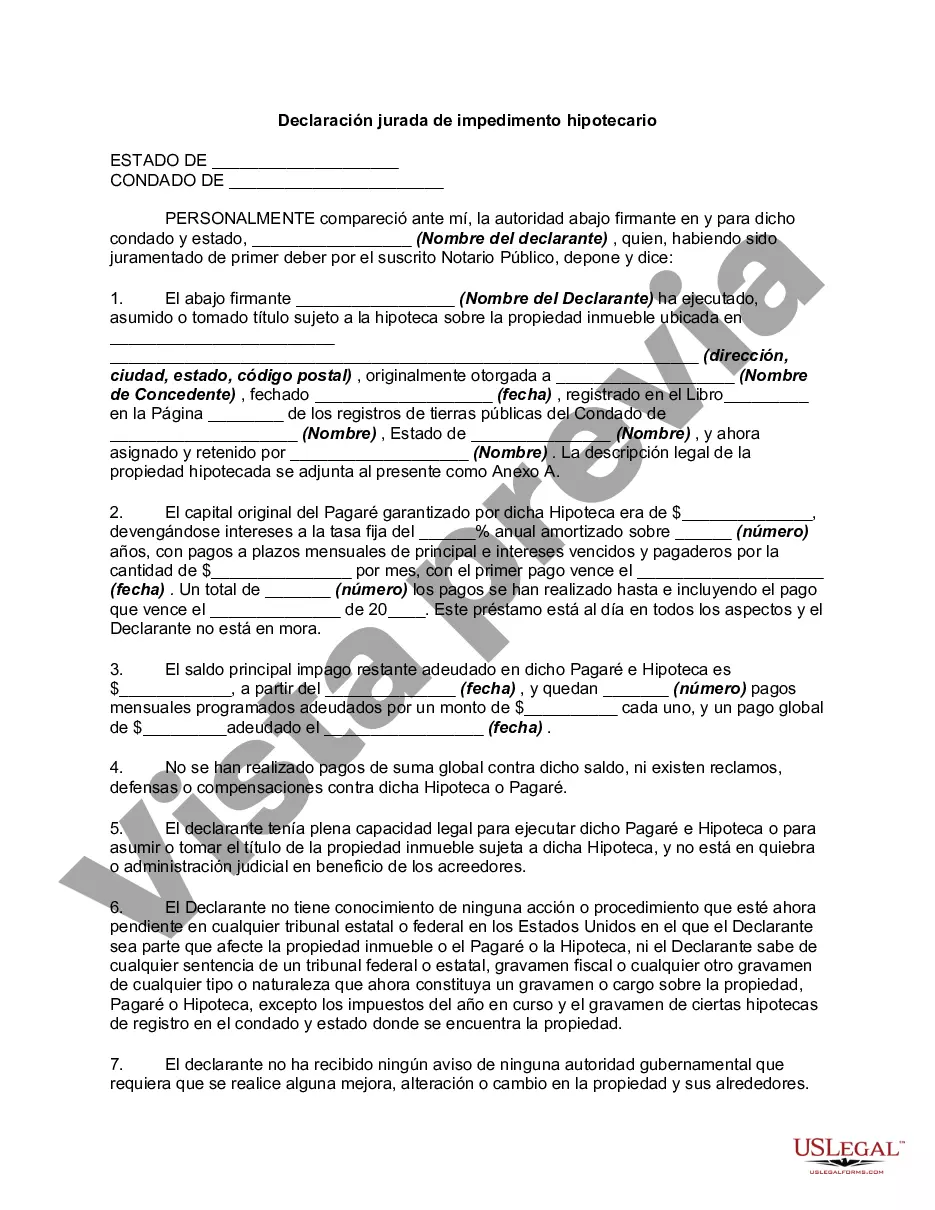

San Jose, California Estoppel Affidavit of Mortgagor is a legal document that serves as a detailed declaration made by the homeowner (mortgagor) regarding the terms and conditions of their mortgage agreement. This affidavit is commonly used during property sales or refinancing transactions, and it plays a crucial role in verifying the accuracy of the mortgage information provided. The San Jose, California Estoppel Affidavit of Mortgagor typically includes several key elements to ensure comprehensive disclosure. It identifies the mortgagor, the owner of the property, and provides their personal details. In addition, it outlines the specifics of the mortgage, including the loan amount, interest rate, repayment terms, and any other relevant loan conditions such as prepayment penalties or escrow requirements. Moreover, this document helps the buyer or lender assess the current status of the mortgage. It includes details about the remaining balance, the outstanding principal amount, any accrued interest, and potential liens or encumbrances. The affidavit also confirms whether the mortgage is in good standing, free of default, or subject to any pending legal actions. Different types of San Jose, California Estoppel Affidavit of Mortgagor may include: 1. Residential Estoppel Affidavit: This type of affidavit is specific to residential properties and provides a comprehensive overview of the mortgage terms and conditions. 2. Commercial Estoppel Affidavit: Designed for commercial properties, this affidavit encompasses the unique aspects of commercial mortgages, such as lease agreements, rental income, or tenant information. 3. Debt Estoppel Affidavit: This variant focuses on mortgages that involve an outstanding debt, allowing the mortgagor to attest to the accuracy of the debt amount and to confirm any previous changes or modifications made. 4. Refinance Estoppel Affidavit: Used during mortgage refinancing, this affidavit acts as a confirmation that the terms of the new loan are in alignment with the original mortgage agreement to be replaced. The San Jose, California Estoppel Affidavit of Mortgagor is a critical document that safeguards the interests of all parties involved in a property transaction. It ensures transparency and prevents any misunderstandings or misrepresentations regarding the mortgage terms and conditions. By providing accurate and comprehensive information, this affidavit contributes to smoother real estate transactions and strengthens the trust between the parties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Declaración jurada de impedimento hipotecario - Estoppel Affidavit of Mortgagor

Description

How to fill out San Jose California Declaración Jurada De Impedimento Hipotecario?

Whether you intend to start your business, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you need to prepare certain documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business occurrence. All files are grouped by state and area of use, so opting for a copy like San Jose Estoppel Affidavit of Mortgagor is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of additional steps to get the San Jose Estoppel Affidavit of Mortgagor. Follow the guidelines below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the correct one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the San Jose Estoppel Affidavit of Mortgagor in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!