Homestead laws are primarily governed by state laws, which vary by state. They may deal with such matters as the ability of creditors to attach a person's home, the amount of real estate taxes owed on the home, or the ability of the homeowner to mortgage or devise the home under a will, among other issues.

For example, in one state, when you record a Declaration of Homestead, the equity in your home is protected up to a statutory amount. In another state, there is no statutory limit. This protection precludes seizure or forced sale of your residence by general creditor claims (unpaid medical bills, bankruptcy, charge card debts, business & personal loans, accidents, etc.). State laws often provide a homestead exemption for older citizens so that a certain dollar amount of the home's value is exempt from real estate taxes. Other laws may provide rules for a person's ability to mortgage or devise the homestead. Local laws should be consulted for requirements in your area.

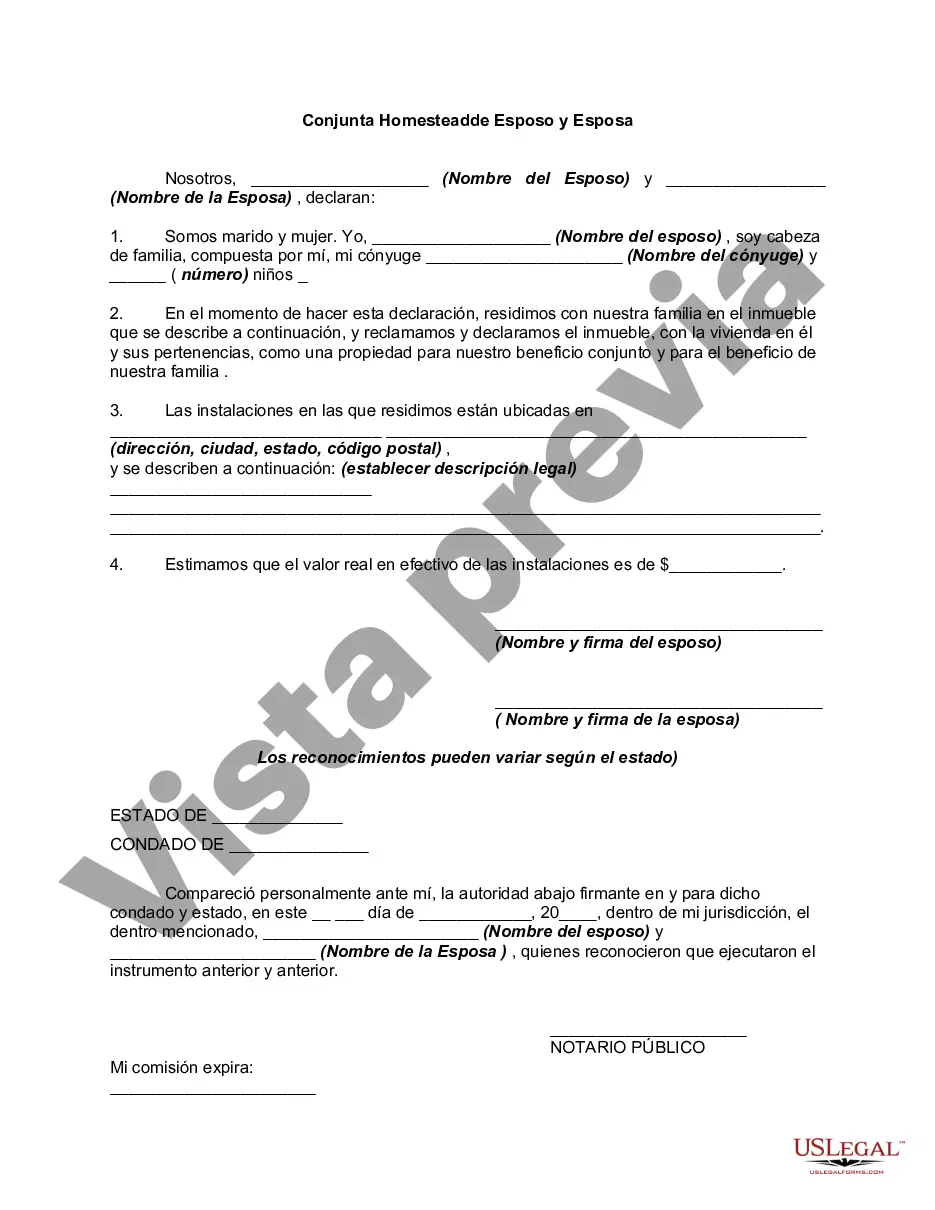

A Houston Texas Joint Homestead Declaration by Husband and Wife is a legal document that allows married couples to declare their homestead status and protect their property rights in the state of Texas. This declaration is commonly used to establish the couple's primary residence as a homestead, providing legal protection against certain creditors and ensuring certain benefits under Texas law. The Houston Texas Joint Homestead Declaration by Husband and Wife is typically filed with the county clerk's office where the property is located. It is important to note that the requirements and regulations for filing this declaration may vary between counties, so couples should consult with a legal professional or research their specific county's guidelines. This declaration serves as a legal affirmation that the couple is jointly declaring their property as their primary residence or homestead. By doing so, they are asserting their right to certain exemptions and protections under the Texas Constitution and Property Code. Some key benefits and features of a Houston Texas Joint Homestead Declaration by Husband and Wife include: 1. Protection against forced sale: The declaration provides protection against forced sale by general creditors, meaning that a couple's primary residence cannot be seized as part of a judgment or debt collection process. This protection applies to both the husband and wife. 2. Spousal consent: Both spouses must sign the declaration to establish their joint homestead status. This ensures that both parties are aware of the declaration and consent to its terms. 3. Limitations on home equity loans: The declaration establishes certain limitations on home equity loans and lines of credit. It helps safeguard the primary residence from excessive debt and helps prevent the erosion of home equity. 4. Family and marital protections: A Houston Texas Joint Homestead Declaration by Husband and Wife helps protect the interests of the spouse and family members residing in the homestead. It ensures that the surviving spouse and certain family members have a legal right to remain in the homestead and continue enjoying its privileges even after the death of one spouse. It is important to note that there may be variations or additional types of Joint Homestead Declarations that might exist specifically in Houston, Texas. Factors such as marital status, property ownership structure, and the presence of a prenuptial agreement can affect the nature and provisions of these declarations. It is advisable for couples to consult with a legal professional to determine the appropriate type of Joint Homestead Declaration that suits their specific circumstances. In conclusion, a Houston Texas Joint Homestead Declaration by Husband and Wife is a significant legal document that enables married couples to establish their primary residence as a homestead and protect their property rights in Texas. By declaring their homestead status, couples can enjoy various benefits, including protection against forced sale, limitations on home equity loans, and marital and family protections.A Houston Texas Joint Homestead Declaration by Husband and Wife is a legal document that allows married couples to declare their homestead status and protect their property rights in the state of Texas. This declaration is commonly used to establish the couple's primary residence as a homestead, providing legal protection against certain creditors and ensuring certain benefits under Texas law. The Houston Texas Joint Homestead Declaration by Husband and Wife is typically filed with the county clerk's office where the property is located. It is important to note that the requirements and regulations for filing this declaration may vary between counties, so couples should consult with a legal professional or research their specific county's guidelines. This declaration serves as a legal affirmation that the couple is jointly declaring their property as their primary residence or homestead. By doing so, they are asserting their right to certain exemptions and protections under the Texas Constitution and Property Code. Some key benefits and features of a Houston Texas Joint Homestead Declaration by Husband and Wife include: 1. Protection against forced sale: The declaration provides protection against forced sale by general creditors, meaning that a couple's primary residence cannot be seized as part of a judgment or debt collection process. This protection applies to both the husband and wife. 2. Spousal consent: Both spouses must sign the declaration to establish their joint homestead status. This ensures that both parties are aware of the declaration and consent to its terms. 3. Limitations on home equity loans: The declaration establishes certain limitations on home equity loans and lines of credit. It helps safeguard the primary residence from excessive debt and helps prevent the erosion of home equity. 4. Family and marital protections: A Houston Texas Joint Homestead Declaration by Husband and Wife helps protect the interests of the spouse and family members residing in the homestead. It ensures that the surviving spouse and certain family members have a legal right to remain in the homestead and continue enjoying its privileges even after the death of one spouse. It is important to note that there may be variations or additional types of Joint Homestead Declarations that might exist specifically in Houston, Texas. Factors such as marital status, property ownership structure, and the presence of a prenuptial agreement can affect the nature and provisions of these declarations. It is advisable for couples to consult with a legal professional to determine the appropriate type of Joint Homestead Declaration that suits their specific circumstances. In conclusion, a Houston Texas Joint Homestead Declaration by Husband and Wife is a significant legal document that enables married couples to establish their primary residence as a homestead and protect their property rights in Texas. By declaring their homestead status, couples can enjoy various benefits, including protection against forced sale, limitations on home equity loans, and marital and family protections.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.