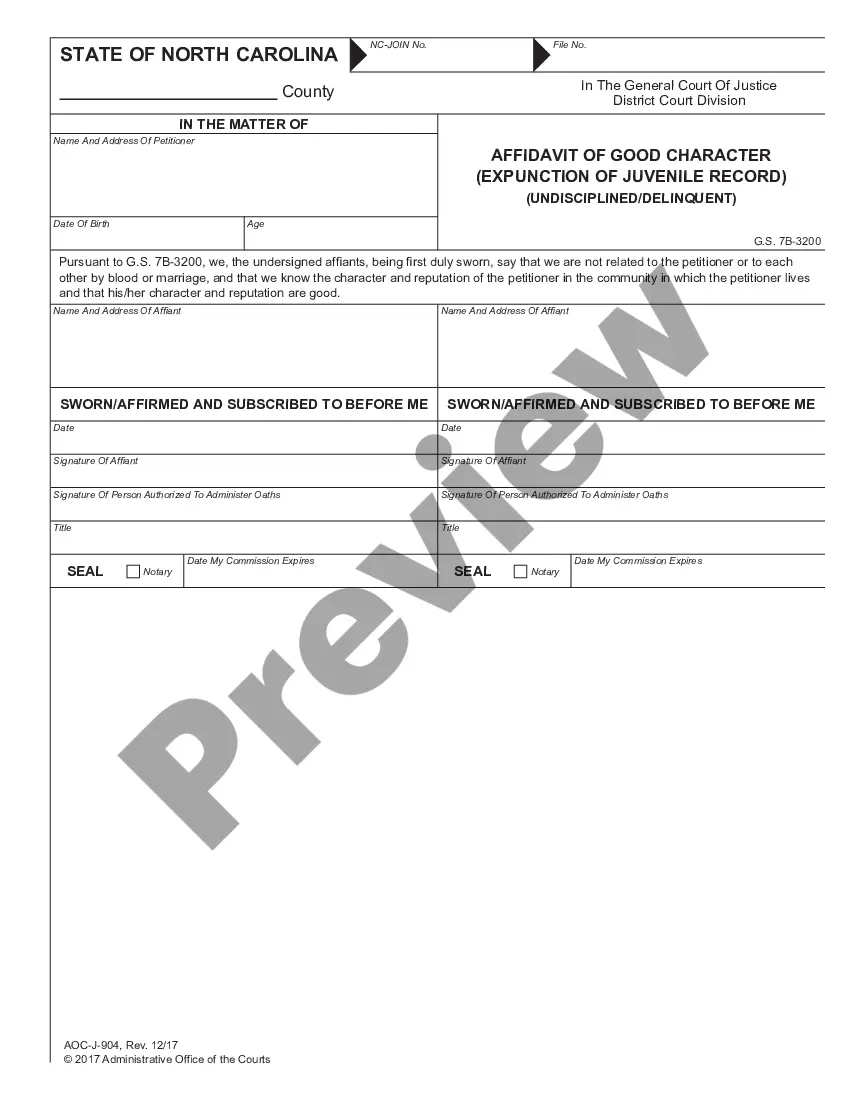

A Kings New York Estoppel Affidavit of Mortgagor is a legal document used in the state of New York to verify the outstanding balance of a mortgage and provide other relevant information about the mortgage and property. This document is usually required in real estate transactions, such as when refinancing or selling a property. The purpose of the Kings New York Estoppel Affidavit of Mortgagor is to ensure that all parties involved are aware of the current status and terms of the mortgage. Some common types of Kings New York Estoppel Affidavit of Mortgagor include: 1. Residential Estoppel Affidavit: This type of affidavit is used in residential real estate transactions where the property being mortgaged is a single-family home, townhouse, condominium, or any other residential property. 2. Commercial Estoppel Affidavit: This variant is used in commercial real estate transactions, involving properties such as office buildings, retail spaces, industrial facilities, or any other commercial property. 3. Cooperative Estoppel Affidavit: Cooperative housing corporations often require a specific form of Kings New York Estoppel Affidavit for their transactions. This type of affidavit is used when the property being mortgaged is a cooperative apartment, where ownership is divided into shares rather than individually owned units. The Kings New York Estoppel Affidavit of Mortgagor typically includes the following information: 1. Identification details: The name, address, and contact information of the mortgagor (the borrower) and mortgagee (the lender). 2. Property information: The legal description of the property being mortgaged, including the property address, lot number, and any other relevant details to accurately identify the property. 3. Mortgage details: This section includes information about the current mortgage, such as the loan amount, interest rate, term, and the date the mortgage was executed. 4. Payment history: The affidavit will detail the payment history of the mortgage, including the total amount paid, the outstanding balance, and any missed or late payments. 5. Liens or encumbrances: Any other liens or encumbrances on the property, such as tax liens or judgments, will be disclosed in this section. 6. Assurances and disclosures: The mortgagor will affirm that the information provided in the affidavit is accurate and complete to the best of their knowledge. They may also be required to disclose any pending litigation or disputes related to the property or mortgage. It is important to note that the specific requirements and format of a Kings New York Estoppel Affidavit of Mortgagor may vary depending on the particular real estate transaction and the lender's preferences. Therefore, it is essential to consult with legal professionals or real estate experts to ensure compliance with local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Declaración jurada de impedimento hipotecario - Estoppel Affidavit of Mortgagor

Description

How to fill out Kings New York Declaración Jurada De Impedimento Hipotecario?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and many other life situations demand you prepare official paperwork that varies from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business purpose utilized in your county, including the Kings Estoppel Affidavit of Mortgagor.

Locating forms on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Kings Estoppel Affidavit of Mortgagor will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guide to obtain the Kings Estoppel Affidavit of Mortgagor:

- Ensure you have opened the correct page with your localised form.

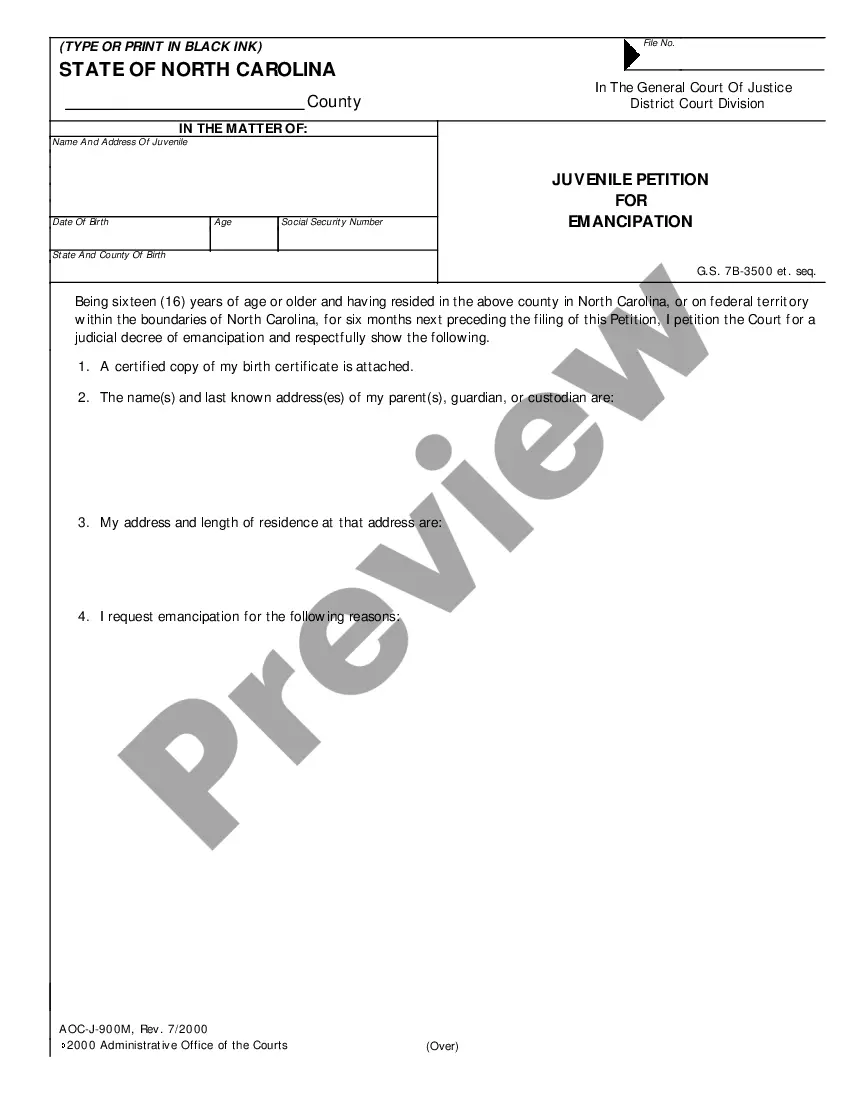

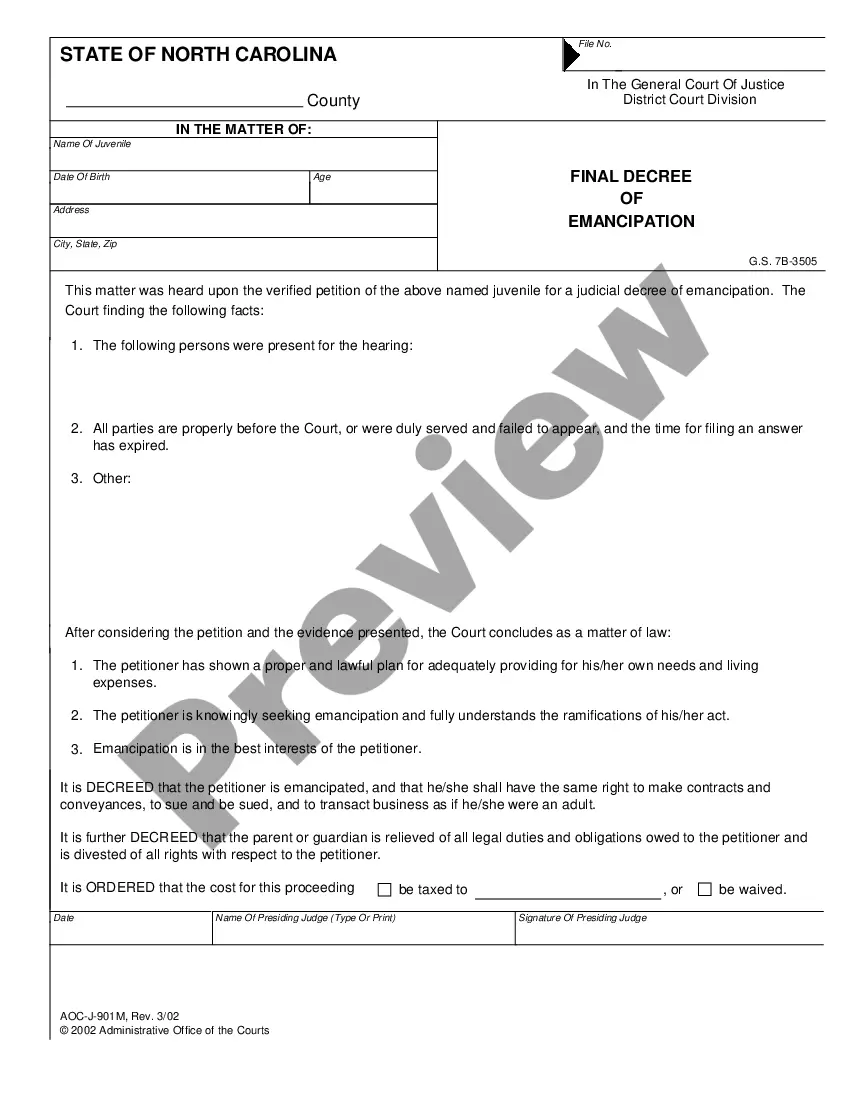

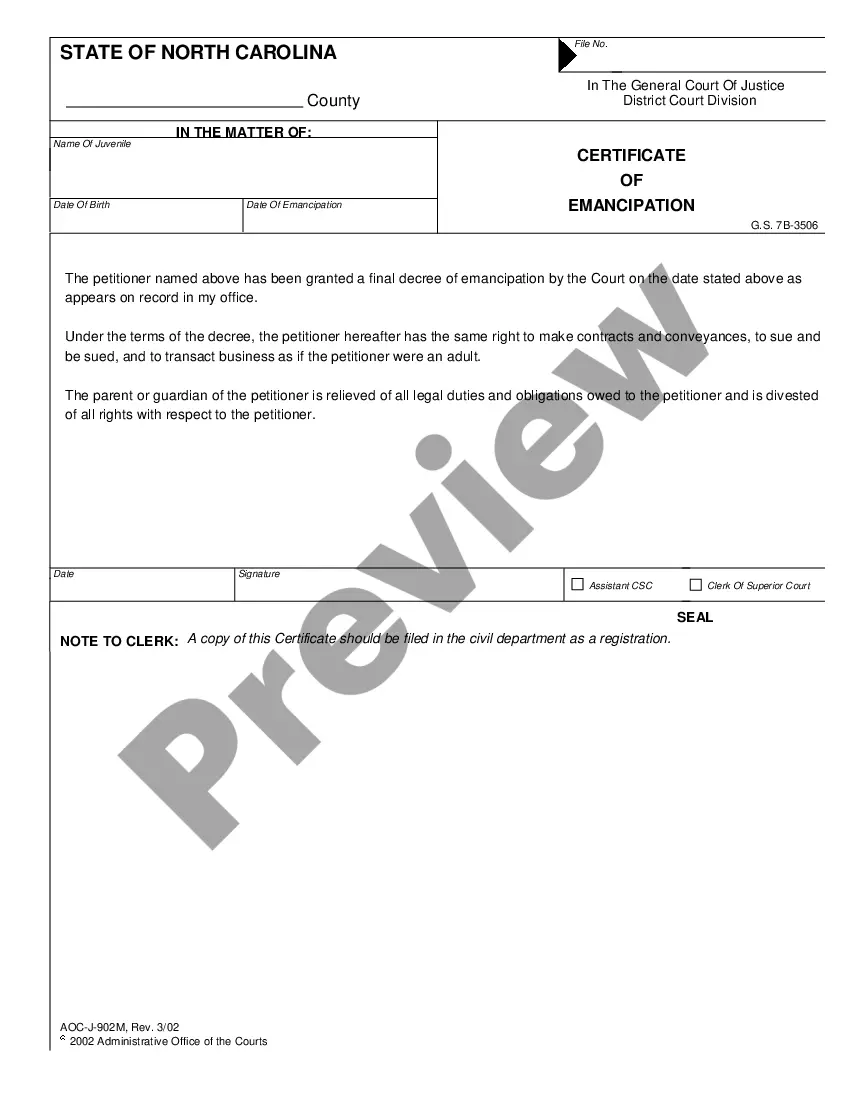

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template meets your needs.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Kings Estoppel Affidavit of Mortgagor on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!