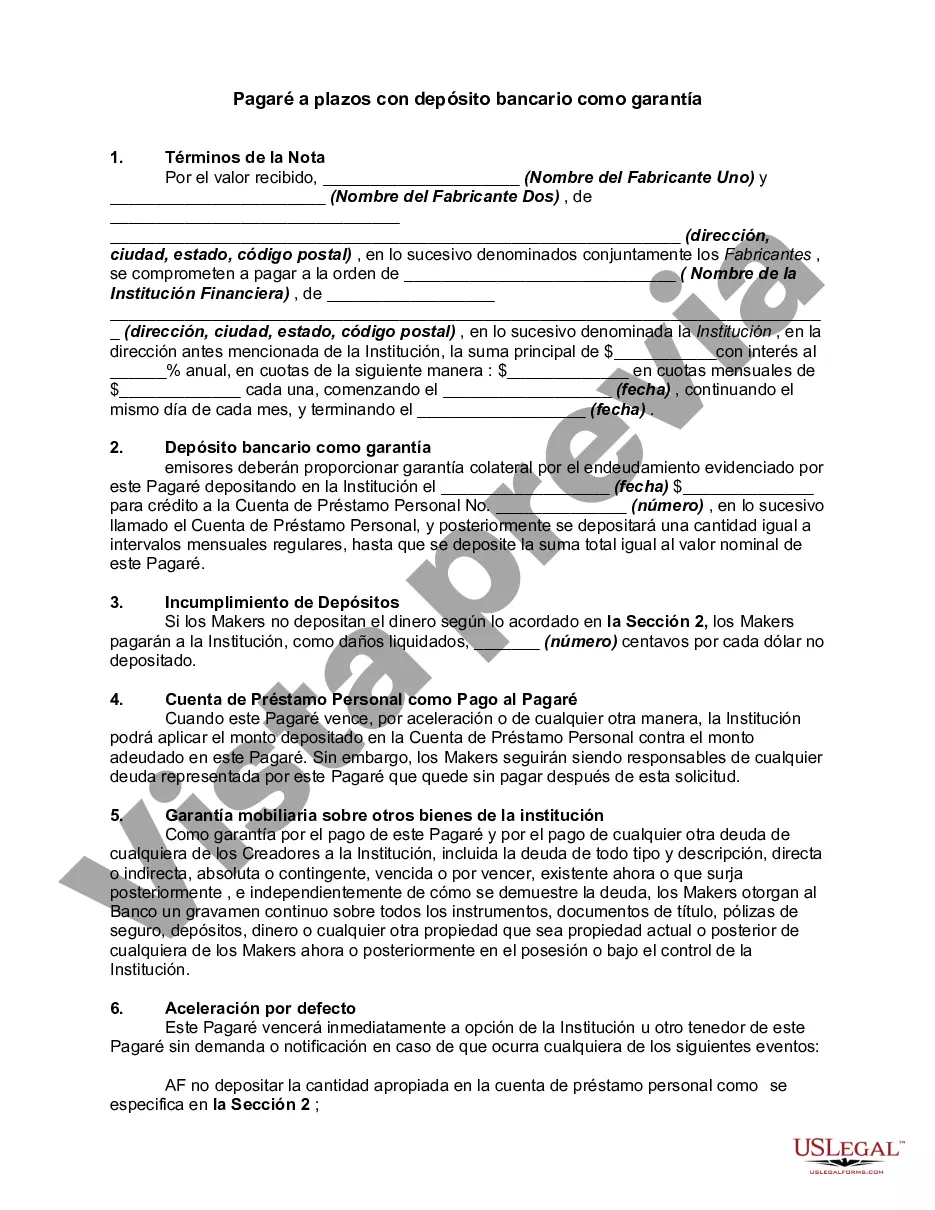

A Philadelphia Pennsylvania Installment Promissory Note with Bank Deposit as Collateral is a legal document that outlines the terms of a loan agreement between a borrower and a lender, specifically in the city of Philadelphia, Pennsylvania. This type of promissory note is unique because it requires the borrower to provide a bank deposit as collateral. The Philadelphia Pennsylvania Installment Promissory Note with Bank Deposit as Collateral serves as a binding agreement between the borrower and lender, detailing the terms of the loan, including the principal amount, interest rate, repayment schedule, and any other relevant conditions. This note ensures that both parties are aware of their obligations and understand the consequences of defaulting on the loan. This type of promissory note is often used in situations where the borrower does not possess sufficient assets or a strong credit history to secure a traditional loan. By providing a bank deposit as collateral, the borrower reduces the lender's risk, making it more likely for them to approve the loan. The bank deposit serves as security, ensuring that the lender will have an avenue to recover their funds if the borrower fails to repay the loan as agreed. In addition to the general Philadelphia Pennsylvania Installment Promissory Note with Bank Deposit as Collateral, there may be variations or subcategories of this type of loan agreement. For instance, some lenders might offer different interest rates or repayment terms based on the borrower's creditworthiness or the loan purpose. Others may provide options for early repayment without penalties or offer a flexible repayment schedule tailored to the borrower's financial situation. Overall, a Philadelphia Pennsylvania Installment Promissory Note with Bank Deposit as Collateral offers an opportunity for individuals or businesses in Philadelphia to obtain a loan even if they lack traditional collateral or have a less favorable credit history. It provides security for the lender and a chance for the borrower to access the funds they need to meet various financial obligations or invest in opportunities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Pagaré a plazos con depósito bancario como garantía - Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out Philadelphia Pennsylvania Pagaré A Plazos Con Depósito Bancario Como Garantía?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare formal documentation that varies from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any personal or business purpose utilized in your county, including the Philadelphia Installment Promissory Note with Bank Deposit as Collateral.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Philadelphia Installment Promissory Note with Bank Deposit as Collateral will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to obtain the Philadelphia Installment Promissory Note with Bank Deposit as Collateral:

- Make sure you have opened the right page with your local form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template satisfies your requirements.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the suitable subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Philadelphia Installment Promissory Note with Bank Deposit as Collateral on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!