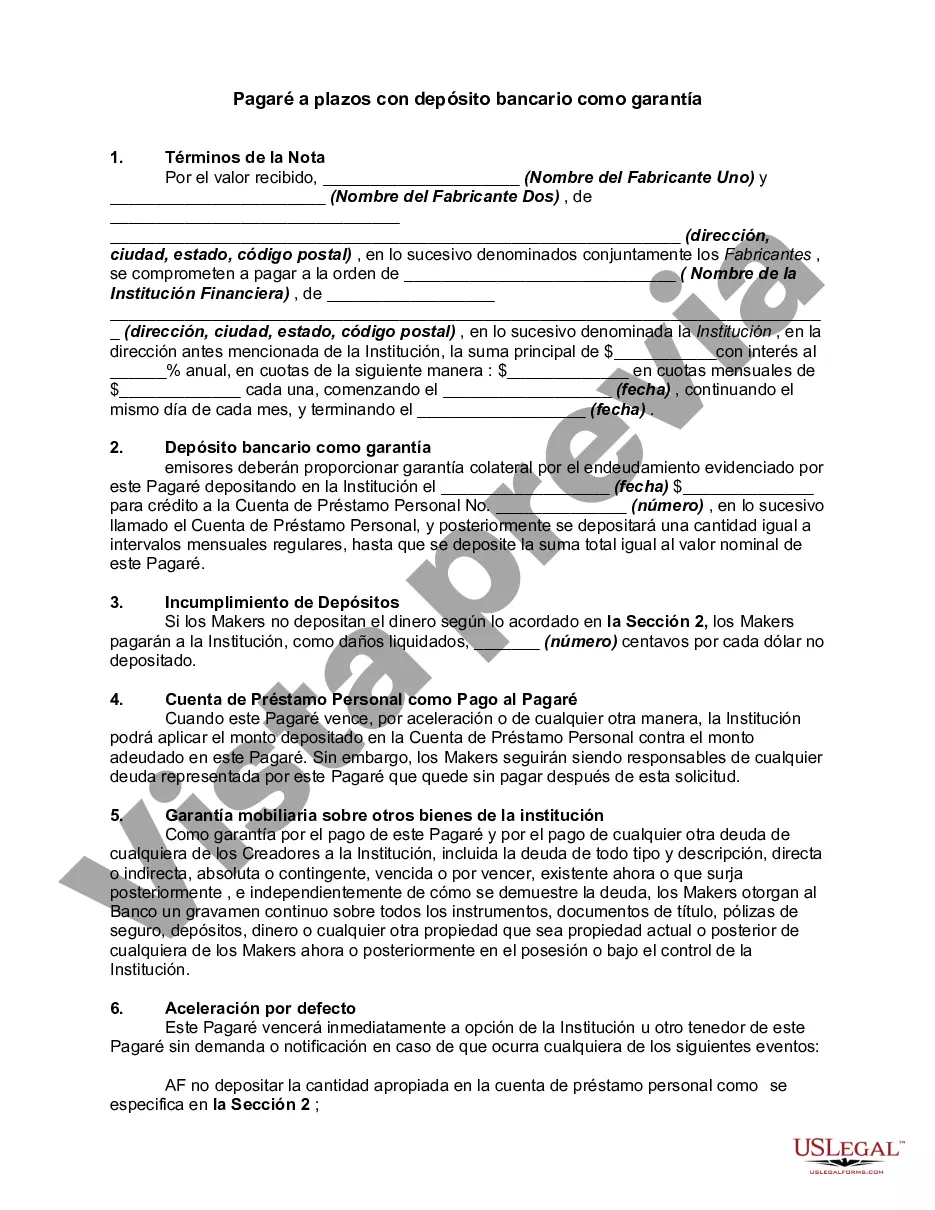

Miami-Dade Florida Installment Promissory Note with Bank Deposit as Collateral is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Miami-Dade County, Florida. This type of promissory note is unique as it requires the borrower to provide a bank deposit as collateral for the loan. The installment promissory note specifies the principal amount of the loan, the interest rate, the repayment schedule, and any penalties or fees associated with late payments or default. By using a bank deposit as collateral, the lender gains additional security against the loan, reducing the risk of non-payment. In Miami-Dade County, there are different types of installment promissory notes with bank deposits as collateral, including: 1. Personal Installment Promissory Note with Bank Deposit as Collateral: This type of promissory note is used for personal loans where the borrower pledges a bank deposit as collateral. It can be used for various purposes, such as debt consolidation, home improvements, or educational expenses. 2. Business Installment Promissory Note with Bank Deposit as Collateral: This promissory note is specifically designed for business loans. Entrepreneurs and business owners in Miami-Dade County can provide a bank deposit as collateral to secure financing for business expansion, equipment purchase, or working capital. 3. Mortgage Installment Promissory Note with Bank Deposit as Collateral: This type of promissory note is commonly used in real estate transactions. Borrowers who seek a mortgage loan to finance the purchase of a property in Miami-Dade County can offer a bank deposit as collateral to secure the loan. It is important to note that each type of Miami-Dade Florida Installment Promissory Note with Bank Deposit as Collateral may have specific clauses and provisions tailored to the borrower's and lender's needs. The terms and conditions outlined in the promissory note should be carefully reviewed and agreed upon by both parties before signing the document.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Pagaré a plazos con depósito bancario como garantía - Installment Promissory Note with Bank Deposit as Collateral

State:

Multi-State

County:

Miami-Dade

Control #:

US-02974BG

Format:

Word

Instant download

Description

A negotiable instrument means an instrument which contains unconditional promise or order to pay a fixed amount of money, with or without interest or other charges described in the promise or order, if it: (1) is payable to bearer or to order at the time it is issued or first comes into possession of a holder; (2) is payable on demand or at a definite time; and (3) does not state any other undertaking or instruction by the person promising or ordering payment to do any act in addition to the payment of money.

Miami-Dade Florida Installment Promissory Note with Bank Deposit as Collateral is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Miami-Dade County, Florida. This type of promissory note is unique as it requires the borrower to provide a bank deposit as collateral for the loan. The installment promissory note specifies the principal amount of the loan, the interest rate, the repayment schedule, and any penalties or fees associated with late payments or default. By using a bank deposit as collateral, the lender gains additional security against the loan, reducing the risk of non-payment. In Miami-Dade County, there are different types of installment promissory notes with bank deposits as collateral, including: 1. Personal Installment Promissory Note with Bank Deposit as Collateral: This type of promissory note is used for personal loans where the borrower pledges a bank deposit as collateral. It can be used for various purposes, such as debt consolidation, home improvements, or educational expenses. 2. Business Installment Promissory Note with Bank Deposit as Collateral: This promissory note is specifically designed for business loans. Entrepreneurs and business owners in Miami-Dade County can provide a bank deposit as collateral to secure financing for business expansion, equipment purchase, or working capital. 3. Mortgage Installment Promissory Note with Bank Deposit as Collateral: This type of promissory note is commonly used in real estate transactions. Borrowers who seek a mortgage loan to finance the purchase of a property in Miami-Dade County can offer a bank deposit as collateral to secure the loan. It is important to note that each type of Miami-Dade Florida Installment Promissory Note with Bank Deposit as Collateral may have specific clauses and provisions tailored to the borrower's and lender's needs. The terms and conditions outlined in the promissory note should be carefully reviewed and agreed upon by both parties before signing the document.

Free preview