Title: Allegheny, Pennsylvania: Checklist of Matters to be Considered in Drafting Escrow Agreement Keywords: Allegheny, Pennsylvania, escrow agreement, legal protection, draft, considerations, checklist, financial transactions, parties involved, assets, funds, conditions, terms, procedures, documentation, specific requirements, potential challenges. Introduction: An escrow agreement serves as a legal tool that offers protection and security in financial transactions. In Allegheny, Pennsylvania, several considerations must be kept in mind while drafting an escrow agreement. This checklist aims to outline the essential matters that should be addressed to ensure a comprehensive and robust agreement, tailored to the specific needs and requirements of the parties involved. 1. Identify the Parties: Clearly identify and describe the individuals or entities involved in the escrow agreement, including their full legal names, addresses, and any relevant identification or registration numbers. 2. Specify Assets or Funds: Define and document the precise description of the assets or funds that will be subject to the escrow agreement. This could include money, securities, real estate, or any other assets of value. 3. Establish Conditions and Terms: Outline the specific conditions that must be met before the release of the BS crowed assets or funds. Consider factors such as timelines, milestones, event triggers, and any other criteria that are crucial for the agreement's fulfillment. 4. Determine Escrow Agent Duties: Clearly define and allocate the responsibilities and duties of the escrow agent, who will act as an impartial third party overseeing the escrow process. Include provisions regarding the agent's role, rights, obligations, and any limitations on liability. 5. Detail the Escrow Procedures: Specify and document the step-by-step procedures to be followed throughout the escrow process, from inception to termination. Clear guidelines should include instructions for depositing, verifying, managing, and releasing the BS crowed assets or funds. 6. Address Documentation Requirements: Identify and outline the necessary documentation that both parties must provide to initiate and maintain the escrow agreement. This may include legal agreements, contracts, licenses, permits, certifications, and any additional documentation required by Allegheny, Pennsylvania, laws. 7. Include Specific Requirements: Consider any specific legal, regulatory, or jurisdictional requirements that must be fulfilled in Allegheny, Pennsylvania. Ensure compliance with local ordinances, relevant statutes, and any unique provisions applicable to the jurisdiction. 8. Anticipate Potential Challenges: Proactively address potential challenges or disputes that may arise during the escrow period. Establish procedures for dispute resolution, including arbitration or mediation, to minimize the negative impact on the involved parties. Types of Allegheny, Pennsylvania Checklist of Matters to be Considered in Drafting Escrow Agreement: 1. Real Estate Escrow Agreement Checklist: This checklist focuses on drafting escrow agreements related specifically to real estate transactions, including property sales, lease agreements, or development projects. 2. Financial Escrow Agreement Checklist: This checklist caters to escrow agreements involving financial transactions, such as mergers and acquisitions, loan agreements, or investment deals. 3. Legal Escrow Agreement Checklist: This checklist emphasizes the drafting of escrow agreements in the legal industry, including settlement agreements, litigation escrows, or attorney trust accounts. In conclusion, drafting a comprehensive escrow agreement in Allegheny, Pennsylvania requires thorough attention to detail to ensure all crucial matters are considered. By following this checklist and tailoring it to suit specific transactional needs, parties can enhance the legal protection, transparency, and security surrounding their escrow arrangements.

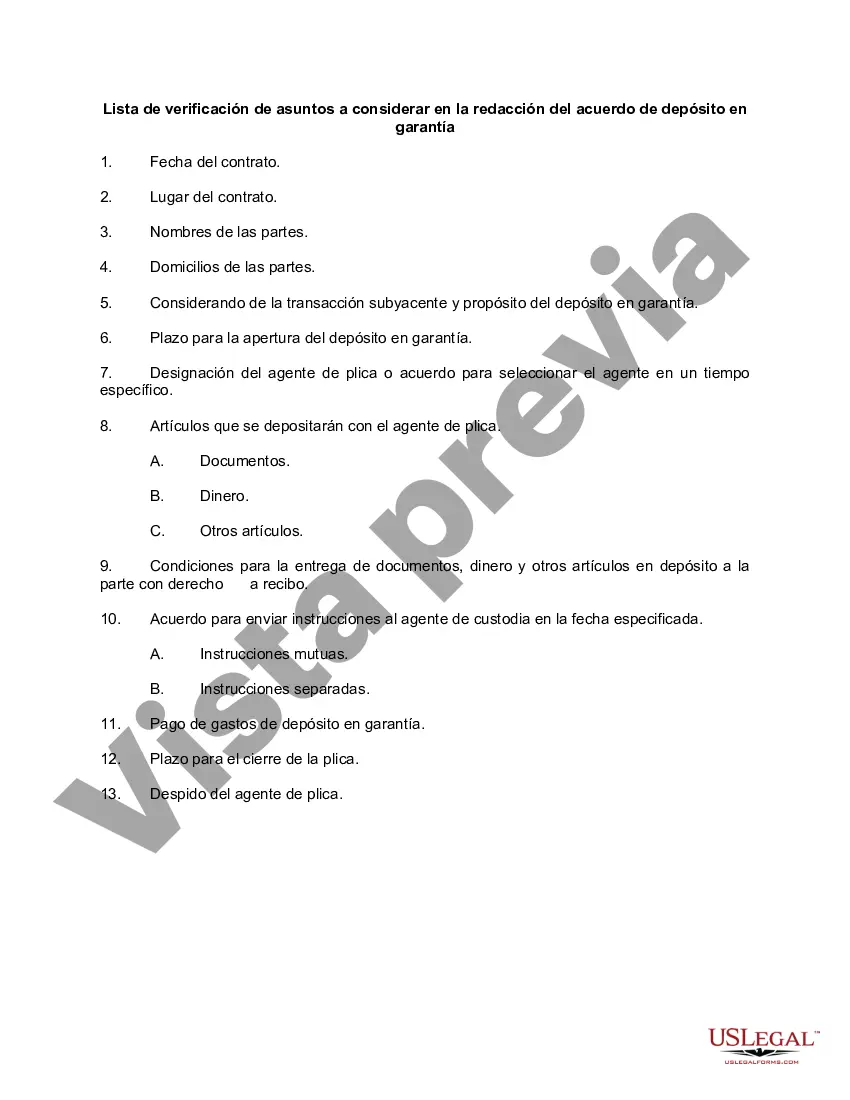

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Lista de verificación de asuntos a considerar en la redacción del acuerdo de depósito en garantía - Checklist of Matters to be Considered in Drafting Escrow Agreement

Description

How to fill out Allegheny Pennsylvania Lista De Verificación De Asuntos A Considerar En La Redacción Del Acuerdo De Depósito En Garantía?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare formal documentation that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any individual or business objective utilized in your county, including the Allegheny Checklist of Matters to be Considered in Drafting Escrow Agreement.

Locating templates on the platform is amazingly simple. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Allegheny Checklist of Matters to be Considered in Drafting Escrow Agreement will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to obtain the Allegheny Checklist of Matters to be Considered in Drafting Escrow Agreement:

- Ensure you have opened the correct page with your local form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Allegheny Checklist of Matters to be Considered in Drafting Escrow Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!