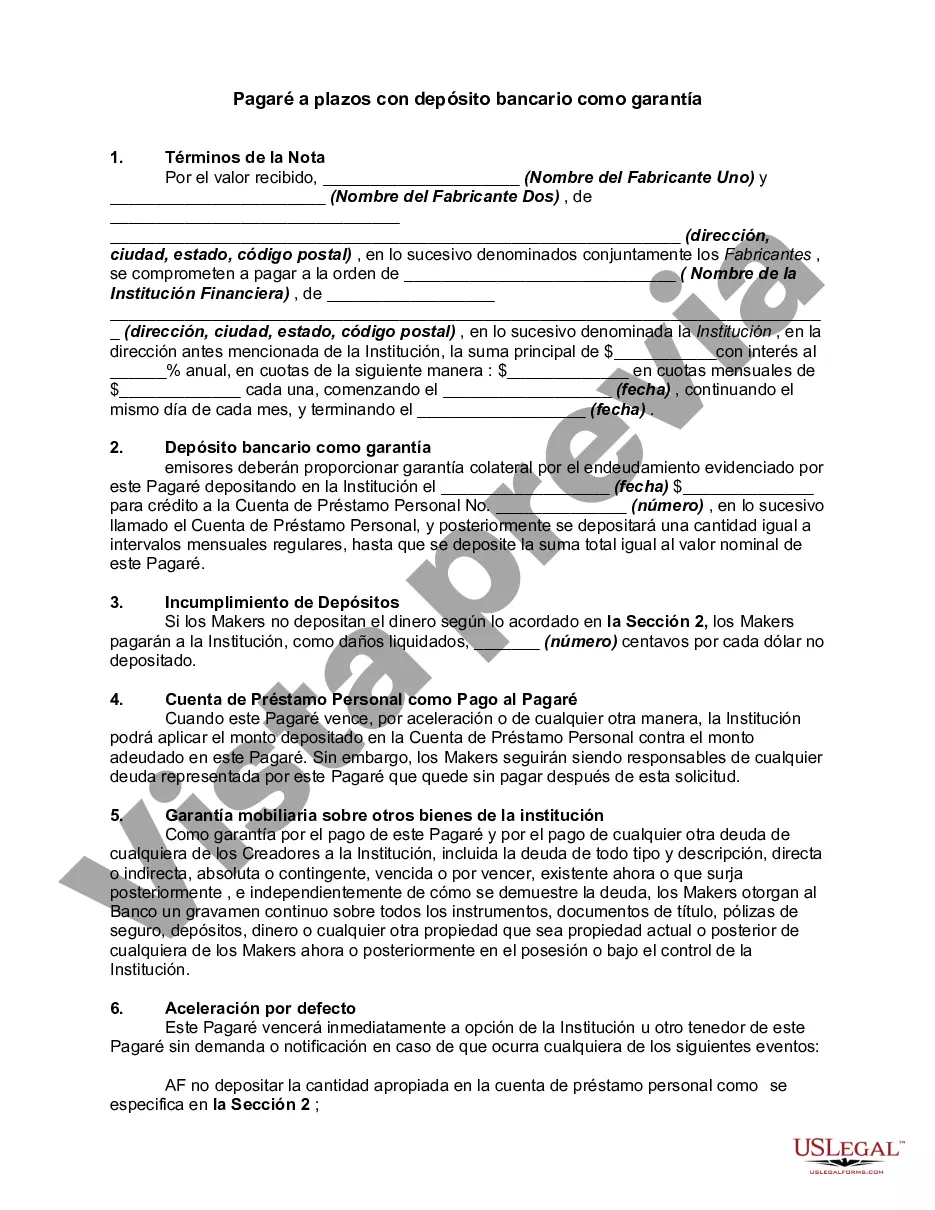

Maricopa, Arizona Installment Promissory Note with Bank Deposit as Collateral is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender. This specific type of promissory note allows a borrower to secure the loan by providing a bank deposit as collateral. This installment promissory note serves as proof of the loan, stating the principal amount borrowed, the interest rate, the repayment schedule, and any other terms agreed upon by both parties involved. The borrower agrees to repay the loan in regular installments over a specific period, while the lender holds the bank deposit as security against potential default. The Maricopa, Arizona community offers multiple types of Installment Promissory Notes with Bank Deposit as Collateral, tailored to different financial needs: 1. Personal Installment Promissory Note: This type of promissory note is used for personal loans between individuals or entities. It allows borrowers to obtain funds for various purposes, such as debt consolidation, education expenses, or home improvements. 2. Business Installment Promissory Note: Designed for businesses, this promissory note is suitable for securing funds for entrepreneurial ventures, equipment purchases, working capital, or other commercial purposes. It enables businesses to access the necessary financial resources while offering lenders a secure investment. 3. Real Estate Installment Promissory Note: Specifically for real estate transactions, this promissory note allows individuals or entities to secure a loan for purchasing property, financing a construction project, or refinancing an existing mortgage. The bank deposit serves as collateral against the borrowed funds. By utilizing a Maricopa, Arizona Installment Promissory Note with Bank Deposit as Collateral, borrowers can benefit from potentially lower interest rates due to the increased security for the lender. Lenders, on the other hand, can have peace of mind knowing they have a fallback with the bank deposit in case of default. It is crucial for both parties to fully understand the terms and conditions stated in the installment promissory note, as it legally binds them to fulfill their obligations. Seeking legal advice or using a reputable template can be highly beneficial in ensuring all necessary aspects are covered and the document complies with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Pagaré a plazos con depósito bancario como garantía - Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out Maricopa Arizona Pagaré A Plazos Con Depósito Bancario Como Garantía?

Do you need to quickly draft a legally-binding Maricopa Installment Promissory Note with Bank Deposit as Collateral or probably any other form to handle your own or business matters? You can select one of the two options: contact a legal advisor to write a legal document for you or create it entirely on your own. Luckily, there's a third solution - US Legal Forms. It will help you receive neatly written legal documents without having to pay sky-high fees for legal services.

US Legal Forms provides a rich catalog of over 85,000 state-specific form templates, including Maricopa Installment Promissory Note with Bank Deposit as Collateral and form packages. We provide templates for an array of life circumstances: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra hassles.

- First and foremost, carefully verify if the Maricopa Installment Promissory Note with Bank Deposit as Collateral is adapted to your state's or county's regulations.

- If the document includes a desciption, make sure to check what it's suitable for.

- Start the searching process over if the form isn’t what you were seeking by utilizing the search box in the header.

- Select the plan that is best suited for your needs and proceed to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the Maricopa Installment Promissory Note with Bank Deposit as Collateral template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Moreover, the templates we provide are reviewed by law professionals, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!