Fairfax, Virginia Installment Promissory Note with Bank Deposit as Collateral: An Overview In Fairfax, Virginia, an Installment Promissory Note with Bank Deposit as Collateral is a legal financial agreement that involves a borrower obtaining a loan from a financial institution or a lender, with a bank deposit serving as collateral against the borrowed amount. This agreement ensures that the lender has a secured interest in the borrower's deposit balance, providing them additional assurance of repayment. Fairfax Virginia offers various types of Installment Promissory Notes with Bank Deposit as Collateral, each catering to different borrower needs: 1. Traditional Installment Promissory Note: This type involves a borrower borrowing a specific sum of money from the lender and agreeing to repay it in regular installments over a predetermined period. The bank deposit acts as security, allowing the lender to seize the deposit if the borrower defaults on the loan. 2. Personal Loan with Collateral: In this type, borrowers can secure personal loans with their bank deposits as collateral. This provides borrowers with the flexibility to use the loan amount for various purposes while enjoying lower interest rates since the bank deposit reduces the lender's risk. 3. Mortgage Loan with Deposit as Collateral: Homebuyers in Fairfax, Virginia, can use a bank deposit as collateral to secure a mortgage loan. This type of loan enables individuals to borrow a significant amount while benefiting from competitive interest rates due to the secured nature of the agreement. 4. Business Loan with Collateral: Entrepreneurs and businesses in Fairfax, Virginia, can opt for business loans where their bank deposits serve as collateral. This type of loan allows businesses to access capital for expansion or operational needs, with the bank deposit ensuring favorable loan terms and lower interest rates. Benefits of a Fairfax Virginia Installment Promissory Note with Bank Deposit as Collateral: 1. Access to Lower Interest Rates: Since the bank deposit serves as collateral, lenders view the loan as less risky, leading to lower interest rates compared to traditional unsecured loans. 2. Enhanced Borrowing Capacity: The presence of collateral increases the borrower's chances of securing a larger loan amount, enabling individuals and businesses to fulfill their financial objectives efficiently. 3. Favorable Repayment Terms: Installment repayment options make it easier for borrowers to manage their loan payments, ensuring timely repayment, and reducing the risk of default. 4. Opportunity for Credit Building: By successfully repaying the loan, borrowers can improve their credit scores, demonstrating financial responsibility and increasing their future borrowing opportunities. In conclusion, a Fairfax Virginia Installment Promissory Note with Bank Deposit as Collateral provides borrowers with a secure means of obtaining loans at competitive interest rates. Whether for personal, business, or housing needs, this type of financial agreement offers several advantages while ensuring the lender's peace of mind through the lateralization of bank deposits.

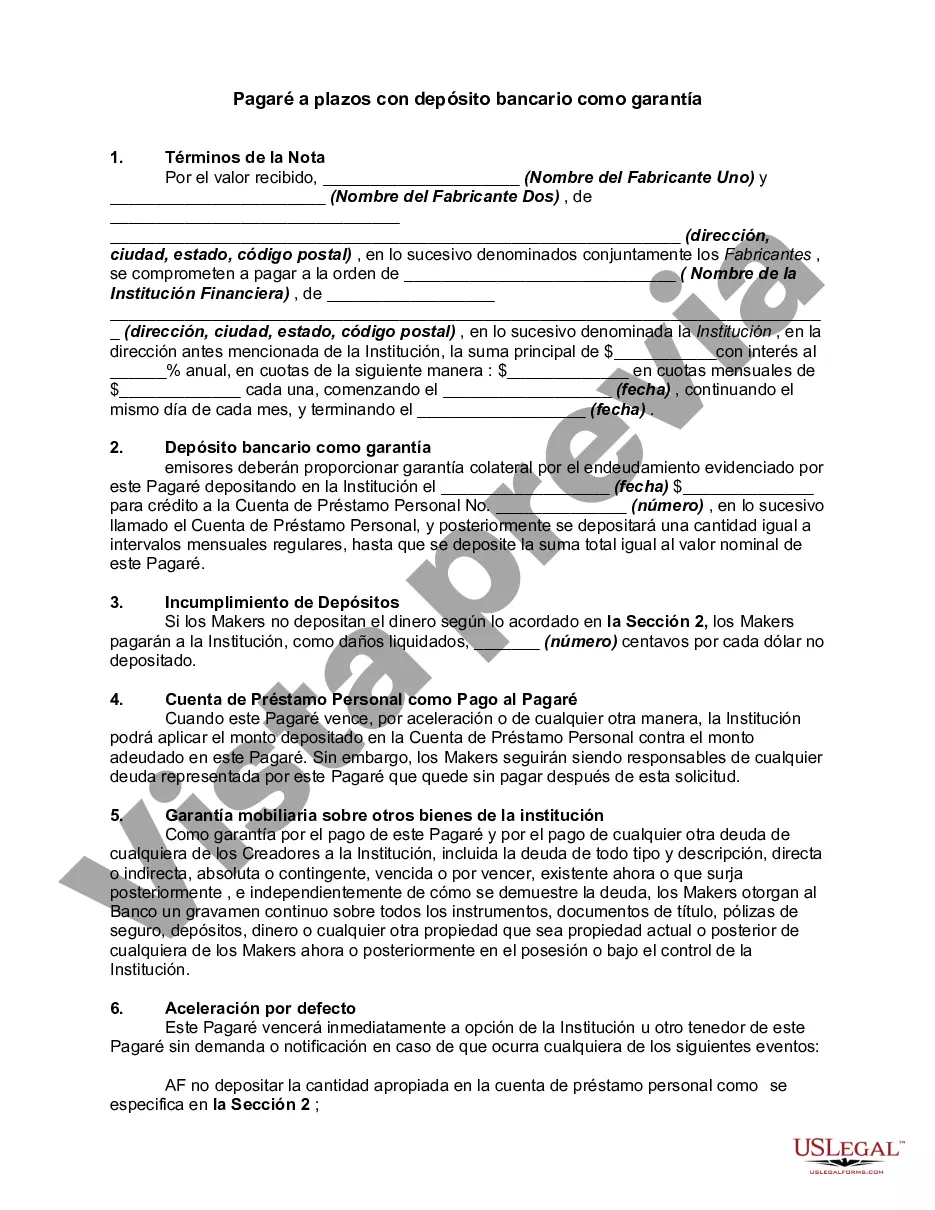

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Pagaré a plazos con depósito bancario como garantía - Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out Fairfax Virginia Pagaré A Plazos Con Depósito Bancario Como Garantía?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid high priced legal assistance when preparing the Fairfax Installment Promissory Note with Bank Deposit as Collateral, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Fairfax Installment Promissory Note with Bank Deposit as Collateral from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Fairfax Installment Promissory Note with Bank Deposit as Collateral:

- Take a look at the page content to ensure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document when you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!