Homestead laws are primarily governed by state laws, which vary by state. They may deal with such matters as the ability of creditors to attach a person's home, the amount of real estate taxes owed on the home, or the ability of the homeowner to mortgage or devise the home under a will, among other issues.

For example, in one state, when you record a Declaration of Homestead, the equity in your home is protected up to a statutory amount. In another state, there is no statutory limit. This protection precludes seizure or forced sale of your residence by general creditor claims (unpaid medical bills, bankruptcy, charge card debts, business & personal loans, accidents, etc.). State laws often provide a homestead exemption for older citizens so that a certain dollar amount of the home's value is exempt from real estate taxes. Other laws may provide rules for a person's ability to mortgage or devise the homestead. Local laws should be consulted for requirements in your area.

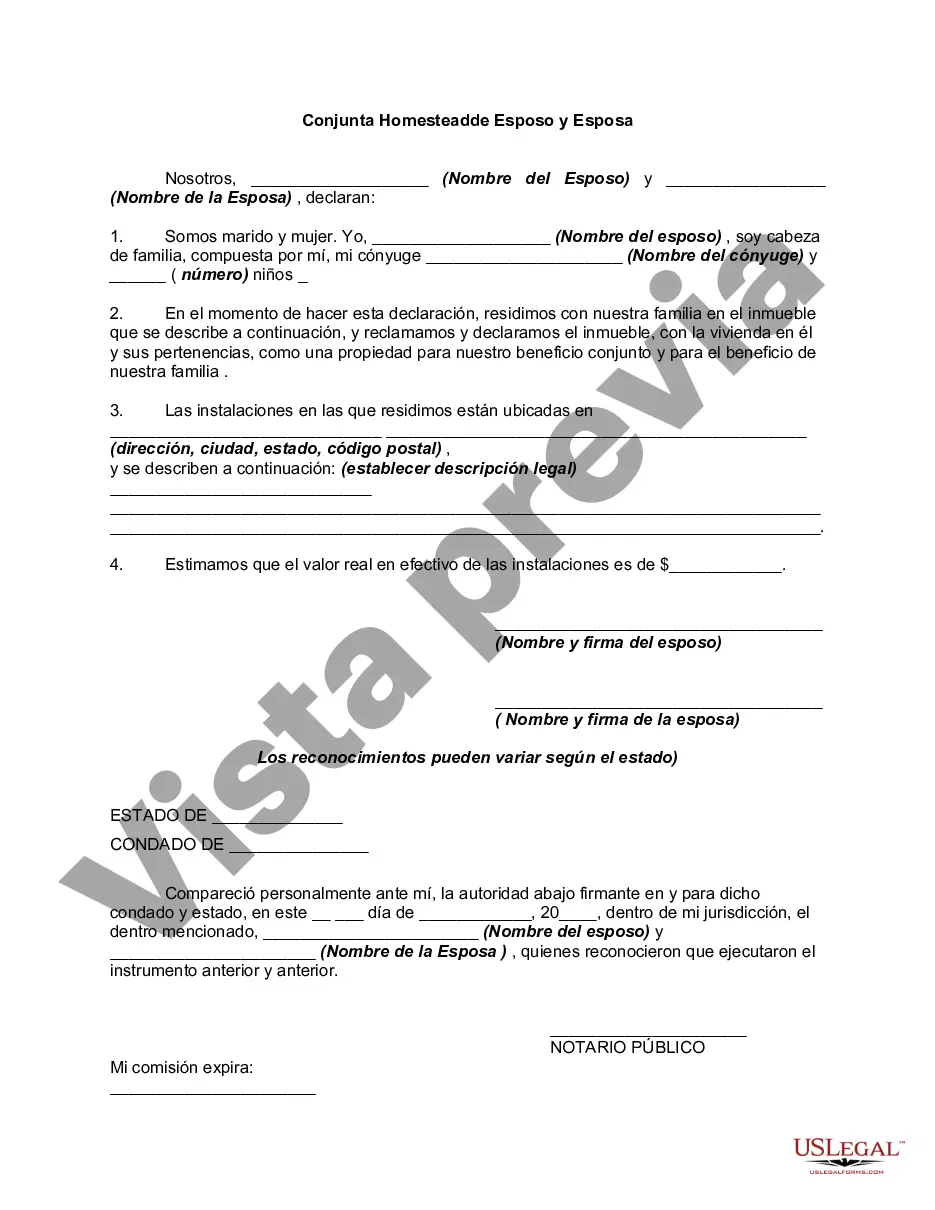

Salt Lake Utah Joint Homestead Declaration by Husband and Wife is a legal document that offers protection to spouses who jointly own a property in Salt Lake City, Utah. A Joint Homestead Declaration is typically designed to establish the property as a primary residence and provide financial protection to married couples in case of bankruptcy or other legal actions. By filing this declaration, both spouses actively declare their intention to establish the property as their homestead and ensure its exempt status from creditors' claims up to a certain limit prescribed by Utah law. The Salt Lake Utah Joint Homestead Declaration is an essential legal safeguard for couples seeking to protect their property from potential creditors during financial difficulties. This declaration can shield the residential property from being seized to satisfy debts or judgments by creditors. It establishes a legal protection that allows married individuals to maintain their home as a shelter for themselves and their family. In Salt Lake City, Utah, there are two main types of Joint Homestead Declarations available to married couples: 1. Voluntary Joint Homestead Declaration: This type of declaration is filed willingly by both spouses to protect their primary residence from creditors. It requires the consent and signatures of both husband and wife. Once executed and properly recorded, this declaration enables couples to claim a specific monetary value exemption on their property in the event of bankruptcy or other legal actions. 2. Involuntary Joint Homestead Declaration: In certain circumstances, a spouse can file a Joint Homestead Declaration even without the consent of the other party. This can occur when one spouse is absent, uncooperative, or unable to sign the declaration due to various reasons such as mental illness or incarceration. The filing spouse will need to provide sufficient evidence to the court to justify the involuntary declaration. To complete the Joint Homestead Declaration process in Salt Lake City, Utah, couples must accurately complete the required forms, sign them in the presence of a notary public, and file the documents with the appropriate county recorder's office. It is recommended to seek legal advice or consult an attorney to ensure compliance with all relevant laws and regulations. Overall, the Salt Lake Utah Joint Homestead Declaration by Husband and Wife is a crucial legal document that allows married couples to protect their jointly owned property from potential creditors and establish it as their primary residence. By taking this proactive step, couples can secure their home and ensure a safe haven for their family.Salt Lake Utah Joint Homestead Declaration by Husband and Wife is a legal document that offers protection to spouses who jointly own a property in Salt Lake City, Utah. A Joint Homestead Declaration is typically designed to establish the property as a primary residence and provide financial protection to married couples in case of bankruptcy or other legal actions. By filing this declaration, both spouses actively declare their intention to establish the property as their homestead and ensure its exempt status from creditors' claims up to a certain limit prescribed by Utah law. The Salt Lake Utah Joint Homestead Declaration is an essential legal safeguard for couples seeking to protect their property from potential creditors during financial difficulties. This declaration can shield the residential property from being seized to satisfy debts or judgments by creditors. It establishes a legal protection that allows married individuals to maintain their home as a shelter for themselves and their family. In Salt Lake City, Utah, there are two main types of Joint Homestead Declarations available to married couples: 1. Voluntary Joint Homestead Declaration: This type of declaration is filed willingly by both spouses to protect their primary residence from creditors. It requires the consent and signatures of both husband and wife. Once executed and properly recorded, this declaration enables couples to claim a specific monetary value exemption on their property in the event of bankruptcy or other legal actions. 2. Involuntary Joint Homestead Declaration: In certain circumstances, a spouse can file a Joint Homestead Declaration even without the consent of the other party. This can occur when one spouse is absent, uncooperative, or unable to sign the declaration due to various reasons such as mental illness or incarceration. The filing spouse will need to provide sufficient evidence to the court to justify the involuntary declaration. To complete the Joint Homestead Declaration process in Salt Lake City, Utah, couples must accurately complete the required forms, sign them in the presence of a notary public, and file the documents with the appropriate county recorder's office. It is recommended to seek legal advice or consult an attorney to ensure compliance with all relevant laws and regulations. Overall, the Salt Lake Utah Joint Homestead Declaration by Husband and Wife is a crucial legal document that allows married couples to protect their jointly owned property from potential creditors and establish it as their primary residence. By taking this proactive step, couples can secure their home and ensure a safe haven for their family.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.