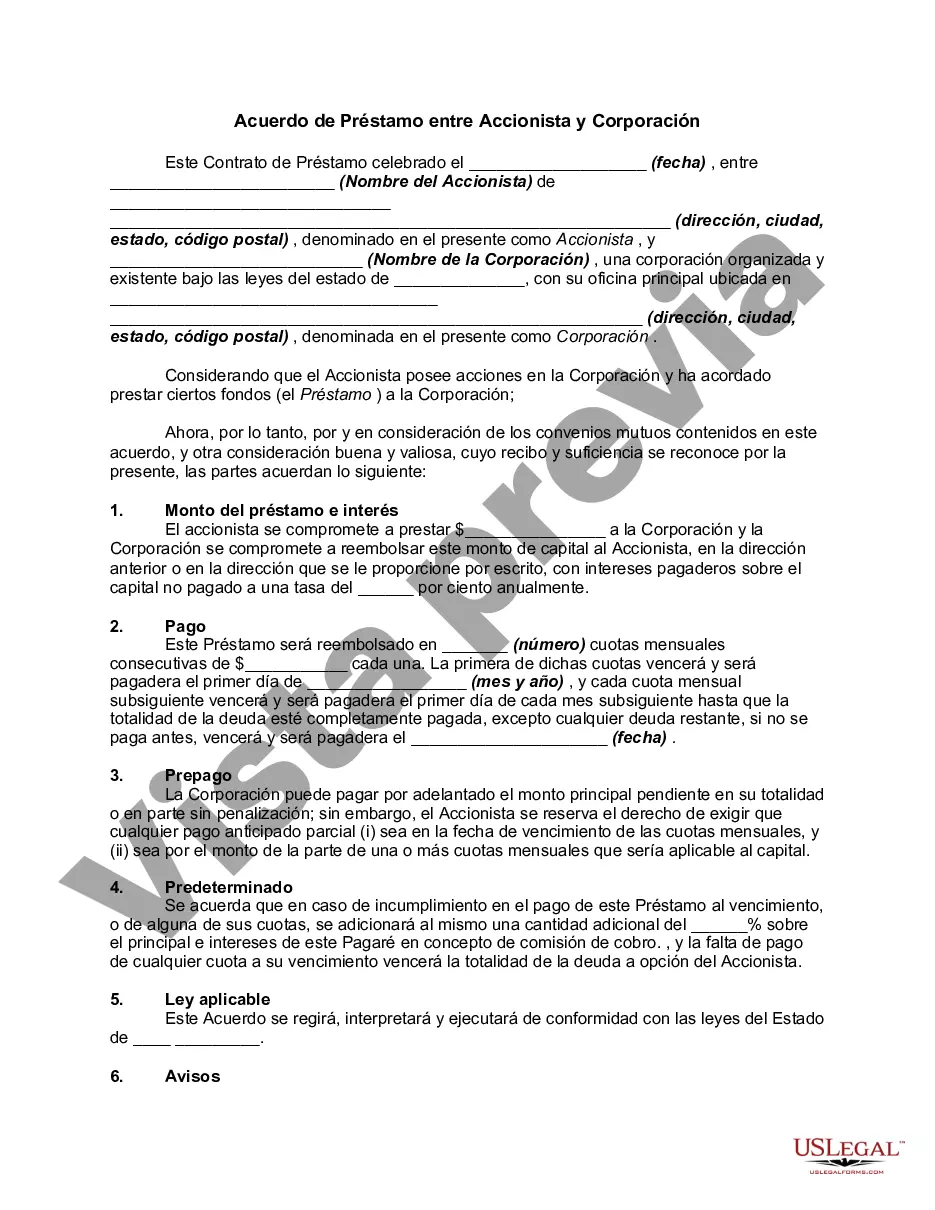

Title: Bexar Texas Loan Agreement between Stockholder and Corporation: A Comprehensive Guide Keywords: Bexar Texas Loan Agreement, Stockholder, Corporation, Types Introduction: A Bexar Texas Loan Agreement between Stockholder and Corporation is a legally binding document that outlines the terms and conditions under which a stockholder lends money to a corporation in Bexar County, Texas. It serves as a formal agreement between the two parties, ensuring clarity and protection of each party's rights and obligations. There are various types of Bexar Texas Loan Agreements available, each designed to cater to specific needs and situations. Let's explore these types in detail: 1. Promissory Note: A Promissory Note Loan Agreement is the most common type, wherein the stockholder (lender) agrees to loan a specific amount of money to the corporation (borrower). This agreement includes the principal loan amount, interest rate, repayment terms, and any additional fees or provisions. It establishes a legally binding promise from the borrower to repay the loan within a specified timeframe. 2. Secured Loan Agreement: A Secured Loan Agreement involves the stockholder securing their loan against specific assets or collateral owned by the corporation. This type of agreement provides an additional layer of protection for the lender, as it allows them to seize the collateral if the borrower fails to repay the loan as per the agreed terms. 3. Convertible Loan Agreement: A Convertible Loan Agreement offers an alternative repayment option to stockholders. In this type, the loan amount can be converted into equity or shares of the corporation's stock at a specified conversion rate and under particular circumstances, such as when the corporation reaches a certain valuation or during a future funding round. 4. Demand Loan Agreement: A Demand Loan Agreement provides flexibility to the lender, allowing them to request repayment of the loan at any time. This type doesn't have a fixed repayment schedule and grants the stockholder the ability to demand full repayment whenever they deem necessary. 5. Bridge Loan Agreement: A Bridge Loan Agreement is commonly used in situations where a corporation needs immediate funds to bridge a financial gap. It offers short-term financing options until the corporation secures a more substantial, long-term loan or funding. This type of agreement often has a higher interest rate and shorter repayment period. Conclusion: Bexar Texas Loan Agreements between Stockholder and Corporation encompass various types, each serving different purposes and catering to the unique needs of the parties involved. Understanding the different types of loan agreements available can help both stockholders and corporations negotiate terms that align with their financial goals and mitigate potential risks. It is crucial for both parties to consult legal professionals to ensure compliance with applicable laws and drafting accurate loan agreements tailored to their specific circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Acuerdo de Préstamo entre Accionista y Corporación - Loan Agreement between Stockholder and Corporation

Description

How to fill out Bexar Texas Acuerdo De Préstamo Entre Accionista Y Corporación?

Whether you plan to open your business, enter into a contract, apply for your ID update, or resolve family-related legal issues, you must prepare certain documentation corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Bexar Loan Agreement between Stockholder and Corporation is quick and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several additional steps to get the Bexar Loan Agreement between Stockholder and Corporation. Adhere to the guidelines below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to get the file once you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Bexar Loan Agreement between Stockholder and Corporation in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your earlier purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!