The Wayne Michigan Estoppel Affidavit of Mortgagor is a legal document that plays a significant role in the mortgage process. It is crucial for both mortgage lenders and borrowers, as it certifies certain key details about a property and the mortgage itself. In Wayne County, Michigan, the Estoppel Affidavit of Mortgagor is often required during real estate transactions, ensuring transparency and legal compliance. The Estoppel Affidavit of Mortgagor in Wayne Michigan contains essential information regarding the property and the parties involved. It serves as a legally binding statement by the borrower (mortgagor) to the lender, affirming specific details related to the mortgage agreement. This document aims to protect all parties involved by providing an accurate representation of the mortgage status and ownership rights. Key components of a typical Estoppel Affidavit of Mortgagor may include: 1. Identification: The affidavit usually begins with the borrower's full legal name, address, contact details, and the property's complete address in Wayne County, Michigan. 2. Mortgage details: This section outlines the specifics of the mortgage, including the lender's name, address, and contact information. It typically describes the mortgage terms, loan amount, interest rate, payment schedule, and any other relevant financial obligations. 3. Payment status: The affidavit will confirm the borrower's payment history by stating whether mortgage payments are up-to-date, delinquent, or paid in full. It may also contain information regarding any late fees, penalties, or outstanding amounts. 4. Liens and encumbrances: This part discloses if there are any additional liens, judgments, or encumbrances on the property that could affect its ownership rights. It ensures that both parties are aware of any restrictions or legal claims on the property. 5. Insurance and tax status: The document may require the mortgagor to confirm if property insurance coverage is in place and up-to-date. It may also address property tax payments to ensure compliance with local regulations. 6. Third-party acknowledgments: In some instances, the Estoppel Affidavit of Mortgagor may include sections for third-party acknowledgments, where other individuals with a vested interest in the property confirm their knowledge and agreement with the provided information. Different types of Estoppel Affidavit of Mortgagor may exist based on specific circumstances or requirements. For example, variations can be seen in cases of refinancing, foreclosures, or property transfers. Each type aims to address the unique aspects of the mortgage process, providing accurate and relevant information tailored to the situation at hand. In conclusion, the Wayne Michigan Estoppel Affidavit of Mortgagor is a crucial legal document ensuring transparency and accuracy in real estate transactions within Wayne County. It verifies the borrower's representation of the mortgage terms, property details, and payment status, protecting all parties involved and helping to establish a secure mortgage agreement.

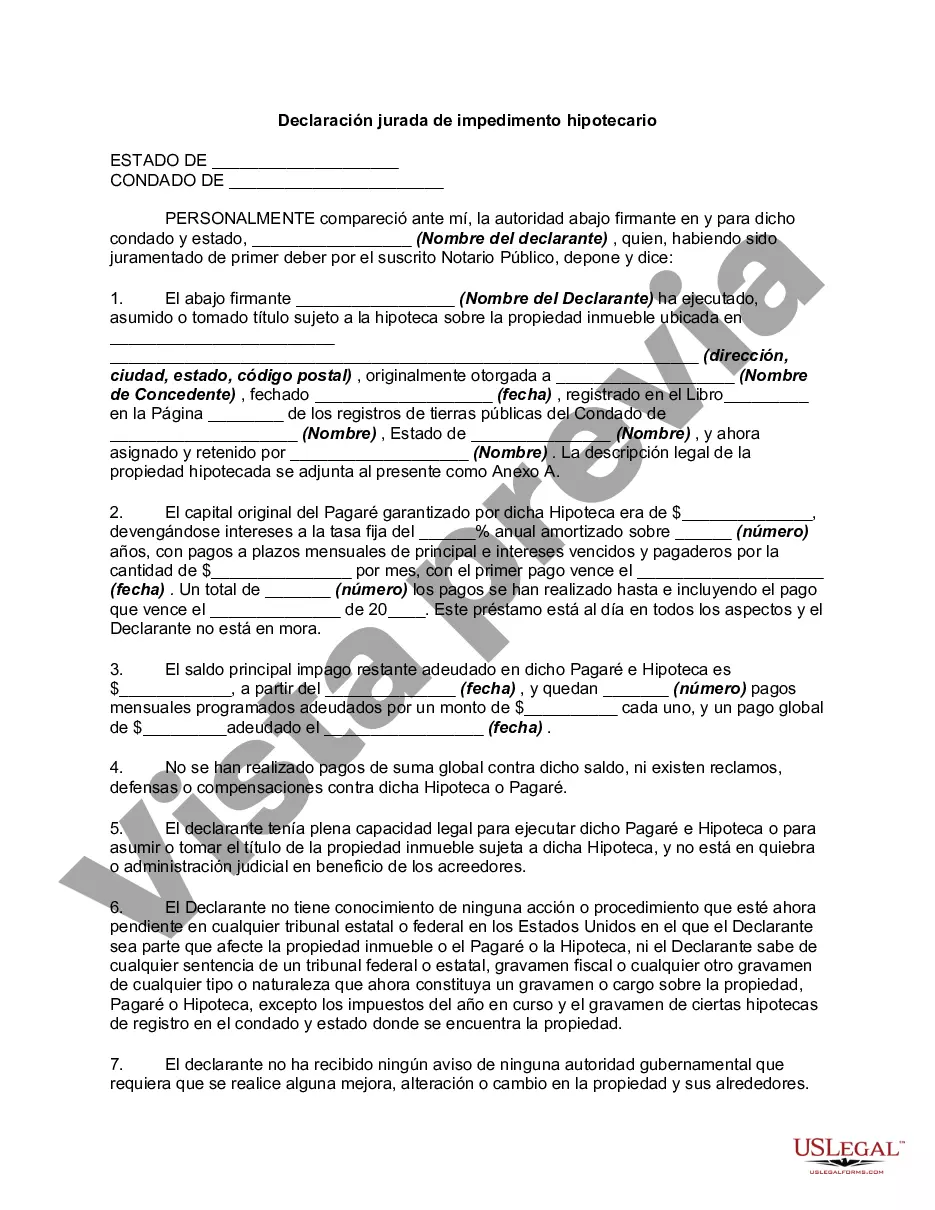

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Declaración jurada de impedimento hipotecario - Estoppel Affidavit of Mortgagor

Description

How to fill out Wayne Michigan Declaración Jurada De Impedimento Hipotecario?

If you need to find a reliable legal form provider to get the Wayne Estoppel Affidavit of Mortgagor, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed form.

- You can browse from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, number of learning resources, and dedicated support team make it easy to locate and complete different paperwork.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

Simply select to look for or browse Wayne Estoppel Affidavit of Mortgagor, either by a keyword or by the state/county the form is intended for. After locating required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to get started! Simply locate the Wayne Estoppel Affidavit of Mortgagor template and check the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be immediately available for download once the payment is completed. Now you can complete the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes these tasks less costly and more affordable. Create your first business, organize your advance care planning, draft a real estate agreement, or execute the Wayne Estoppel Affidavit of Mortgagor - all from the comfort of your sofa.

Sign up for US Legal Forms now!