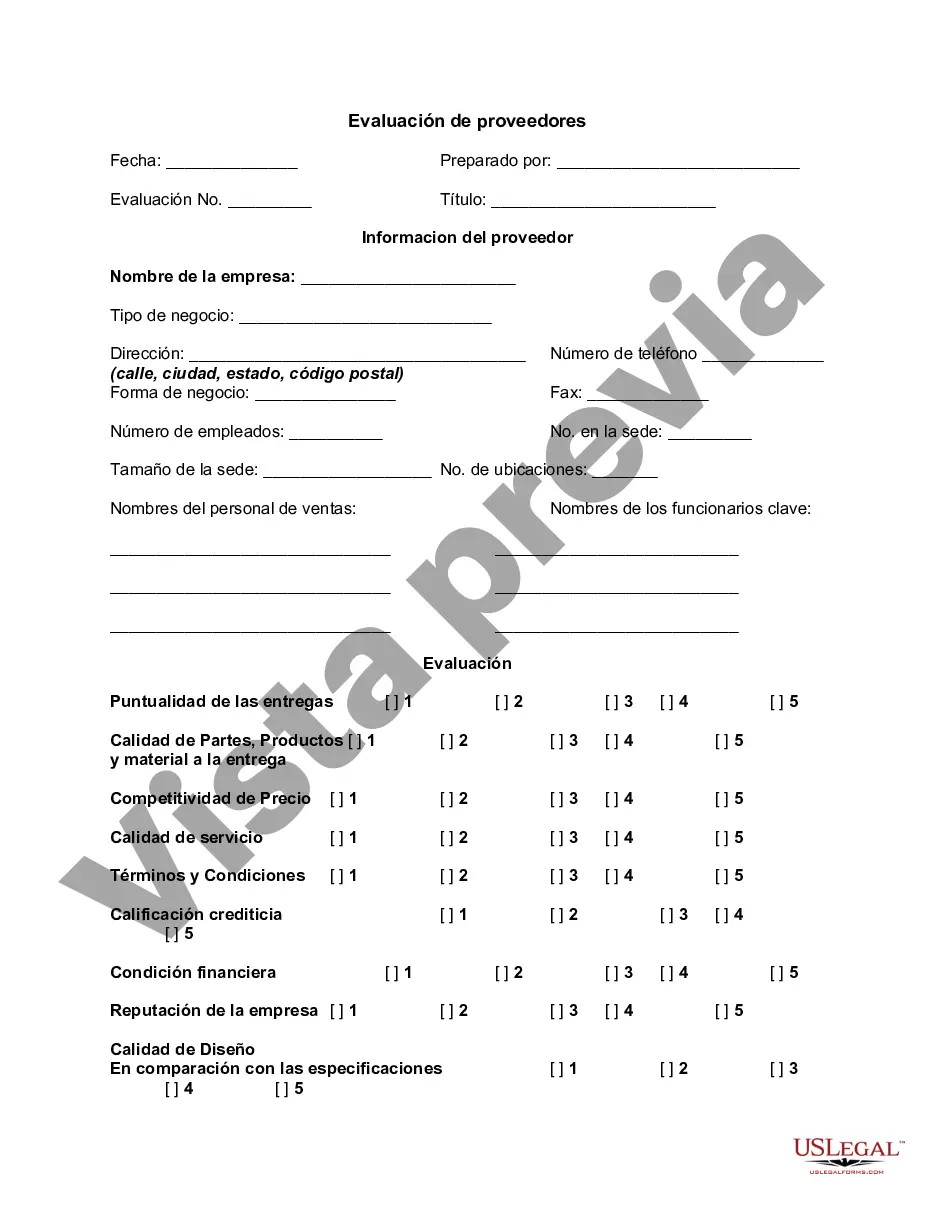

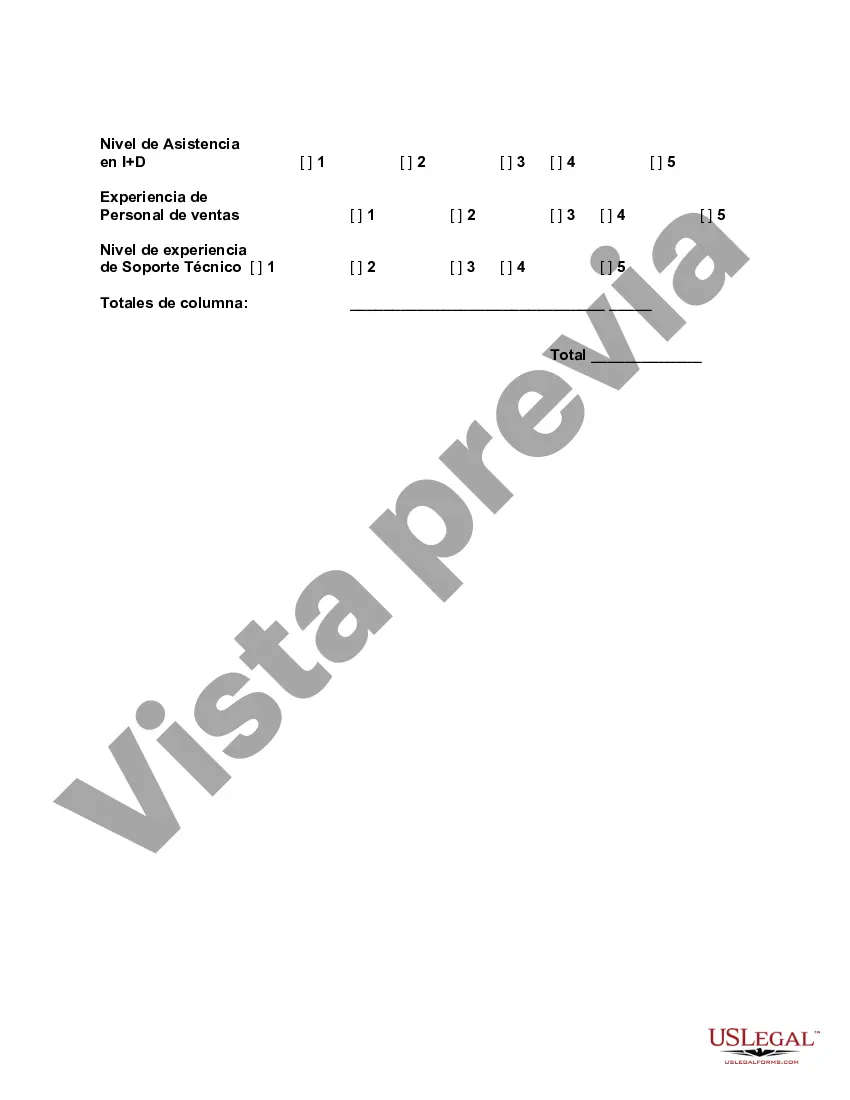

Fulton Georgia Vendor Evaluation is the process of assessing and analyzing vendors or suppliers operating in Fulton County, Georgia, to determine their suitability and suitability for an organization's specific needs. This evaluation is crucial for ensuring that the vendors meet the quality, performance, and cost objectives of a business. Keywords: Fulton Georgia, Vendor Evaluation, vendors, suppliers, assessment, suitability, quality, performance, cost objectives, business. Types of Fulton Georgia Vendor Evaluation: 1. Performance Evaluation: This type of evaluation focuses on examining the vendor's ability to meet predetermined performance metrics, such as timely delivery, product quality, customer service, and adherence to contractual obligations. It involves collecting data, assessing performance indicators, and comparing vendors in terms of their ability to meet set targets. 2. Quality Evaluation: Quality evaluation assesses vendors based on their ability to consistently deliver products or services that meet or exceed pre-established quality standards. This evaluation typically involves inspections, audits, and surveys to ensure that vendors comply with quality assurance protocols and industry-specific regulations. 3. Financial Evaluation: Financial evaluation examines the financial stability and viability of vendors. It involves reviewing vendors' financial statements, credit ratings, and financial ratios to assess their ability to meet contractual obligations and deliver goods/services without disruptions due to financial instability. 4. Compliance Evaluation: Compliance evaluation focuses on checking if vendors adhere to legal, ethical, and regulatory requirements. It includes analyzing vendors' compliance with laws, industry standards, codes of conduct, environmental and safety regulations, and other relevant guidelines. 5. Risk Evaluation: Risk evaluation assesses vendors' potential risks and their impact on the buyer's operations. It involves identifying and analyzing risks associated with vendors, such as financial risks, operational risks, reputational risks, and vendor dependency risks. This evaluation helps organizations mitigate potential risks and ensure continuity of their supply chain. In conclusion, Fulton Georgia Vendor Evaluation encompasses various types of assessments to ensure that vendors meet the specific needs and objectives of businesses in Fulton County. Performance evaluation, quality evaluation, financial evaluation, compliance evaluation, and risk evaluation are pivotal in selecting reliable and trustworthy vendors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Evaluación de proveedores - Vendor Evaluation

Description

How to fill out Fulton Georgia Evaluación De Proveedores?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a lawyer to write a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Fulton Vendor Evaluation, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Consequently, if you need the recent version of the Fulton Vendor Evaluation, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Fulton Vendor Evaluation:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Fulton Vendor Evaluation and save it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!