Lima, Arizona Installment Promissory Note with Bank Deposit as Collateral is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender. This type of promissory note is commonly used when a borrower needs to secure a loan by depositing money into a bank account as collateral. The Lima, Arizona Installment Promissory Note with Bank Deposit as Collateral provides a detailed description of the loan amount, interest rate, repayment schedule, and consequences of default. There are different variations of Lima, Arizona Installment Promissory Note with Bank Deposit as Collateral, depending on the specific terms and conditions agreed upon by the parties involved. These variations may include: 1. Fixed Interest Rate: This type of promissory note sets a predetermined interest rate that remains constant throughout the loan term. Borrowers benefit from predictable monthly payments, while lenders are assured of a consistent return on their investment. 2. Variable Interest Rate: Unlike a fixed interest rate, a variable interest rate installment promissory note allows the interest rate to fluctuate over time. The interest rate is usually tied to a specific financial index, such as the prime rate or LIBOR. Borrowers may experience changes in their monthly installments based on market conditions. 3. Balloon Payment: In a balloon payment installment promissory note, the borrower agrees to make regular monthly installments for a portion of the loan term. However, the remaining balance becomes due as a lump sum at the end of the term. This type of note may be advantageous for borrowers who anticipate having sufficient funds by the end of the loan term. 4. Amortizing Installment: With an amortizing installment promissory note, both the interest and principal are paid off gradually over the loan term. Borrowers make equal monthly payments, ensuring that the loan is fully repaid at the end of the term. It is important for borrowers and lenders in Lima, Arizona to consult with legal professionals or financial advisors to draft a comprehensive Lima, Arizona Installment Promissory Note with Bank Deposit as Collateral that meets their specific requirements and ensures compliance with applicable laws and regulations. Always thoroughly review and understand the terms and conditions before entering into any financial agreement.

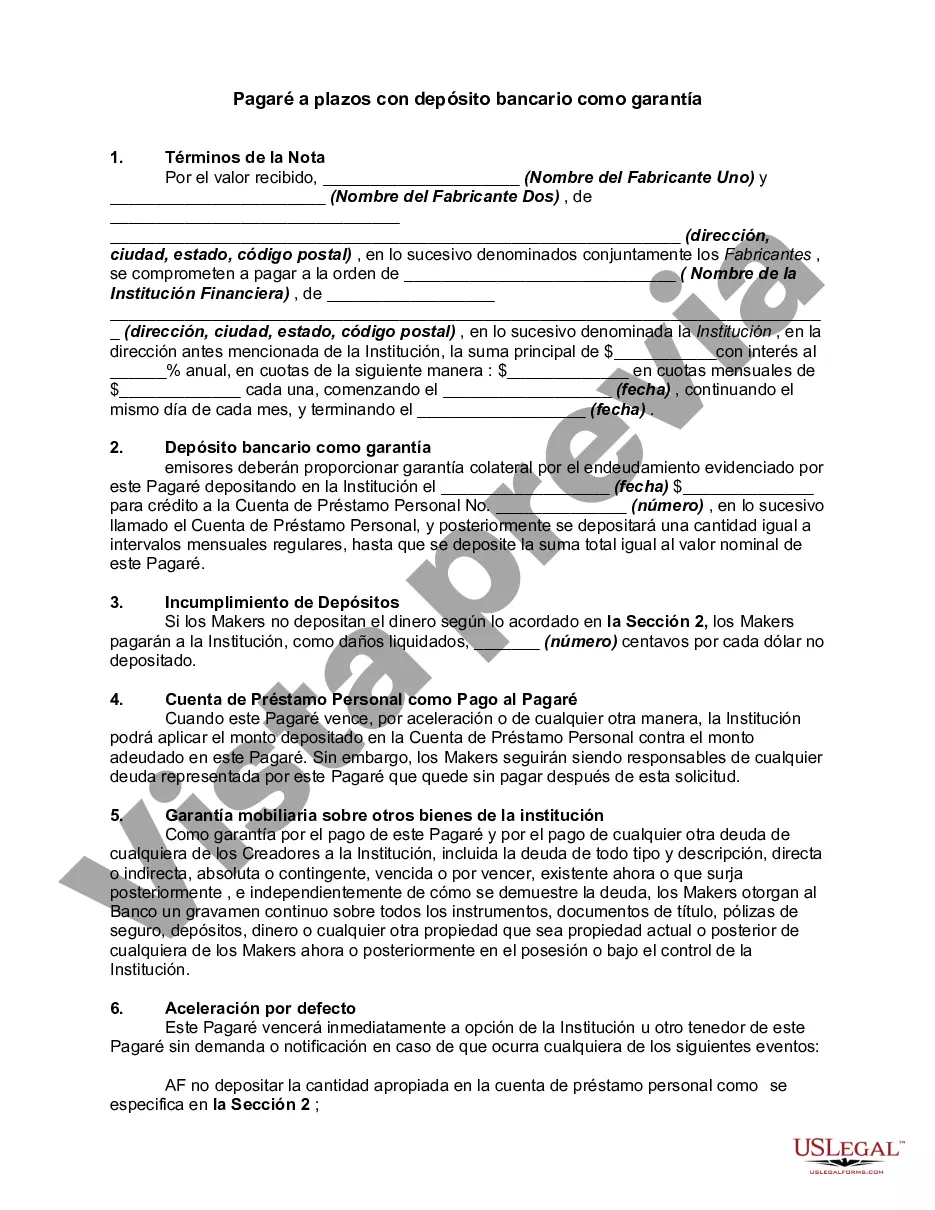

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Pagaré a plazos con depósito bancario como garantía - Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out Pima Arizona Pagaré A Plazos Con Depósito Bancario Como Garantía?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare official paperwork that varies from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any individual or business objective utilized in your county, including the Pima Installment Promissory Note with Bank Deposit as Collateral.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Pima Installment Promissory Note with Bank Deposit as Collateral will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to obtain the Pima Installment Promissory Note with Bank Deposit as Collateral:

- Make sure you have opened the right page with your localised form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Pima Installment Promissory Note with Bank Deposit as Collateral on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!