Houston, Texas Installment Promissory Note with Bank Deposit as Collateral is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender. This type of promissory note is particularly unique as it involves using a bank deposit as collateral to secure the loan. The Houston Texas Installment Promissory Note with Bank Deposit as Collateral includes all the essential details of the loan, including the principal amount, interest rate, repayment schedule, late payment penalties, and any other pertinent terms agreed upon by both parties. This document serves as evidence of the borrower's commitment to repay the loan in predefined installments over a specified period. There are several types of Houston Texas Installment Promissory Note with Bank Deposit as Collateral, depending on the specific requirements of the lender and the borrower. Some of the most common variations include: 1. Fixed-rate installment promissory note: This type of promissory note sets a fixed interest rate for the entire loan term, ensuring that the borrower pays the same amount of interest with each installment. 2. Adjustable-rate installment promissory note: Unlike a fixed-rate note, an adjustable-rate promissory note allows the interest rate to fluctuate over time, based on specific market conditions or a predetermined index. This type of note provides flexibility in interest payments but may carry additional risks. 3. Balloon payment installment promissory note: In this case, the borrower agrees to make regular installments for the loan term, but with a large final payment known as a "balloon payment." This option is often suitable for borrowers expecting a substantial future inflow of cash to cover the final payment. 4. Interest-only installment promissory note: With this type of note, the borrower initially makes payments that only cover the accrued interest, and the principal amount remains unchanged. However, after a specified period, the borrower must begin making payments towards the principal as well. The Houston Texas Installment Promissory Note with Bank Deposit as Collateral is a valuable financial tool for both lenders and borrowers. Lenders benefit from the added security of having a bank deposit as collateral, increasing the likelihood of loan repayment. Meanwhile, borrowers gain access to funds while using their bank deposit as collateral, potentially securing more favorable loan terms and interest rates. Before entering into a Houston Texas Installment Promissory Note with Bank Deposit as Collateral, it is crucial for both parties to carefully review and understand the terms and conditions outlined in the promissory note. Seeking professional legal advice may also be beneficial to ensure compliance with all applicable laws and regulations.

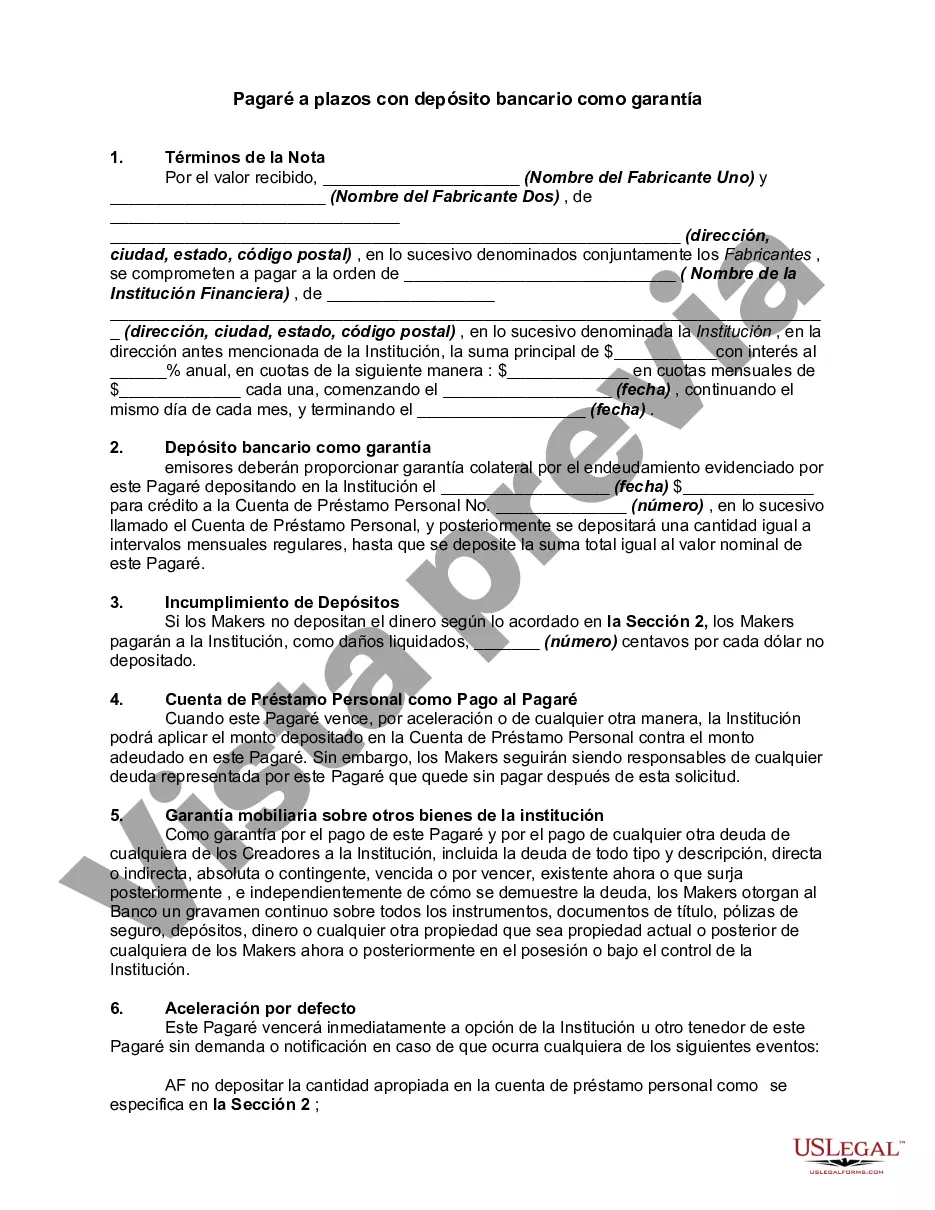

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Pagaré a plazos con depósito bancario como garantía - Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out Houston Texas Pagaré A Plazos Con Depósito Bancario Como Garantía?

Preparing legal documentation can be difficult. Besides, if you decide to ask a legal professional to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Houston Installment Promissory Note with Bank Deposit as Collateral, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario collected all in one place. Therefore, if you need the recent version of the Houston Installment Promissory Note with Bank Deposit as Collateral, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Houston Installment Promissory Note with Bank Deposit as Collateral:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now when you find the required sample and pick the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Houston Installment Promissory Note with Bank Deposit as Collateral and download it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!