Homestead laws are primarily governed by state laws, which vary by state. They may deal with such matters as the ability of creditors to attach a person's home, the amount of real estate taxes owed on the home, or the ability of the homeowner to mortgage or devise the home under a will, among other issues.

For example, in one state, when you record a Declaration of Homestead, the equity in your home is protected up to a statutory amount. In another state, there is no statutory limit. This protection precludes seizure or forced sale of your residence by general creditor claims (unpaid medical bills, bankruptcy, charge card debts, business & personal loans, accidents, etc.). State laws often provide a homestead exemption for older citizens so that a certain dollar amount of the home's value is exempt from real estate taxes. Other laws may provide rules for a person's ability to mortgage or devise the homestead. Local laws should be consulted for requirements in your area.

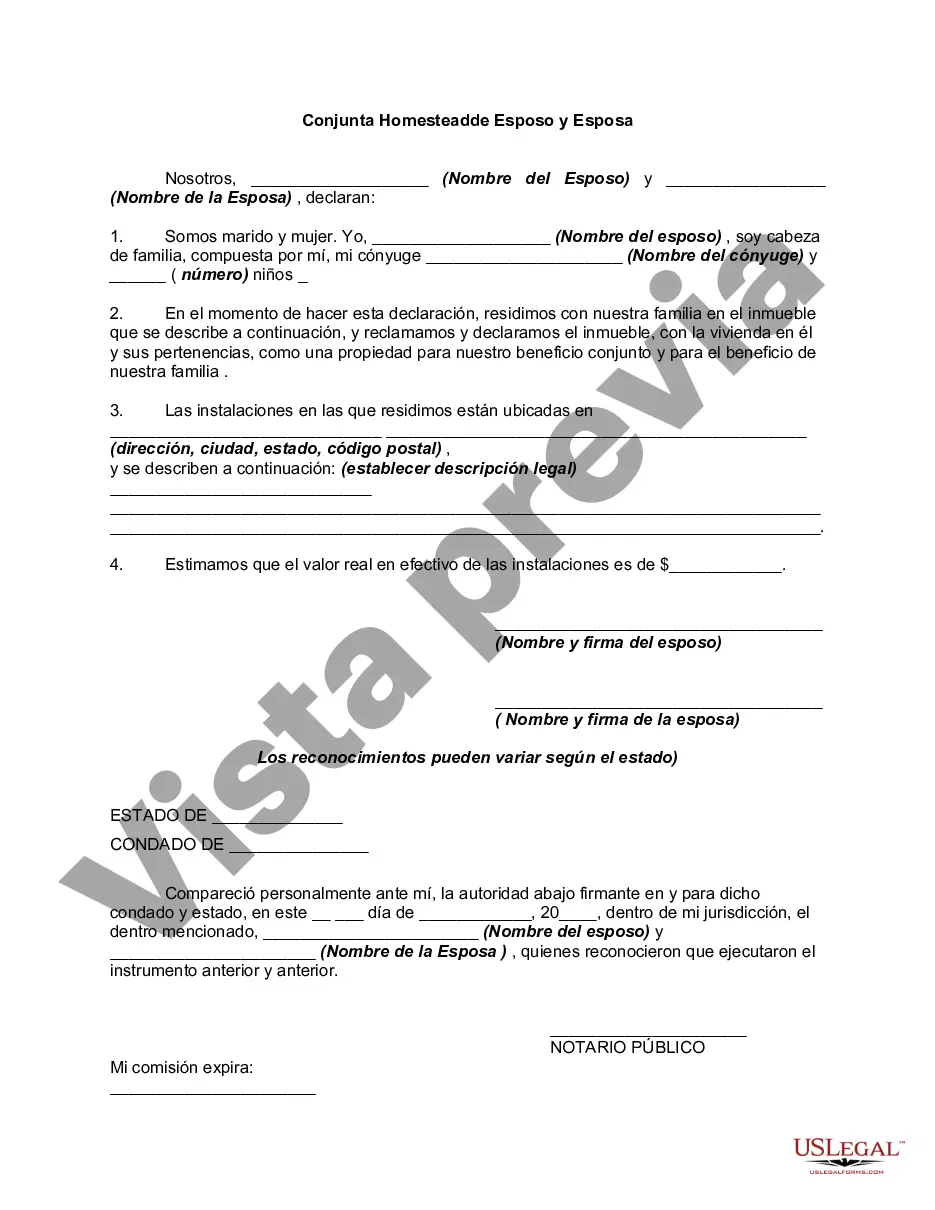

The Suffolk New York Joint Homestead Declaration by Husband and Wife is a legal document that allows spouses in Suffolk County, New York, to declare their property as a joint homestead. This declaration provides certain protections and benefits for both parties. By filing a Joint Homestead Declaration, husbands and wives can assert their rights and interests in their primary residence. It ensures that their property is considered a homestead, which offers various legal advantages. This document is especially beneficial in cases of bankruptcy or creditor claims, as it can help protect a portion of the home's equity from being seized or sold. The Suffolk New York Joint Homestead Declaration emphasizes the joint ownership of the property by both spouses. It clarifies that both husband and wife have equal and undivided ownership interests in the homestead. This declaration also indicates that both parties have the right to occupy, use, and enjoy the property as their primary residence. It is crucial to note that there may be different variations or types of the Suffolk New York Joint Homestead Declaration by Husband and Wife. Some common types include: 1. Basic Joint Homestead Declaration: This type of declaration asserts joint ownership in a primary residence, ensuring equal rights for both spouses. 2. Enhanced Joint Homestead Declaration: This variation provides additional protections and benefits, such as estate tax exemptions or the ability to pass on the homestead to surviving spouses without going through probate. 3. Modified Joint Homestead Declaration: This type of declaration might include specific provisions or modifications tailored to the unique needs or circumstances of a particular couple. It could address issues like inheritance rights, co-ownership percentages, or support obligations. Regardless of the specific type, the Suffolk New York Joint Homestead Declaration by Husband and Wife is a crucial legal tool for spouses to safeguard their jointly owned property and assert their rights as homeowners. It is recommended to consult with a qualified attorney or legal professional to draft and execute this document accurately, ensuring all legal requirements are met and both parties' interests are fully protected.The Suffolk New York Joint Homestead Declaration by Husband and Wife is a legal document that allows spouses in Suffolk County, New York, to declare their property as a joint homestead. This declaration provides certain protections and benefits for both parties. By filing a Joint Homestead Declaration, husbands and wives can assert their rights and interests in their primary residence. It ensures that their property is considered a homestead, which offers various legal advantages. This document is especially beneficial in cases of bankruptcy or creditor claims, as it can help protect a portion of the home's equity from being seized or sold. The Suffolk New York Joint Homestead Declaration emphasizes the joint ownership of the property by both spouses. It clarifies that both husband and wife have equal and undivided ownership interests in the homestead. This declaration also indicates that both parties have the right to occupy, use, and enjoy the property as their primary residence. It is crucial to note that there may be different variations or types of the Suffolk New York Joint Homestead Declaration by Husband and Wife. Some common types include: 1. Basic Joint Homestead Declaration: This type of declaration asserts joint ownership in a primary residence, ensuring equal rights for both spouses. 2. Enhanced Joint Homestead Declaration: This variation provides additional protections and benefits, such as estate tax exemptions or the ability to pass on the homestead to surviving spouses without going through probate. 3. Modified Joint Homestead Declaration: This type of declaration might include specific provisions or modifications tailored to the unique needs or circumstances of a particular couple. It could address issues like inheritance rights, co-ownership percentages, or support obligations. Regardless of the specific type, the Suffolk New York Joint Homestead Declaration by Husband and Wife is a crucial legal tool for spouses to safeguard their jointly owned property and assert their rights as homeowners. It is recommended to consult with a qualified attorney or legal professional to draft and execute this document accurately, ensuring all legal requirements are met and both parties' interests are fully protected.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.