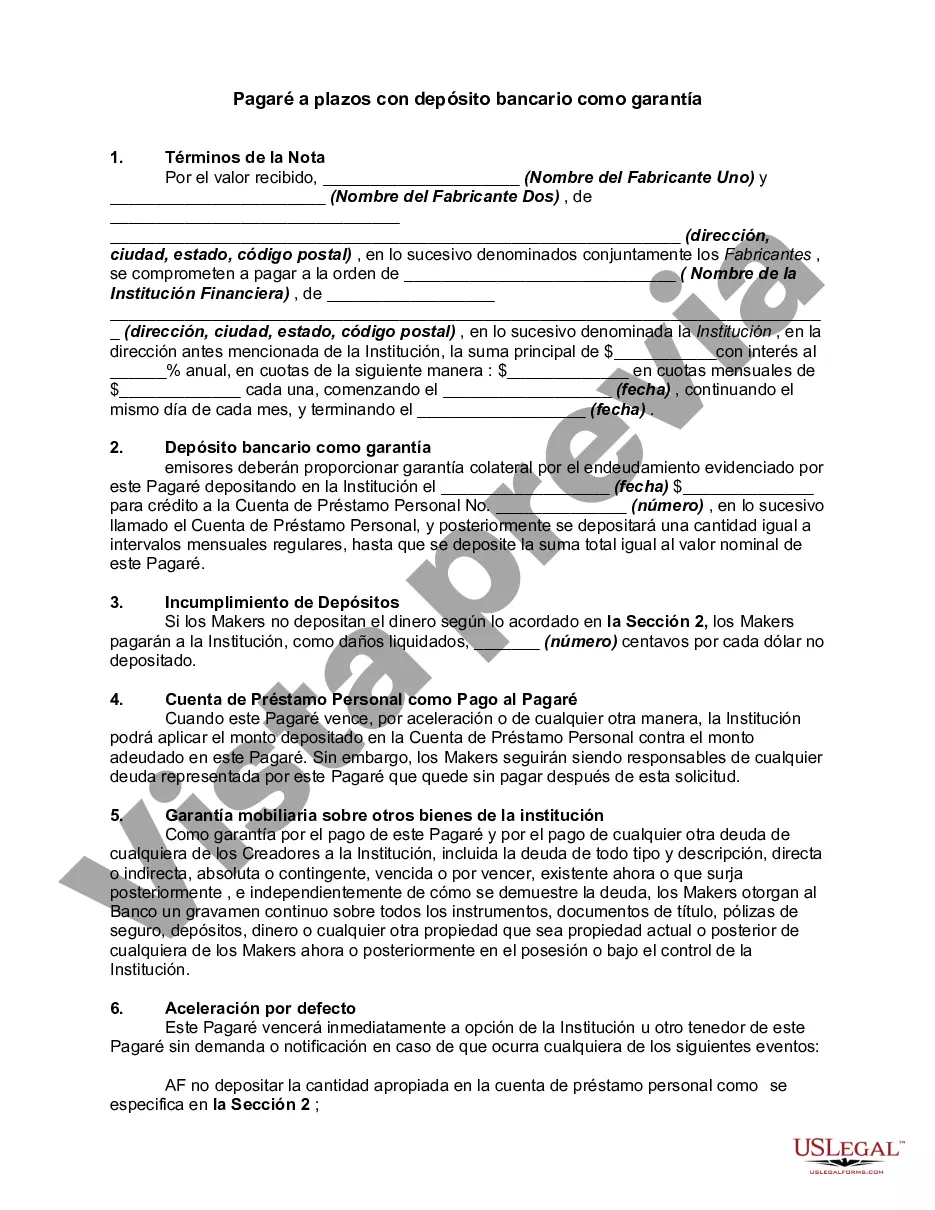

San Bernardino California Installment Promissory Note with Bank Deposit as Collateral refers to a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender in San Bernardino, California. This type of promissory note requires the borrower to make scheduled payments, known as installments, over a designated period until the loan is fully repaid. Unlike other types of promissory notes, this particular note involves using a bank deposit as collateral to secure the loan. The San Bernardino California Installment Promissory Note with Bank Deposit as Collateral is designed to protect the lender's interests by ensuring that the borrower repays the loan in a timely manner. By utilizing a bank deposit as collateral, the lender has an added layer of security, which can help mitigate the risk involved in lending money. In the event that the borrower defaults on the loan, the lender has the right to seize the bank deposit as compensation for the unpaid debt. It is important to note that there may be different variations or types of San Bernardino California Installment Promissory Notes with Bank Deposit as Collateral, each with its own specific terms and conditions. These variations may include but are not limited to: 1. Fixed-Rate Installment Promissory Note: This type of promissory note entails a fixed interest rate throughout the repayment period, offering stability to both the borrower and the lender. The borrower knows the exact amount they need to repay each month, while the lender is assured of a consistent return on their investment. 2. Variable-Rate Installment Promissory Note: Unlike the fixed-rate note, this type of promissory note comes with an adjustable or fluctuating interest rate. The interest rate may change periodically based on predetermined factors such as market conditions or a specific index. The borrower's payments may vary accordingly, which can pose more risk but also the potential for lower interest rates. 3. Secured Installment Promissory Note: In addition to using a bank deposit as collateral, this type of promissory note may also involve other assets, such as real estate, vehicles, or valuable possessions. Multiple forms of collateral provide further security for the lender, making it less likely for them to suffer losses in case of default. 4. Unsecured Installment Promissory Note: This note does not require any collateral. While it may seem riskier from the lender's perspective, it could be an option for borrowers who do not have sufficient assets to pledge as collateral. The interest rates for unsecured loans are often higher to compensate for the increased risk. These are just a few examples of the potential variations of San Bernardino California Installment Promissory Notes with Bank Deposit as Collateral. When entering into any financial agreement, it is crucial for both parties to carefully review and understand the terms and seek legal advice if necessary.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Bernardino California Pagaré a plazos con depósito bancario como garantía - Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out San Bernardino California Pagaré A Plazos Con Depósito Bancario Como Garantía?

Preparing papers for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to draft San Bernardino Installment Promissory Note with Bank Deposit as Collateral without expert help.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid San Bernardino Installment Promissory Note with Bank Deposit as Collateral by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, follow the step-by-step instruction below to obtain the San Bernardino Installment Promissory Note with Bank Deposit as Collateral:

- Look through the page you've opened and check if it has the document you need.

- To do so, use the form description and preview if these options are presented.

- To locate the one that suits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any scenario with just a couple of clicks!