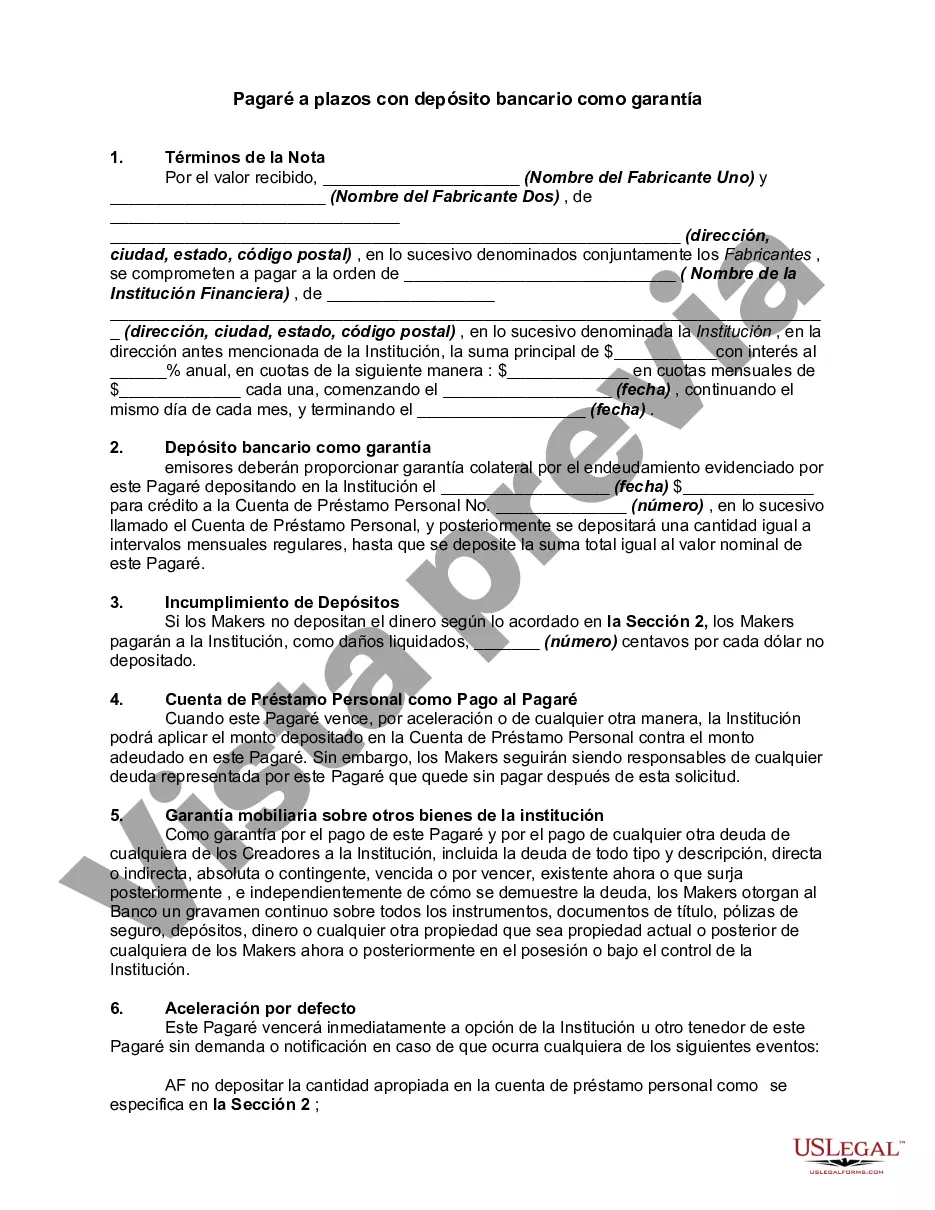

A Santa Clara California Installment Promissory Note with Bank Deposit as Collateral is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of promissory note is specific to Santa Clara, California and holds a bank deposit as collateral, providing additional security for the lender. The Santa Clara California Installment Promissory Note with Bank Deposit as Collateral is commonly used in financial transactions, such as personal loans, real estate transactions, or business financing arrangements. It ensures that the borrower commits to repay the loan amount in scheduled installments, while the lender holds the bank deposit as collateral until the loan is fully repaid. Key features of this promissory note include the loan amount, interest rate, payment schedule, and the consequences for defaulting on the loan. It also details the specific bank deposit that serves as collateral, providing protection for the lender in case of non-payment or default by the borrower. Within the context of Santa Clara, California, there may be variations or specific types of installment promissory notes with bank deposit as collateral. Some potential examples include: 1. Residential Real Estate Installment Promissory Note: This type of promissory note is used in the Santa Clara residential real estate market, where a borrower may secure a loan to purchase or refinance a property. The borrower provides a bank deposit as collateral for the lender, ensuring repayment of the loan based on the agreed installment plan. 2. Small Business Loan Installment Promissory Note: In the vibrant business environment of Santa Clara, this type of promissory note may be used by lenders to extend loans to small businesses. The bank deposit collateralized by the borrower ensures repayment of the loan amount through regular installments over an agreed term. 3. Personal Loan Installment Promissory Note: This promissory note is tailored for personal financial transactions in Santa Clara, where individuals borrow money for various purposes, such as education, medical expenses, or debt consolidation. The borrower utilizes a bank deposit as collateral, easing the lender's concerns about potential default. Overall, the Santa Clara California Installment Promissory Note with Bank Deposit as Collateral serves as a legally binding agreement that protects the interests of both the lender and the borrower. It outlines the repayment structure and conditions, while the bank deposit collateral provides added security for the lender during the loan term.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Pagaré a plazos con depósito bancario como garantía - Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out Santa Clara California Pagaré A Plazos Con Depósito Bancario Como Garantía?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from scratch, including Santa Clara Installment Promissory Note with Bank Deposit as Collateral, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in different categories varying from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching process less overwhelming. You can also find detailed materials and guides on the website to make any tasks related to document execution straightforward.

Here's how to purchase and download Santa Clara Installment Promissory Note with Bank Deposit as Collateral.

- Go over the document's preview and outline (if available) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can impact the validity of some records.

- Examine the similar forms or start the search over to find the right document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy Santa Clara Installment Promissory Note with Bank Deposit as Collateral.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Santa Clara Installment Promissory Note with Bank Deposit as Collateral, log in to your account, and download it. Of course, our platform can’t replace an attorney completely. If you have to deal with an extremely challenging situation, we recommend using the services of a lawyer to examine your document before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Become one of them today and purchase your state-specific documents effortlessly!