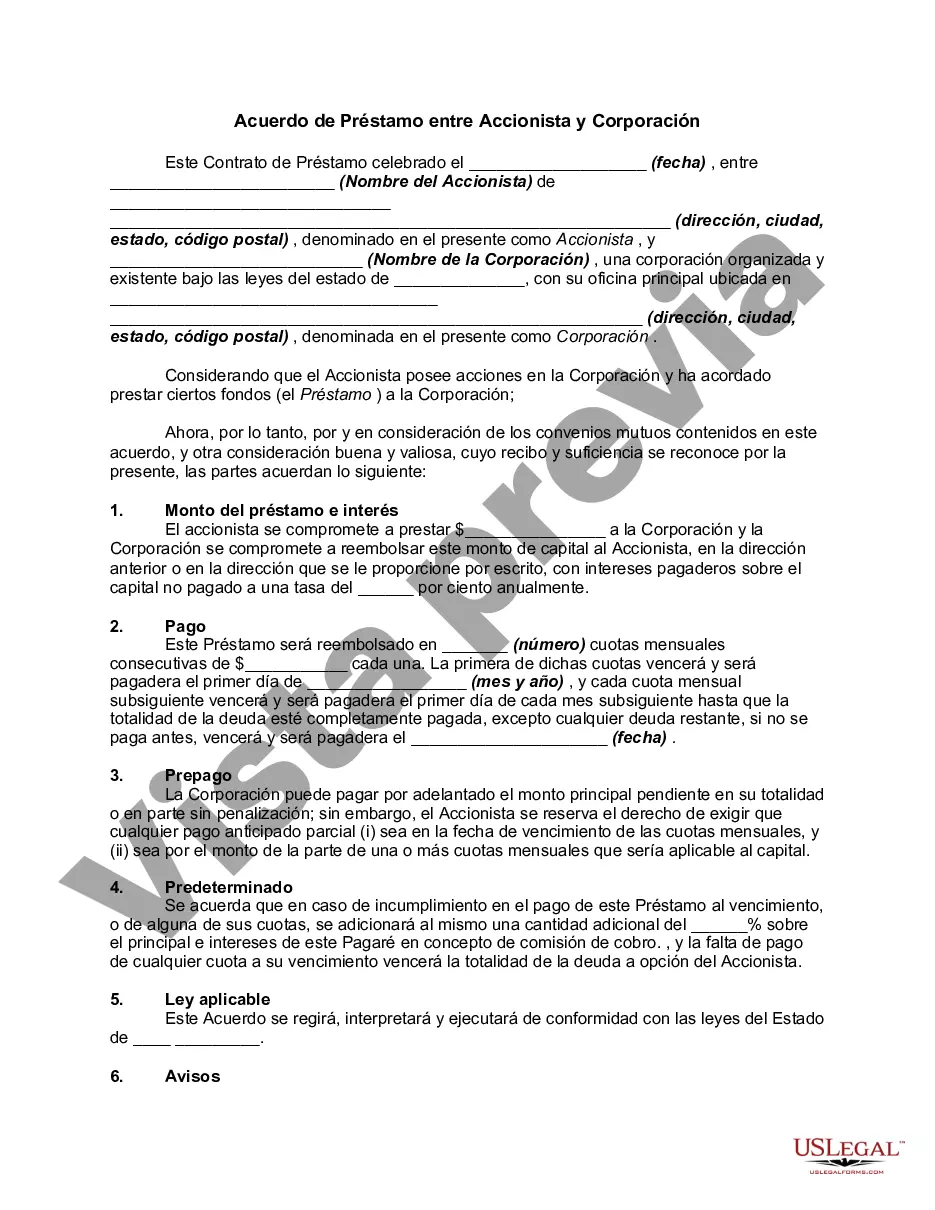

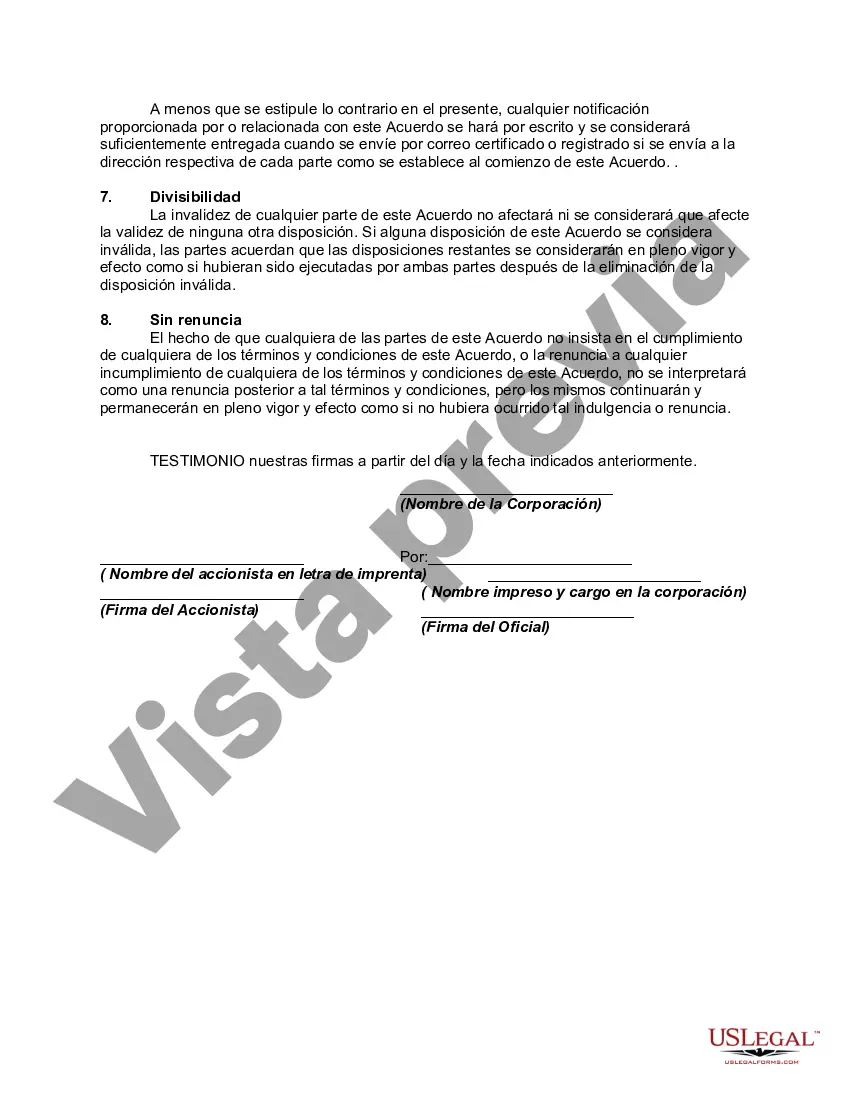

A San Diego California Loan Agreement between Stockholder and Corporation is a legal document that outlines the terms and conditions under which a shareholder can lend funds to a corporation based in San Diego, California. This agreement establishes the rights and obligations of both parties, ensuring transparency and legal protection throughout the loan process. Keywords: San Diego California, loan agreement, stockholder, corporation, legal document, terms and conditions, shareholder, lend funds, rights, obligations, transparency, legal protection, loan process. There are several types of San Diego California Loan Agreements between Stockholder and Corporation, including: 1. Demand Loan Agreement: This type of agreement allows the stockholder to lend funds to the corporation, and the corporation must repay the loan upon demand by the stockholder. The terms, interest rate, and repayment schedule are typically specified in the agreement. 2. Installment Loan Agreement: In this type of agreement, the loan amount is distributed into equal periodic installments, and the corporation repays the loan with interest over a specified period. The agreement includes details on the repayment schedule, interest rate, and any penalties for late payments. 3. Secured Loan Agreement: A secured loan agreement involves the stockholder providing collateral, such as real estate or other valuable assets, to secure the loan. This type of agreement provides additional security to the stockholder in case of default by the corporation. 4. Convertible Loan Agreement: This agreement allows the stockholder to convert the loan into equity, such as preferred or common shares in the corporation, at a specified conversion rate and within a predetermined timeframe. It offers flexibility to the stockholder in case they wish to become a shareholder instead of a creditor. 5. Promissory Note Agreement: Although not strictly a loan agreement, a promissory note can be used as an alternate form of loan documentation. It is a written promise by the corporation to repay the borrowed funds to the stockholder, including details such as repayment terms, interest rate, and any other relevant conditions. Regardless of the specific type of loan agreement, it is crucial for both the stockholder and the corporation to consult legal experts to ensure compliance with San Diego, California laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Acuerdo de Préstamo entre Accionista y Corporación - Loan Agreement between Stockholder and Corporation

Description

How to fill out San Diego California Acuerdo De Préstamo Entre Accionista Y Corporación?

Are you looking to quickly create a legally-binding San Diego Loan Agreement between Stockholder and Corporation or probably any other document to manage your personal or business affairs? You can go with two options: hire a legal advisor to write a valid document for you or create it entirely on your own. The good news is, there's a third option - US Legal Forms. It will help you get neatly written legal documents without paying sky-high prices for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-specific document templates, including San Diego Loan Agreement between Stockholder and Corporation and form packages. We provide templates for a myriad of use cases: from divorce papers to real estate document templates. We've been on the market for over 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and get the needed document without extra hassles.

- To start with, carefully verify if the San Diego Loan Agreement between Stockholder and Corporation is tailored to your state's or county's laws.

- In case the form includes a desciption, make sure to verify what it's suitable for.

- Start the search over if the template isn’t what you were hoping to find by utilizing the search bar in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the San Diego Loan Agreement between Stockholder and Corporation template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Additionally, the templates we provide are updated by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!