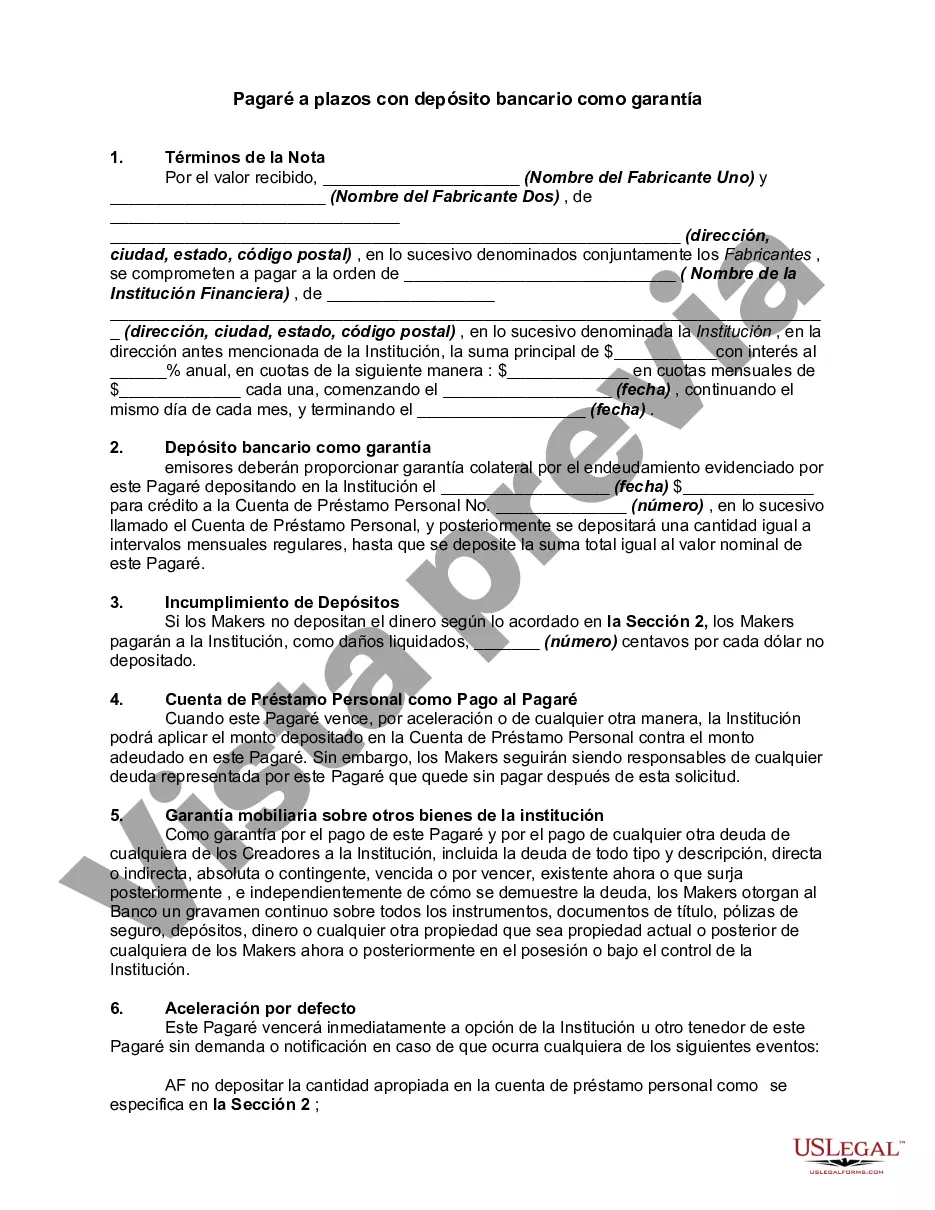

A San Jose California Installment Promissory Note with Bank Deposit as Collateral is a legal document that outlines the details of a loan agreement between a borrower and a lender in San Jose, California. This type of promissory note is secured by a bank deposit held by the lender as collateral, providing additional security for the loan. This installment promissory note in San Jose allows for the repayment of the loan amount, including any interest, in a series of scheduled payments over a specified period. The terms of the promissory note may vary depending on the agreement between the borrower and lender, including the loan amount, interest rate, repayment schedule, and any additional provisions. There are different types of San Jose California Installment Promissory Note with Bank Deposit as Collateral, which include: 1. Fixed Rate Installment Promissory Note: This type of promissory note specifies a fixed interest rate for the entire loan term. The borrower will make equal monthly installments to repay the principal amount along with the fixed interest over a predetermined period. 2. Adjustable Rate Installment Promissory Note: This promissory note allows for an adjustable interest rate, typically based on a specific financial index. The interest rate may fluctuate periodically, affecting the borrower's monthly repayment amount. 3. Balloon Installment Promissory Note: In a balloon promissory note, the borrower makes regular installments for a specified period, with a larger payment, called a balloon payment, due at the end of the term. The balloon payment covers the remaining loan balance. It is crucial to have a properly drafted San Jose California Installment Promissory Note with Bank Deposit as Collateral to ensure that both parties involved are protected. This legal document outlines all the terms and conditions of the loan, including the repayment schedule, interest rate, late payment fees, and any defaults or remedies available. If the borrower fails to make the scheduled payments or defaults on the loan, the lender has the right to use the bank deposit held as collateral to recover the outstanding loan balance. This provides an added level of security for the lender and ensures that the borrower fulfills the loan obligation. In summary, a San Jose California Installment Promissory Note with Bank Deposit as Collateral is a legal agreement that secures a loan by using a bank deposit as collateral. The different types of installment promissory notes can vary based on the interest rate structure, repayment terms, and presence of a balloon payment. It is essential for both parties to understand the terms and obligations outlined in the promissory note to avoid any legal disputes or issues.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Pagaré a plazos con depósito bancario como garantía - Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out San Jose California Pagaré A Plazos Con Depósito Bancario Como Garantía?

If you need to find a trustworthy legal document supplier to find the San Jose Installment Promissory Note with Bank Deposit as Collateral, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can search from more than 85,000 forms categorized by state/county and case.

- The self-explanatory interface, number of learning materials, and dedicated support team make it easy to find and execute various paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply type to look for or browse San Jose Installment Promissory Note with Bank Deposit as Collateral, either by a keyword or by the state/county the document is created for. After locating necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the San Jose Installment Promissory Note with Bank Deposit as Collateral template and check the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be immediately available for download as soon as the payment is processed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes these tasks less expensive and more affordable. Set up your first company, arrange your advance care planning, create a real estate contract, or execute the San Jose Installment Promissory Note with Bank Deposit as Collateral - all from the convenience of your sofa.

Join US Legal Forms now!