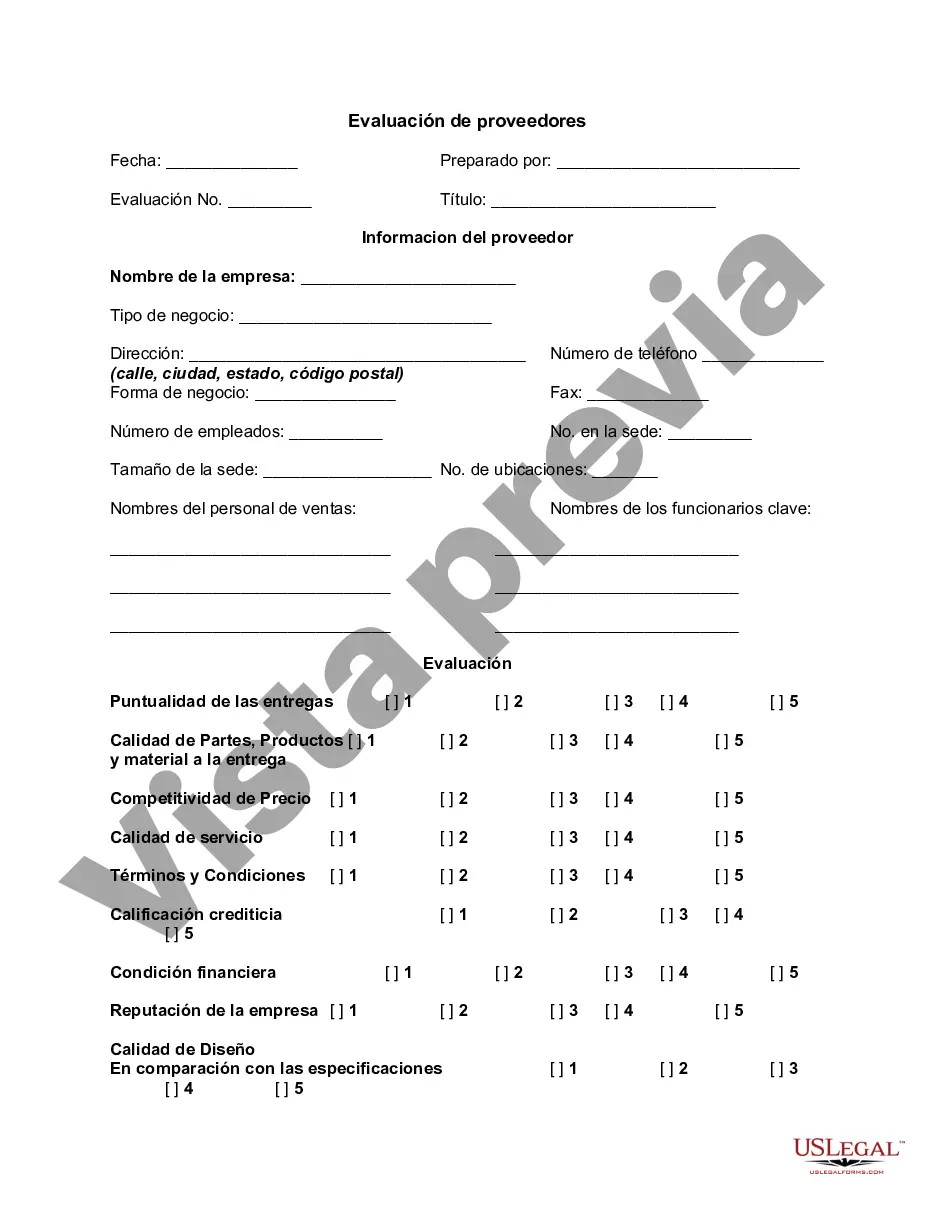

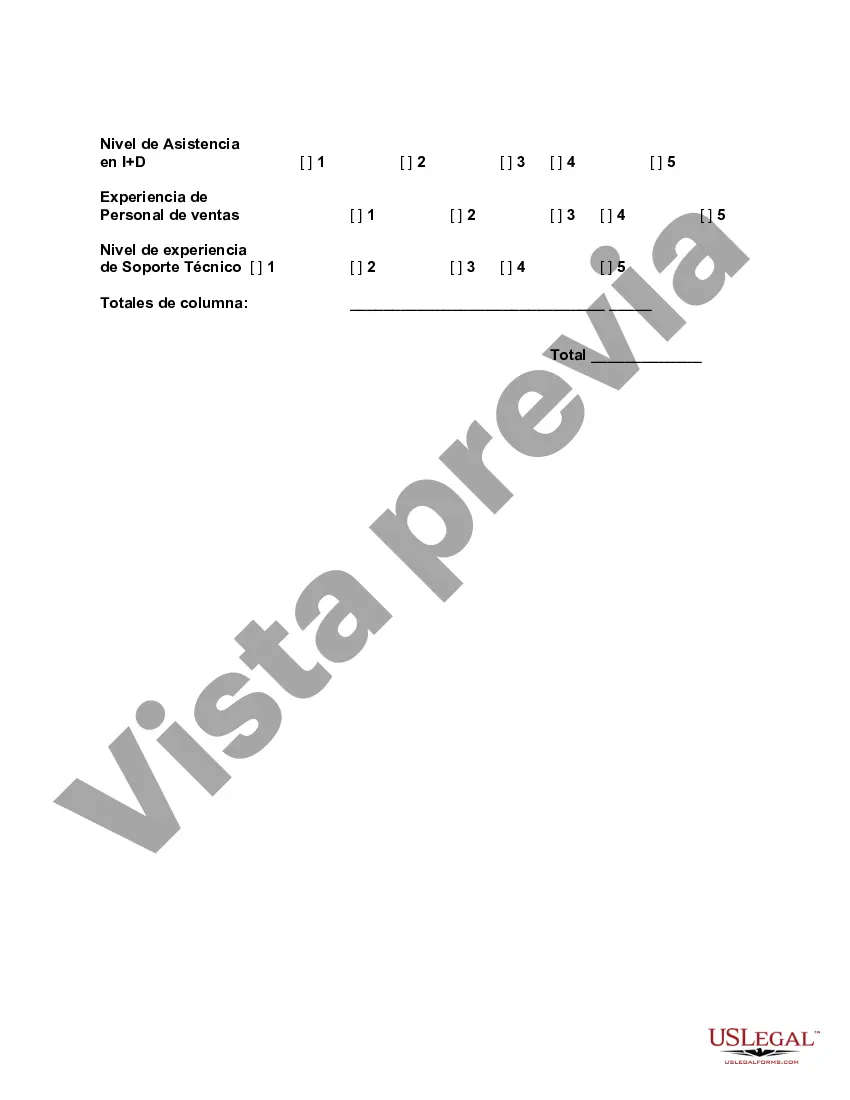

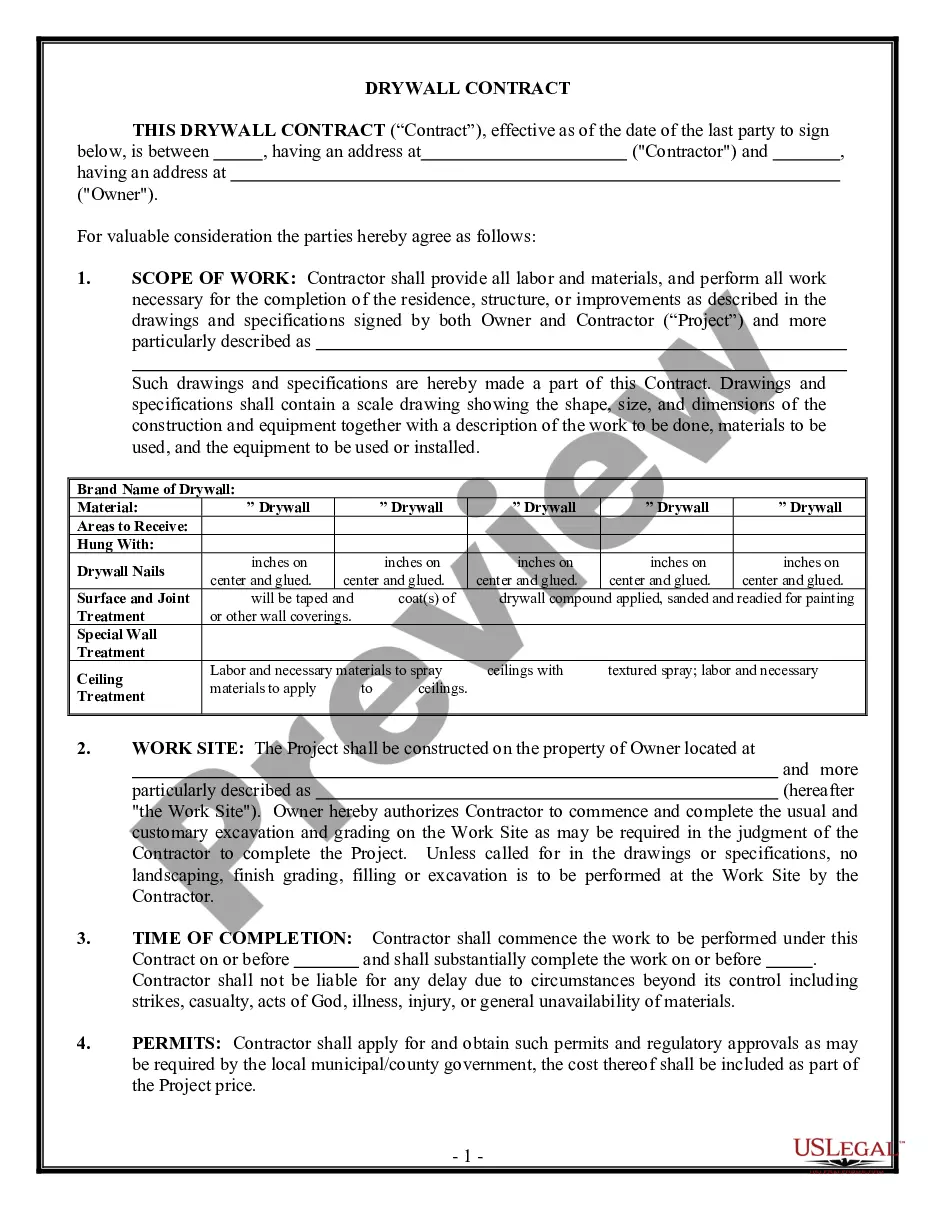

Suffolk New York Vendor Evaluation refers to the process of assessing and determining the suitability and performance of vendors or suppliers in Suffolk County, New York. This evaluation helps organizations make informed decisions when selecting vendors to collaborate with and ensures that their requirements are met effectively. By examining various factors, organizations can evaluate vendors based on their capabilities, reliability, quality, pricing, and other crucial aspects. Suffolk New York Vendor Evaluation plays a vital role in maintaining seamless business operations, establishing fruitful partnerships, and ensuring customer satisfaction. There are different types of Vendor Evaluation methods employed in Suffolk New York, each serving a distinct purpose. These may include: 1. Performance Evaluation: This type of evaluation assesses vendors based on their ability to meet predetermined performance metrics. It includes analyzing factors such as service quality, on-time delivery, adherence to contract terms, and customer satisfaction. 2. Financial Evaluation: Financial evaluation focuses on vendors' financial stability and capability to deliver products or services. It involves reviewing financial statements, credit ratings, cash flow, and debt levels to ensure that vendors have the necessary financial resources to fulfill their obligations. 3. Compliance Evaluation: Compliance evaluation ensures that vendors comply with industry regulations, legal requirements, and ethical standards. It examines aspects such as certifications, licenses, permits, and environmental sustainability practices ensuring vendors' compliance with government regulations and organizational policies. 4. Risk Assessment: Risk assessment evaluates the potential risks associated with engaging a particular vendor. It involves analyzing factors such as reputation, past performance, financial stability, and operational capabilities to identify any potential risks or drawbacks in vendor selection. 5. Technology Evaluation: Technology evaluation focuses on vendors' technological capabilities, infrastructure, and resources. It assesses factors such as IT infrastructure, data security measures, technology support, and integration abilities, ensuring vendors' ability to deliver technological solutions as required. In Suffolk New York, it is crucial for organizations to conduct thorough Vendor Evaluation to ensure the selection of reliable and reputable vendors. By employing these evaluation methods, businesses can enhance their procurement process, reduce operational risks, and establish long-term partnerships with vendors who align with their objectives and requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Evaluación de proveedores - Vendor Evaluation

Description

How to fill out Suffolk New York Evaluación De Proveedores?

Creating legal forms is a must in today's world. However, you don't always need to seek professional help to create some of them from scratch, including Suffolk Vendor Evaluation, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different types ranging from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching process less frustrating. You can also find detailed materials and tutorials on the website to make any activities related to document execution simple.

Here's how to locate and download Suffolk Vendor Evaluation.

- Take a look at the document's preview and outline (if available) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the legality of some documents.

- Examine the similar document templates or start the search over to find the correct document.

- Click Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment gateway, and purchase Suffolk Vendor Evaluation.

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Suffolk Vendor Evaluation, log in to your account, and download it. Of course, our platform can’t replace a legal professional completely. If you have to cope with an extremely complicated situation, we recommend using the services of an attorney to review your document before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Become one of them today and purchase your state-compliant paperwork with ease!