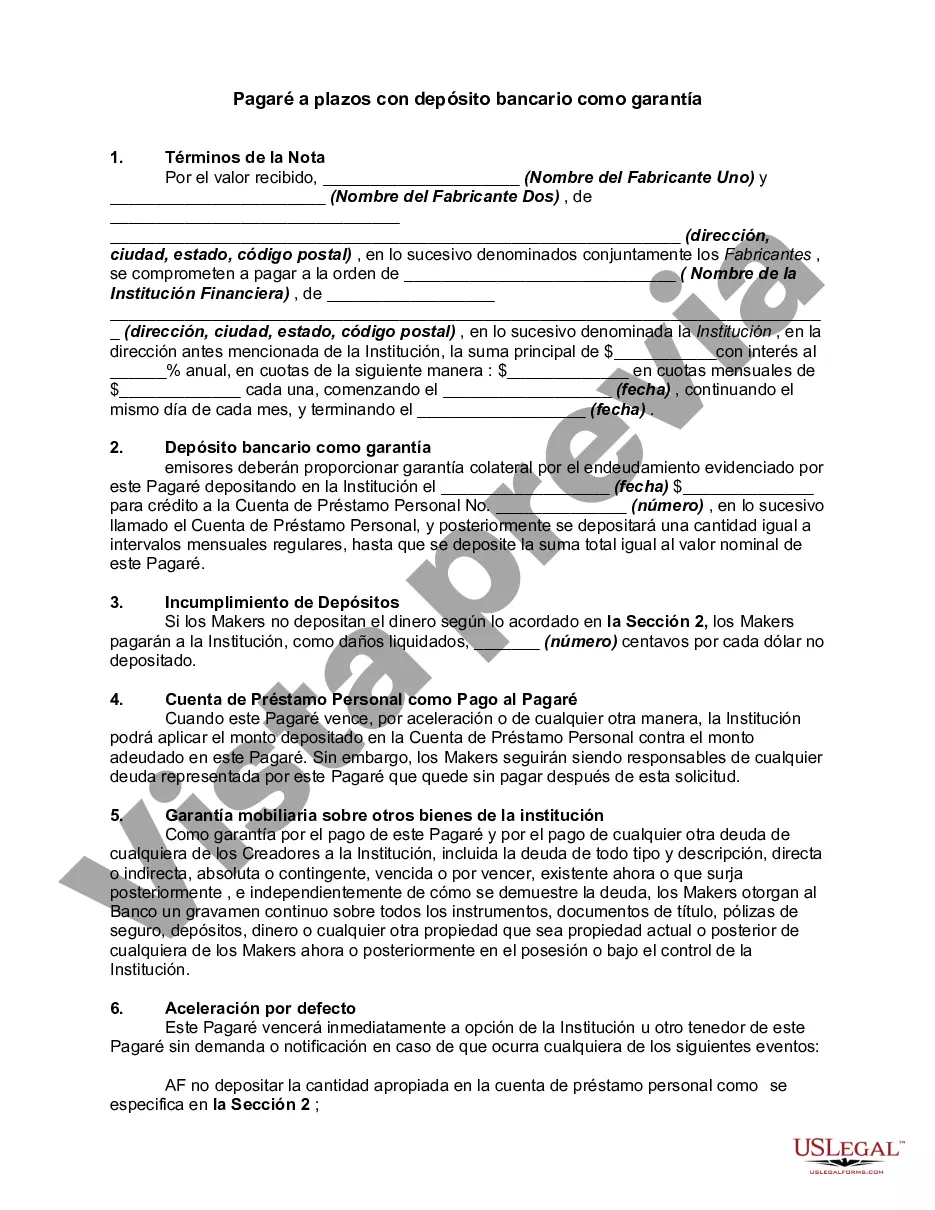

Los Angeles California Installment Promissory Note with Bank Deposit as Collateral is a legal document used to outline the terms and conditions of a loan agreement involving a bank deposit as security. This type of promissory note is specifically tailored to residents and businesses located in Los Angeles, California, and offers a structured repayment plan to borrowers. The Los Angeles California Installment Promissory Note with Bank Deposit as Collateral serves as a binding agreement between the borrower and the lender, ensuring clarity and protection for both parties involved. It secures the loan amount with a bank deposit held as collateral, providing a sense of security to the lender in case the borrower defaults on the loan. Key features of the Los Angeles California Installment Promissory Note with Bank Deposit as Collateral may include: 1. Loan Amount: Specifies the principal amount borrowed by the borrower. 2. Interest Rate: Outlines the fixed or variable interest rate that will be charged on the loan. 3. Repayment Terms: Defines the installment plan, including the frequency of payments (monthly, quarterly, etc.), the amount to be paid in each installment, and the due dates. 4. Bank Deposit Collateral: Details the bank deposit or account that will serve as collateral for the loan, ensuring the lender's security. 5. Default and Remedies: Discusses the consequences and remedies in case of default, such as penalties, additional interest, or legal actions that the lender may pursue. 6. Governing Law: Identifies the specific laws of California that govern the promissory note. 7. Signatures: Requires the signatures of both the borrower and the lender to make the document legally binding. Different types of Installment Promissory Notes with Bank Deposit as Collateral in Los Angeles, California may include variations based on loan purposes, borrower types, or specific industries. Some examples could be: 1. Personal Installment Promissory Note with Bank Deposit as Collateral: This type of promissory note caters to individuals seeking personal loans, using their bank deposits as collateral. 2. Business Installment Promissory Note with Bank Deposit as Collateral: Designed for businesses in Los Angeles, this note secures loans with business bank deposits, providing the lender with additional security. 3. Real Estate Installment Promissory Note with Bank Deposit as Collateral: Tailored for real estate transactions, this promissory note allows borrowers to secure loans using bank deposits while purchasing or refinancing properties in Los Angeles. Remember that obtaining legal and financial advice is essential before entering into any loan agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Pagaré a plazos con depósito bancario como garantía - Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out Los Angeles California Pagaré A Plazos Con Depósito Bancario Como Garantía?

Laws and regulations in every sphere vary throughout the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid high priced legal assistance when preparing the Los Angeles Installment Promissory Note with Bank Deposit as Collateral, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Los Angeles Installment Promissory Note with Bank Deposit as Collateral from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Los Angeles Installment Promissory Note with Bank Deposit as Collateral:

- Examine the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template once you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!