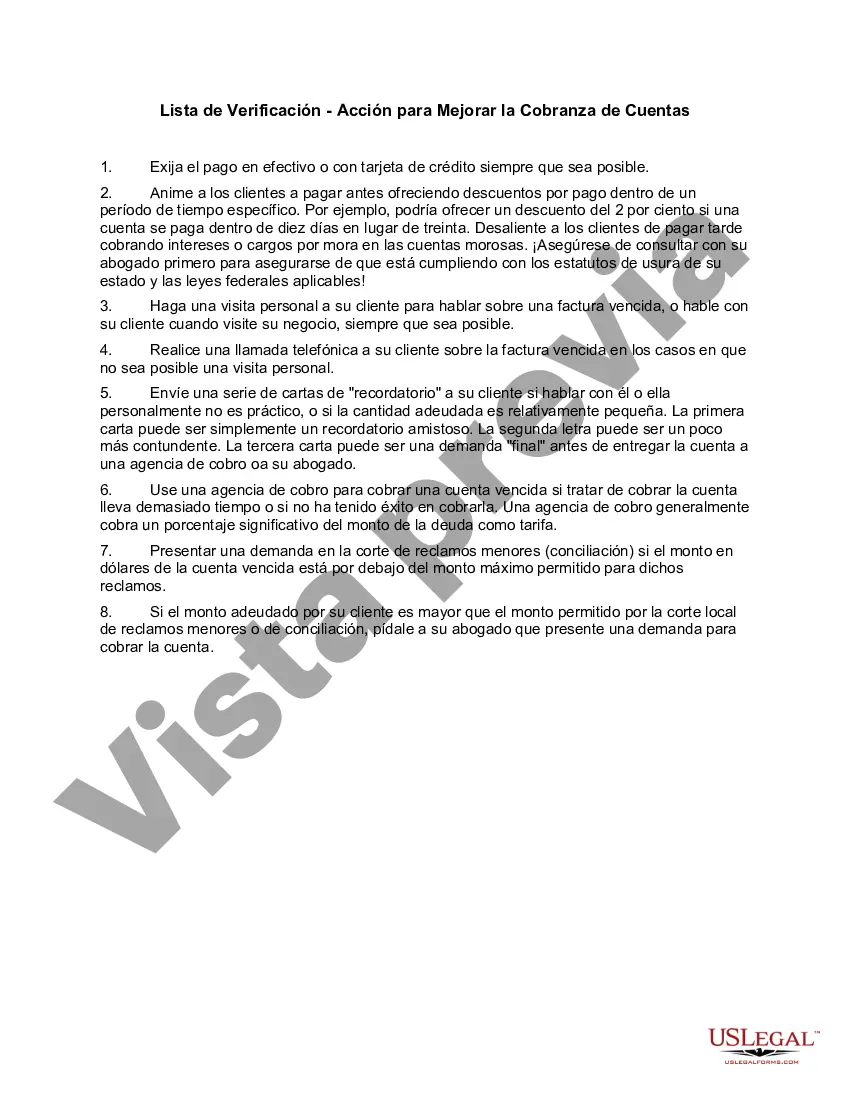

The Broward Florida Checklist — Action to Improve Collection of Accounts is a comprehensive guide aimed at helping individuals, businesses, and organizations in Broward County enhance their account collection processes. By implementing the recommended procedures and strategies outlined in this checklist, entities can significantly improve their chances of successful debt collection and minimize losses. The checklist addresses various aspects that need to be considered and followed, including: 1. Account Verification: Ensure the accuracy and validity of all account information, including contact details, before initiating the collection process. 2. Documentation: Maintain well-organized and up-to-date account documentation, including invoices, purchase orders, delivery receipts, and any other relevant paperwork. 3. Clear Communication: Establish effective communication channels with debtors, providing clear instructions regarding payment expectations, due dates, and available payment options. 4. Timely Invoicing: Send out invoices promptly and accurately, including all necessary details such as payment terms, late payment penalties, and preferred methods of payment. 5. Payment Reminder System: Implement an organized process for sending payment reminders to debtors, ensuring timely notifications and encouraging prompt payment. 6. Professional Collection Calls: Develop a script or guidelines for collection calls, emphasizing professionalism, empathy, and the importance of resolving outstanding debts. 7. Negotiation Strategies: Develop effective negotiation tactics to reach mutually agreeable payment plans or settlements with debtors who are facing financial difficulties. 8. Legal Considerations: Familiarize yourself with the legal requirements and limitations of debt collection in Broward County, including the Fair Debt Collection Practices Act (FD CPA) guidelines. 9. Debt Recovery Agencies: Research and consider working with reputable debt recovery agencies, employing their expertise and resources to enhance the collection process. 10. Ongoing Evaluation: Continuously monitor the effectiveness of your collection efforts, reviewing key performance indicators, such as collection rates and timeframes, to identify areas for improvement. In addition to the general Broward Florida Checklist — Action to Improve Collection of Accounts, there may be specialized checklists tailored for specific industries or sectors within Broward County. For instance, there could be separate checklists for healthcare providers, contractors, retail businesses, or financial institutions, addressing unique collection challenges and requirements in these respective fields.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Broward Florida Lista de Verificación - Acción para Mejorar la Cobranza de Cuentas - Checklist - Action to Improve Collection of Accounts

Description

How to fill out Broward Florida Lista De Verificación - Acción Para Mejorar La Cobranza De Cuentas?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask an attorney to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce papers, or the Broward Checklist - Action to Improve Collection of Accounts, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Therefore, if you need the latest version of the Broward Checklist - Action to Improve Collection of Accounts, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Broward Checklist - Action to Improve Collection of Accounts:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Broward Checklist - Action to Improve Collection of Accounts and save it.

When done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!