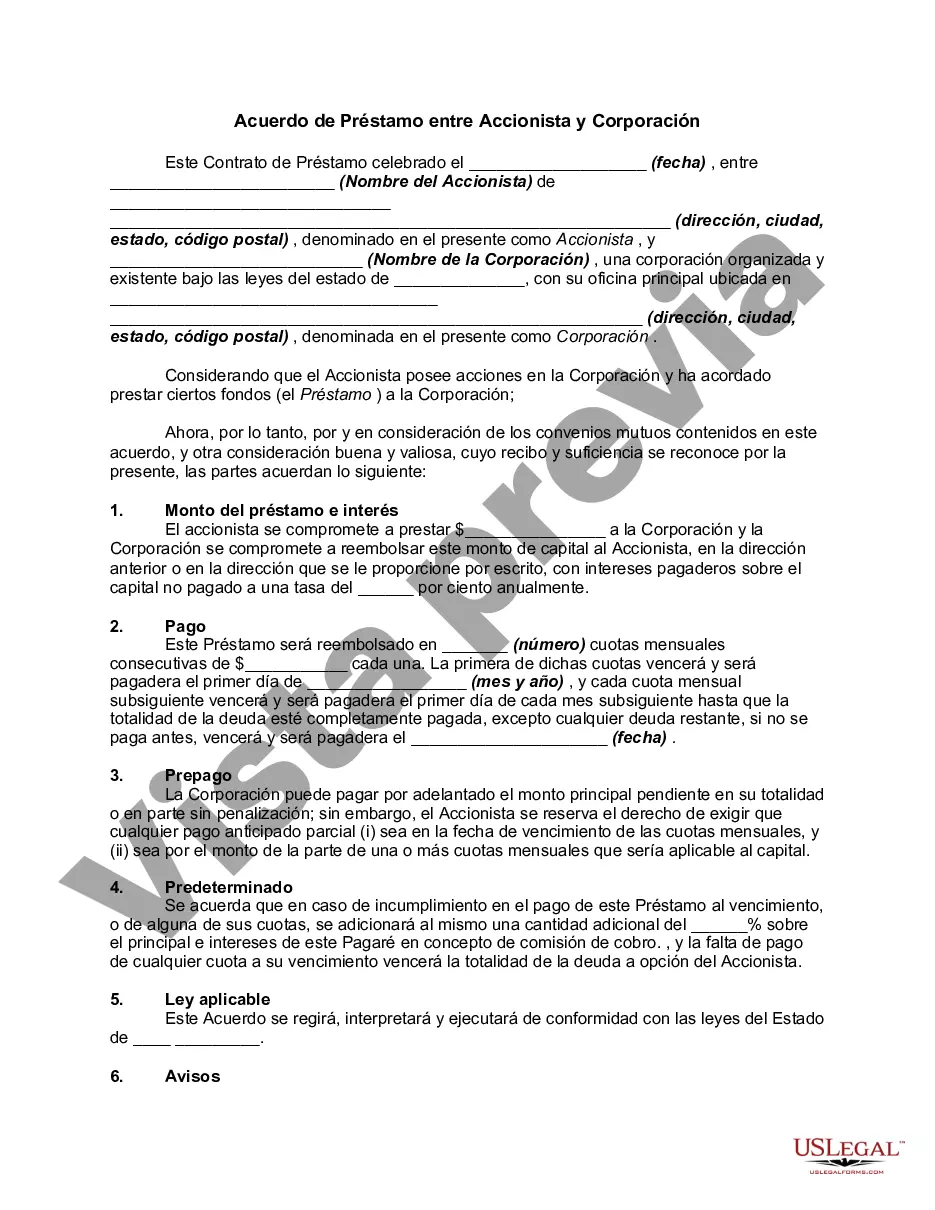

Palm Beach, Florida Loan Agreement between Stockholder and Corporation: A Comprehensive Guide Introduction: In Palm Beach, Florida, a loan agreement between a stockholder and a corporation is a legally binding contract that outlines the terms and conditions for providing a loan from a stockholder to a corporation. Such agreements are designed to protect the interests of both parties involved and establish clear guidelines for the loan transaction. This article will delve into the details of Palm Beach, Florida loan agreements between stockholders and corporations, highlighting key aspects, types, and relevant keywords associated with this topic. Key Components of a Palm Beach, Florida Loan Agreement: 1. Parties Involved: A loan agreement typically involves two parties: the stockholder (lender) and the corporation or company in need of funds (borrower). Both parties must be identified accurately, including their legal names and addresses, to ensure clarity and prevent any confusion later. 2. Loan Amount and Interest: The agreement must specify the loan amount provided by the stockholder to the corporation. Additionally, the interest rate, whether fixed or variable, should be clearly stated. The terms of interest calculation, frequency of interest payments, and any applicable penalties for late payments should also be discussed. 3. Repayment Terms: The repayment terms outline how the loan will be repaid. This includes specifying the payment schedule, whether in installments or as a lump sum, and the duration of the loan. Furthermore, the agreement may address the consequences of default, such as late fees, penalties, or potential legal action. 4. Collateral: If the loan agreement involves securing the loan against specific assets, such as real estate, equipment, or stocks, details regarding the collateral should be provided. This section may cover the valuation of the collateral, conditions for its release, and any associated risks. 5. Governing Law: The agreement should explicitly state that Palm Beach, Florida law governs the loan agreement. Including this provision ensures that both parties are subject to Palm Beach's jurisdiction in case of any legal disputes. Types of Palm Beach, Florida Loan Agreements between Stockholder and Corporation: 1. Simple Loan Agreement: This type of agreement covers the basic terms and conditions of a loan without extensive elaboration. It is suitable for straightforward loan transactions with minimal risks or complexities. 2. Convertible Loan Agreement: In this type of agreement, the loan can be converted into equity or stock ownership in the corporation under specific circumstances. This provides additional flexibility to the stockholder, who can potentially benefit from future growth or success of the corporation. 3. Secured Loan Agreement: In a secured loan agreement, the loan is guaranteed by specific assets as collateral. This type of agreement provides an added layer of security for the stockholder, reducing the risk of default. 4. Demand Loan Agreement: With a demand loan agreement, the stockholder can require immediate repayment of the loan at any time, providing them with maximum flexibility and control over the funds. Conclusion: Palm Beach, Florida Loan Agreements between stockholders and corporations are crucial instruments for managing financial transactions. These agreements help establish clear expectations between parties involved in loan transactions, ensuring fairness, and protecting the interests of both stockholders and corporations. Comprehending the intricacies of loan agreements enables stockholders and corporations to engage in secure and mutually beneficial financial arrangements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Beach Florida Acuerdo de Préstamo entre Accionista y Corporación - Loan Agreement between Stockholder and Corporation

Description

How to fill out Palm Beach Florida Acuerdo De Préstamo Entre Accionista Y Corporación?

Drafting paperwork for the business or individual demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to draft Palm Beach Loan Agreement between Stockholder and Corporation without expert assistance.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Palm Beach Loan Agreement between Stockholder and Corporation by yourself, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Palm Beach Loan Agreement between Stockholder and Corporation:

- Look through the page you've opened and check if it has the sample you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that fits your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any scenario with just a couple of clicks!