Alameda, California: A Vibrant City with a Rich History Alameda, also known as "The Island City," is a scenic coastal community in California. Situated in Alameda County, this charming city offers a unique blend of history, modern amenities, and a vibrant cultural scene. Whether you are a resident or planning to set up an escrow agreement in Alameda, there are several important factors to consider. 1. Property Details: When drafting an escrow agreement in Alameda, it is crucial to include detailed information about the property involved. This includes the property address, legal description (parcel number, lot number), and any specific conditions or restrictions related to the property. 2. Purchase Price: Clearly state the agreed-upon purchase price for the property in the escrow agreement. Address any contingencies or adjustments that might affect the final price, such as repairs or inspections. 3. Timeframe: Define the timeline for the escrow process. This includes important dates like the opening and closing of escrow, deadlines for inspections and disclosures, and the release of funds. It is important to ensure that all parties involved are on the same page regarding these time-sensitive matters. 4. Title and Ownership: Clearly outline the conditions under which the title of the property will transfer from the seller to the buyer. Specify the type of deed to be used and any necessary documents or certifications required during the transfer process. 5. Dispute Resolution: In the event of any disputes or disagreements during the escrow process, it is essential to include provisions for resolutions. Options may include mediation, arbitration, or litigation. Clearly define the jurisdiction and venue for potential legal actions. 6. Escrow Agent Duties: Identify the responsibilities and obligations of the escrow agent. This includes handling funds, coordinating with relevant parties, preparing necessary documents, and facilitating the escrow process. 7. Contingencies and Conditions: Include any contingencies or conditions that must be met for the escrow to proceed smoothly. These may involve financing, inspections, or obtaining necessary permits. Clearly state the consequences or actions to be taken if these contingencies are not met. 8. Prorations and Taxes: Address prorations of property taxes, homeowner association fees, and other applicable charges. Specify how these prorations will be calculated and how adjustments will be made between the parties. 9. Escrow Costs: Clearly define the allocation of escrow-related costs between the buyer and the seller, including escrow fees, notary charges, recording fees, and any other administrative expenses. 10. Applicable Laws and Regulations: Ensure that the escrow agreement complies with all relevant federal, state, and local laws and regulations. This includes adhering to Alameda County and California specific rules governing property transactions and escrow procedures. In summary, when drafting an escrow agreement in Alameda, California, it is vital to consider property details, purchase price, timeframe, title and ownership, dispute resolution, escrow agent duties, contingencies and conditions, prorations and taxes, escrow costs, and applicable laws. By carefully addressing these matters, all parties involved can navigate the escrow process smoothly and efficiently. Types of Alameda California Checklist of Matters to be Considered in Drafting Escrow Agreement: 1. Residential Property Escrow Agreement Checklist 2. Commercial Property Escrow Agreement Checklist 3. Rental Property Escrow Agreement Checklist 4. Land Escrow Agreement Checklist 5. Condominium Escrow Agreement Checklist.

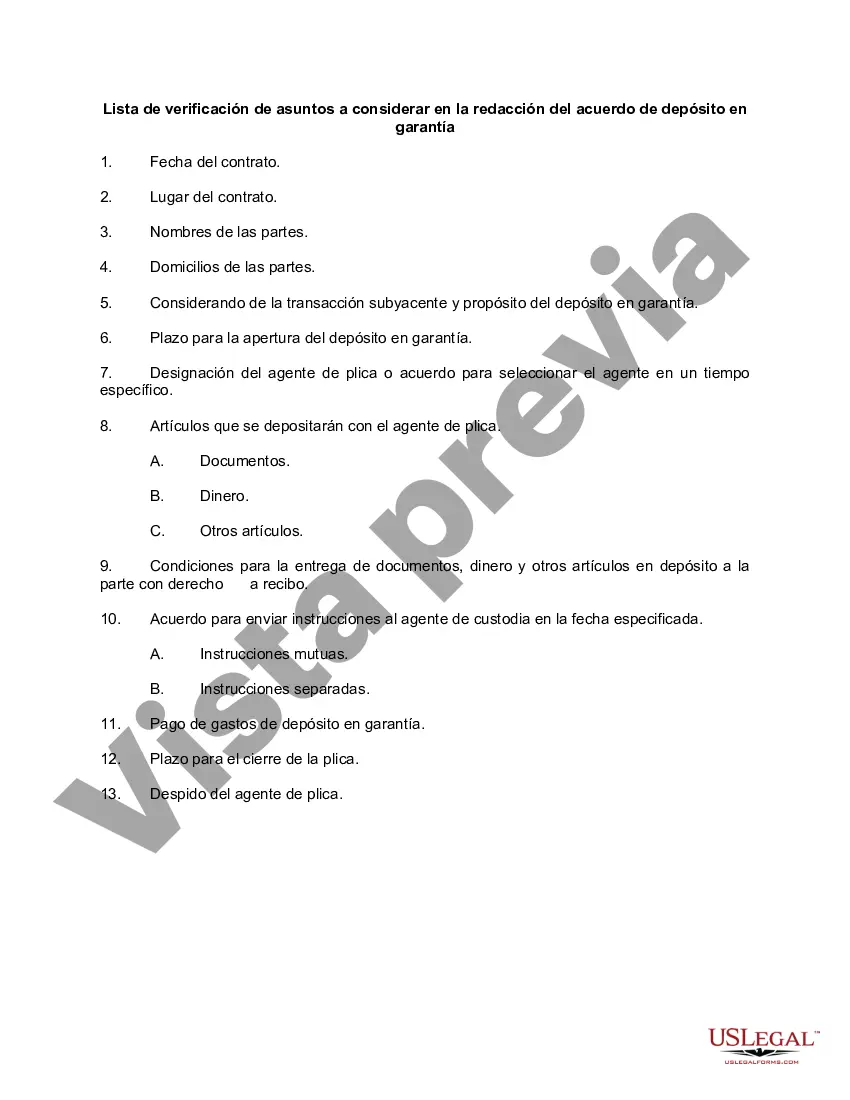

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Lista de verificación de asuntos a considerar en la redacción del acuerdo de depósito en garantía - Checklist of Matters to be Considered in Drafting Escrow Agreement

Description

How to fill out Alameda California Lista De Verificación De Asuntos A Considerar En La Redacción Del Acuerdo De Depósito En Garantía?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Alameda Checklist of Matters to be Considered in Drafting Escrow Agreement, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you obtain a sample, it remains accessible in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Alameda Checklist of Matters to be Considered in Drafting Escrow Agreement from the My Forms tab.

For new users, it's necessary to make some more steps to get the Alameda Checklist of Matters to be Considered in Drafting Escrow Agreement:

- Take a look at the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to obtain the document once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!