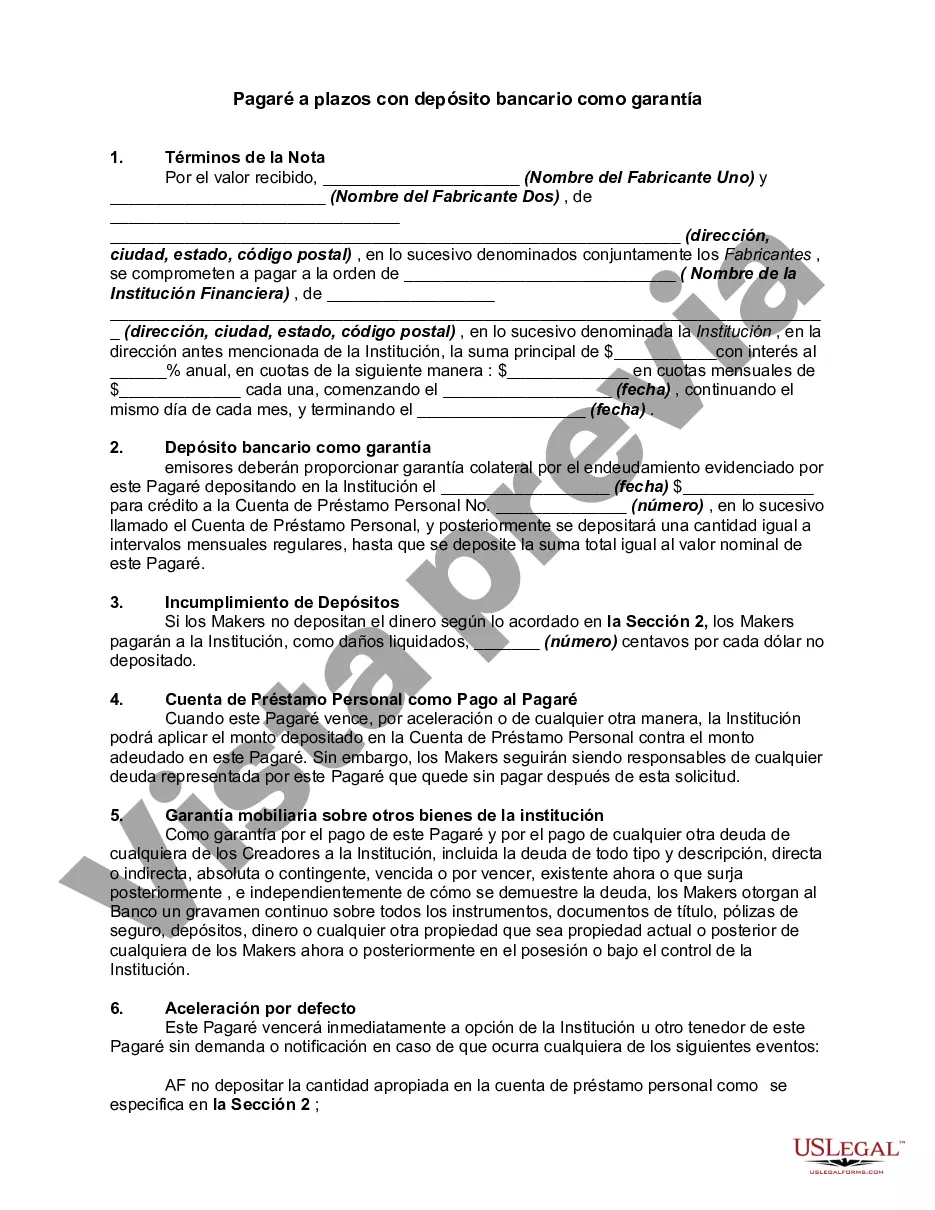

A San Diego California Installment Promissory Note with Bank Deposit as Collateral is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender. This type of promissory note is specific to San Diego, California, and involves the borrower providing a bank deposit as collateral for the loan. In this arrangement, the borrower agrees to repay the loan amount in scheduled installments over a specified period of time. The promissory note will include details such as the loan amount, interest rate, repayment schedule, and any late fees or penalties. By leveraging a bank deposit as collateral, the lender has added security in case the borrower defaults on the loan. The deposit acts as a guarantee, reducing the lender's risk and providing them with the ability to recover their funds by tapping into the deposit if necessary. San Diego California Installment Promissory Notes with Bank Deposit as Collateral can have variations depending on the specific terms and conditions agreed upon by both parties. Some potential variations may include: 1. Fixed-Rate Promissory Note: This type of promissory note specifies a fixed interest rate for the loan, meaning that the interest rate remains constant throughout the repayment period. 2. Variable-Rate Promissory Note: In contrast to the fixed-rate note, a variable-rate promissory note allows the interest rate to fluctuate over time. The interest rate is typically linked to a benchmark rate, such as the prime rate, and may change periodically. 3. Balloon Payment Promissory Note: A balloon payment note involves the borrower making regular installments for a certain period of time, followed by a larger, lump-sum payment (the balloon payment) at the end of the term. 4. Secured Promissory Note: While the primary collateral for this type of note is the bank deposit, additional assets may be included as security for the loan. This could involve the borrower offering other valuable assets such as real estate or vehicles to further secure the loan. It is important for both the borrower and the lender to carefully review and understand the terms and conditions outlined in the San Diego California Installment Promissory Note with Bank Deposit as Collateral before entering into the agreement. Seeking legal advice or consulting with financial professionals can also be beneficial to ensure compliance with relevant laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Pagaré a plazos con depósito bancario como garantía - Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out San Diego California Pagaré A Plazos Con Depósito Bancario Como Garantía?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the San Diego Installment Promissory Note with Bank Deposit as Collateral, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the San Diego Installment Promissory Note with Bank Deposit as Collateral from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the San Diego Installment Promissory Note with Bank Deposit as Collateral:

- Examine the page content to ensure you found the correct sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the document once you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!