An assignment is a transfer of rights that a party has under a contract to another person, called an assignee. The assigning party is called the assignor. If the obligor (person obligated to pay) is notified that there has been an assignment and that any money due must be paid to the assignee, the obligor's obligation can only be discharged by making payment to the assignee. In other words, payment to the assignor would not satisfy the contract after notice. If the obligor does not know of the assignment and makes payments to the assignor who does not turn the money over to the assignee, the assignee cannot sue the obligor, but does have a remedy against the assignor. However, if the obligor both knows of the assignment and has been notified to make future payments to the assignee, any payments made by the obligor to the assignor have no effect and do not reduce the debt of the obligor.

Collin Texas Notice of Assignment is a legally-binding document that informs individuals or entities about the assignment of a particular debt or claim to a third party. This notification is essential as it outlines the transfer of rights, obligations, and responsibilities related to the debt or claim in question. The Notice of Assignment is commonly used in various financial transactions, such as when a lender assigns a loan to another institution or when a company transfers its accounts receivable to a collection agency. The Collin Texas Notice of Assignment serves as an official communication, ensuring transparency and protecting the rights of all parties involved. It typically includes vital information such as the original creditor's name, the assigned party's details, the assigned debt or claim's specific details (e.g., outstanding balance, account number), and the effective date of the assignment. By providing these particulars, the notice clarifies the new ownership or holder of the debt or claim and indicates where future payments or actions should be directed. Types of Collin Texas Notice of Assignment can vary depending on the specific transaction or industry involved. Some common examples include the notice of assignment for mortgages, where a lender assigns the mortgage to another financial institution; notice of assignment for commercial debts, used when a business transfers its outstanding debts to a debt collection agency or another company; notice of assignment for medical invoices or healthcare claims, where medical providers transfer payment rights to a billing company; and notice of assignment for personal loans, in cases where an individual assigns their loan to a family member or friend. In summary, the Collin Texas Notice of Assignment is a crucial document that facilitates the smooth transfer of debts or claims from one party to another. It ensures proper communication, protects the rights of all involved, and clarifies the responsibilities and ownership of the assigned debt or claim. Whether it pertains to mortgages, commercial debts, medical invoices, or personal loans, the Notice of Assignment plays a vital role in maintaining clarity and transparency in various financial transactions.Collin Texas Notice of Assignment is a legally-binding document that informs individuals or entities about the assignment of a particular debt or claim to a third party. This notification is essential as it outlines the transfer of rights, obligations, and responsibilities related to the debt or claim in question. The Notice of Assignment is commonly used in various financial transactions, such as when a lender assigns a loan to another institution or when a company transfers its accounts receivable to a collection agency. The Collin Texas Notice of Assignment serves as an official communication, ensuring transparency and protecting the rights of all parties involved. It typically includes vital information such as the original creditor's name, the assigned party's details, the assigned debt or claim's specific details (e.g., outstanding balance, account number), and the effective date of the assignment. By providing these particulars, the notice clarifies the new ownership or holder of the debt or claim and indicates where future payments or actions should be directed. Types of Collin Texas Notice of Assignment can vary depending on the specific transaction or industry involved. Some common examples include the notice of assignment for mortgages, where a lender assigns the mortgage to another financial institution; notice of assignment for commercial debts, used when a business transfers its outstanding debts to a debt collection agency or another company; notice of assignment for medical invoices or healthcare claims, where medical providers transfer payment rights to a billing company; and notice of assignment for personal loans, in cases where an individual assigns their loan to a family member or friend. In summary, the Collin Texas Notice of Assignment is a crucial document that facilitates the smooth transfer of debts or claims from one party to another. It ensures proper communication, protects the rights of all involved, and clarifies the responsibilities and ownership of the assigned debt or claim. Whether it pertains to mortgages, commercial debts, medical invoices, or personal loans, the Notice of Assignment plays a vital role in maintaining clarity and transparency in various financial transactions.

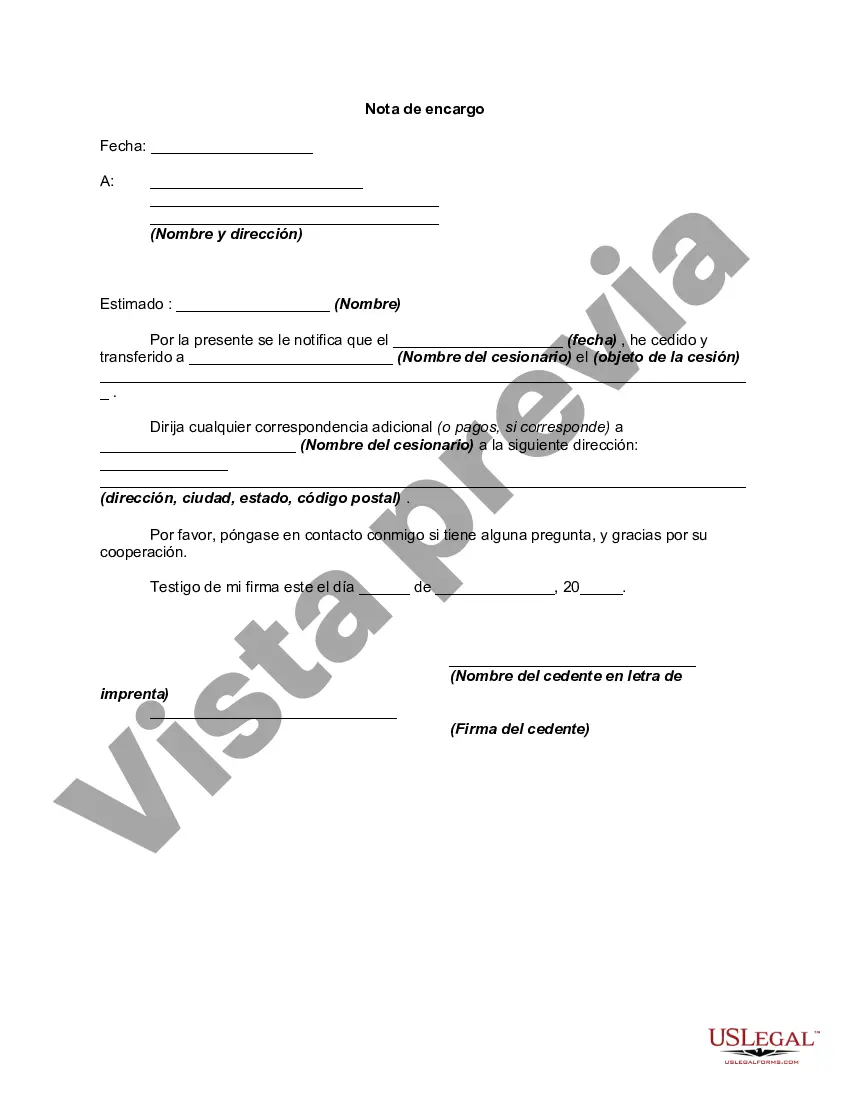

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.