In Mecklenburg County, North Carolina, an Estoppel Affidavit of Mortgagor is a legal document used in real estate transactions. It serves as a statement of facts provided by the mortgagor (the borrower or property owner) to inform the mortgagee (the lender or the party who holds the mortgage) about various details pertaining to the property and the mortgage. This affidavit becomes particularly important when there is a potential transfer of interest or ownership of the property. The Mecklenburg North Carolina Estoppel Affidavit of Mortgagor includes crucial information such as the current outstanding loan balance, interest rate, maturity date, and any other critical terms and conditions of the mortgage. It aims to protect the interests of all parties involved and ensure transparency in the transaction. Different types of Mecklenburg North Carolina Estoppel Affidavit of Mortgagor may include: 1. Standard Estoppel Affidavit: This is the most common type, used in regular real estate transactions. It covers all necessary information related to the mortgage and property ownership. 2. Estoppel Affidavit for Refinancing: In case the borrower decides to refinance the property, this type of affidavit discloses the relevant details required by the new mortgagee. It confirms the terms of the original mortgage and provides updates on any changes that may have occurred over time. 3. Estoppel Affidavit in Condominium or Homeowner Associations: In situations where the mortgaged property is part of a condominium or homeowner association, this affidavit addresses additional aspects. It may include confirmation of timely payment of association fees, assessment details, and compliance with the association's rules and regulations. 4. Estoppel Affidavit in Commercial Real Estate: This type focuses specifically on commercial properties and addresses any pertinent information related to the property's use, zoning restrictions, environmental concerns, and any other commercial-specific aspects. Overall, the main purpose of the Mecklenburg North Carolina Estoppel Affidavit of Mortgagor is to establish clear communication between all parties involved in a real estate transaction. It ensures that both the current and future mortgagees have a comprehensive understanding of the mortgage terms, property title, and any related obligations or encumbrances. By providing accurate and detailed information, this affidavit helps facilitate a smooth transfer of property ownership and protects the rights of all parties.

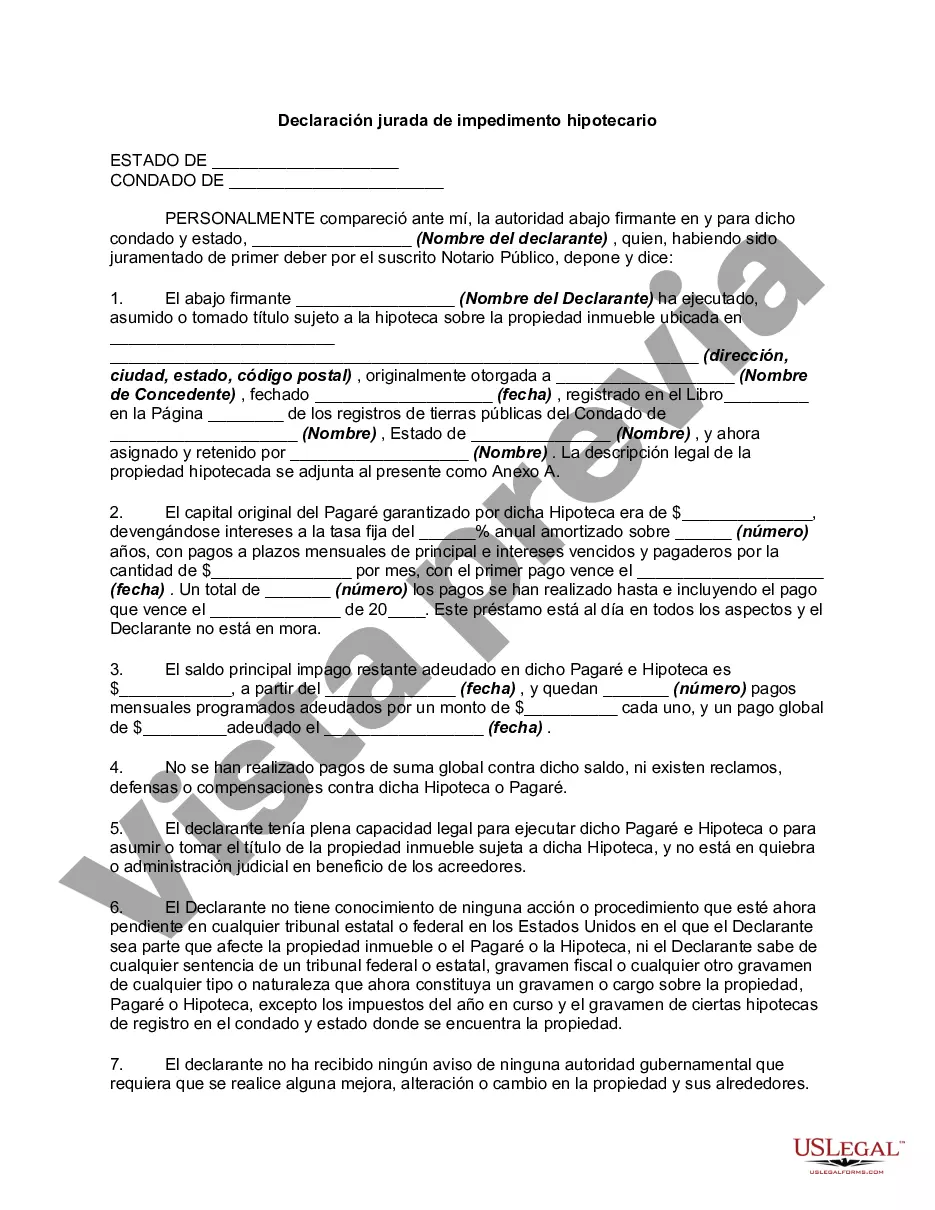

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Declaración jurada de impedimento hipotecario - Estoppel Affidavit of Mortgagor

Description

How to fill out Mecklenburg North Carolina Declaración Jurada De Impedimento Hipotecario?

Whether you intend to start your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business occasion. All files are grouped by state and area of use, so opting for a copy like Mecklenburg Estoppel Affidavit of Mortgagor is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to get the Mecklenburg Estoppel Affidavit of Mortgagor. Follow the instructions below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the file when you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Mecklenburg Estoppel Affidavit of Mortgagor in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are reusable. Having an active subscription, you can access all of your earlier purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!