A Philadelphia Pennsylvania Guaranty of a Lease is a legal document that is commonly used in the real estate industry. This document provides assurance and security to a landlord by guaranteeing that a tenant will fulfill their obligations under a lease agreement. It serves as a form of protection for property owners, ensuring that they have recourse in case a tenant defaults on the lease. A Philadelphia Pennsylvania Guaranty of a Lease typically involves a third party, known as the guarantor, who agrees to be liable for any losses or damages incurred by the landlord due to the tenant's failure to comply with the terms of the lease agreement. This means that if the tenant fails to pay rent, damages the property, or violates any other conditions outlined in the lease, the guarantor will be responsible for covering these costs. The primary purpose of a Guaranty of a Lease is to provide financial security to the landlord. It helps to mitigate risks associated with renting out property, especially when dealing with tenants who may have limited credit history, unstable income, or uncertain financial standing. Landlords often require this type of guarantee when dealing with businesses, startups, or individuals who may not meet their traditional rental criteria. In Philadelphia, Pennsylvania, there are different types of Guaranty of a Lease agreement depending on the specific situation: 1. Corporate Guaranty: This type of guaranty involves a corporation or a company acting as the guarantor. It is commonly used when a business entity is the tenant, providing additional protection to the landlord and ensuring that the corporation will cover any costs resulting from lease violations. 2. Individual or Personal Guaranty: In this scenario, an individual, usually the principal of a business or a high-ranking employee, agrees to personally guarantee the lease. This means that their personal assets and finances are at stake if the tenant fails to fulfill their obligations. 3. Joint Guaranty: A joint guaranty involves multiple guarantors sharing the responsibility of guaranteeing the lease. This type of agreement can provide additional security to the landlord as it spreads the financial risk among several parties. 4. Limited Guaranty: A limited guaranty imposes certain limitations on the guarantor's liability. This may include specifying a maximum amount that the guarantor will be responsible for, or stating that their liability is limited to a specific time period or set of circumstances. It is important to note that the specific terms and conditions of a Philadelphia Pennsylvania Guaranty of a Lease can vary depending on the parties involved and the purpose of the lease. Seeking legal advice from a qualified attorney is recommended to ensure that the agreement meets all necessary legal requirements and protects the interests of both parties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Garantía de un arrendamiento - Guaranty of a Lease

Description

How to fill out Philadelphia Pennsylvania Garantía De Un Arrendamiento?

Draftwing documents, like Philadelphia Guaranty of a Lease, to take care of your legal matters is a challenging and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task not really affordable. However, you can get your legal affairs into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms crafted for various cases and life circumstances. We make sure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Philadelphia Guaranty of a Lease template. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is just as straightforward! Here’s what you need to do before downloading Philadelphia Guaranty of a Lease:

- Ensure that your document is specific to your state/county since the rules for writing legal paperwork may differ from one state another.

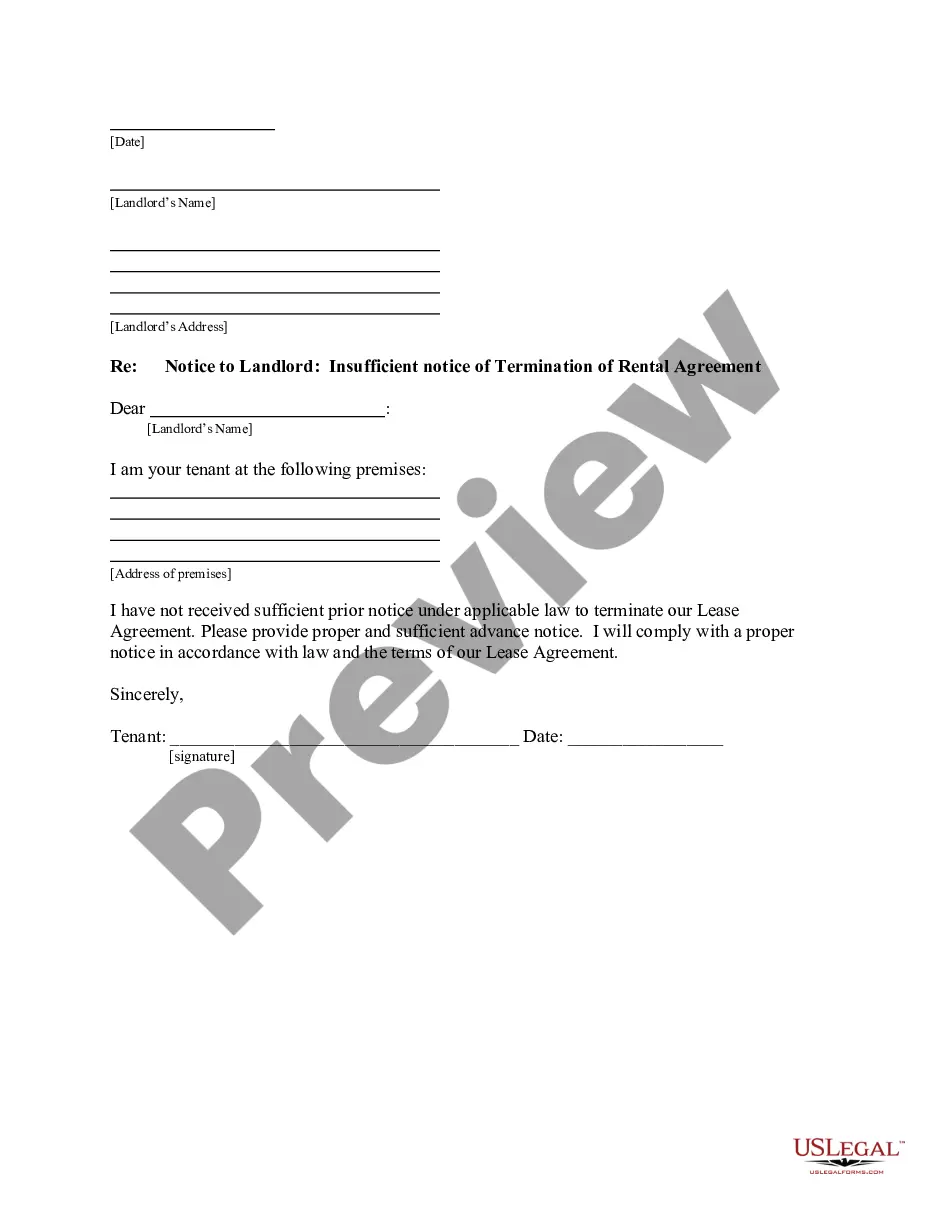

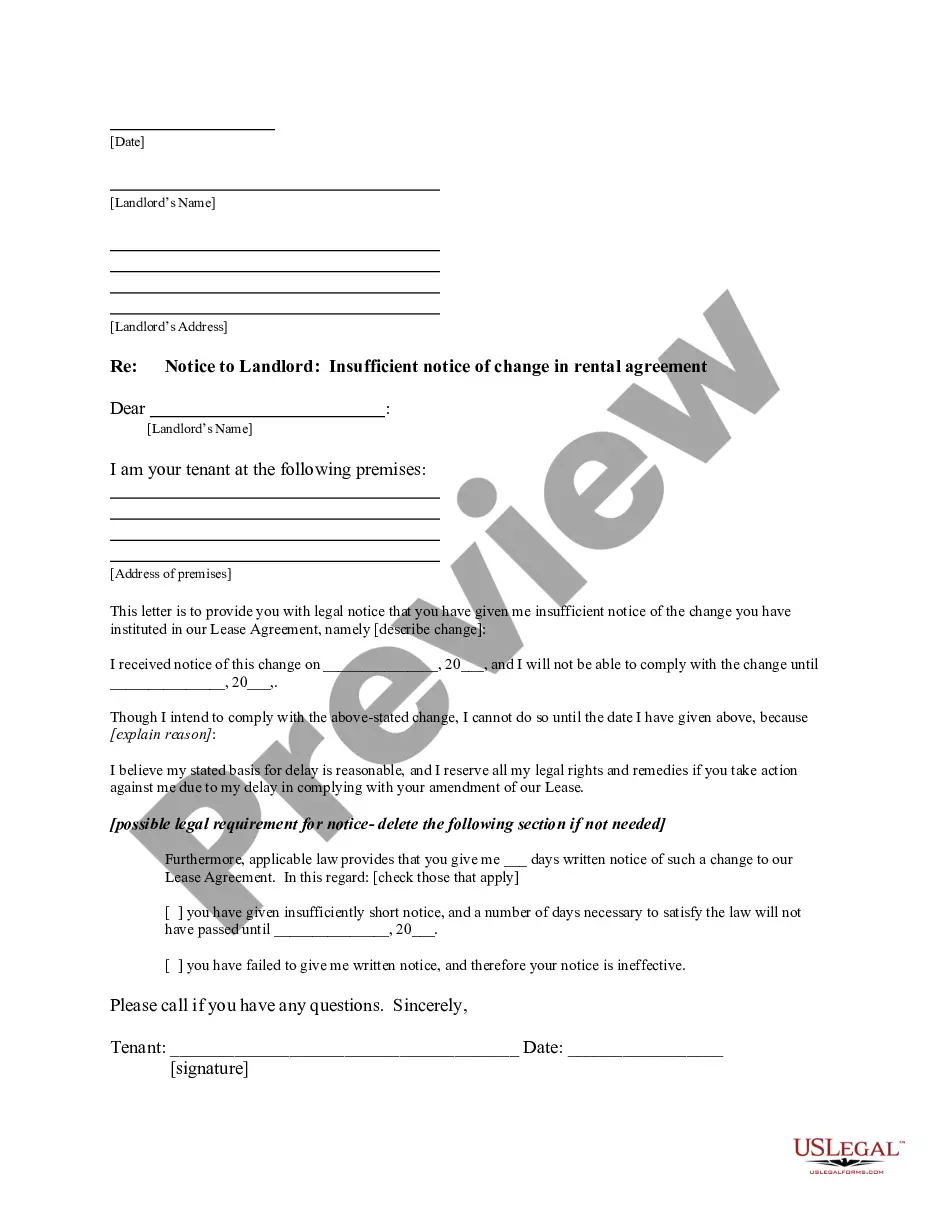

- Discover more information about the form by previewing it or reading a quick intro. If the Philadelphia Guaranty of a Lease isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to begin utilizing our service and get the document.

- Everything looks good on your end? Hit the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment information.

- Your template is all set. You can go ahead and download it.

It’s an easy task to find and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!