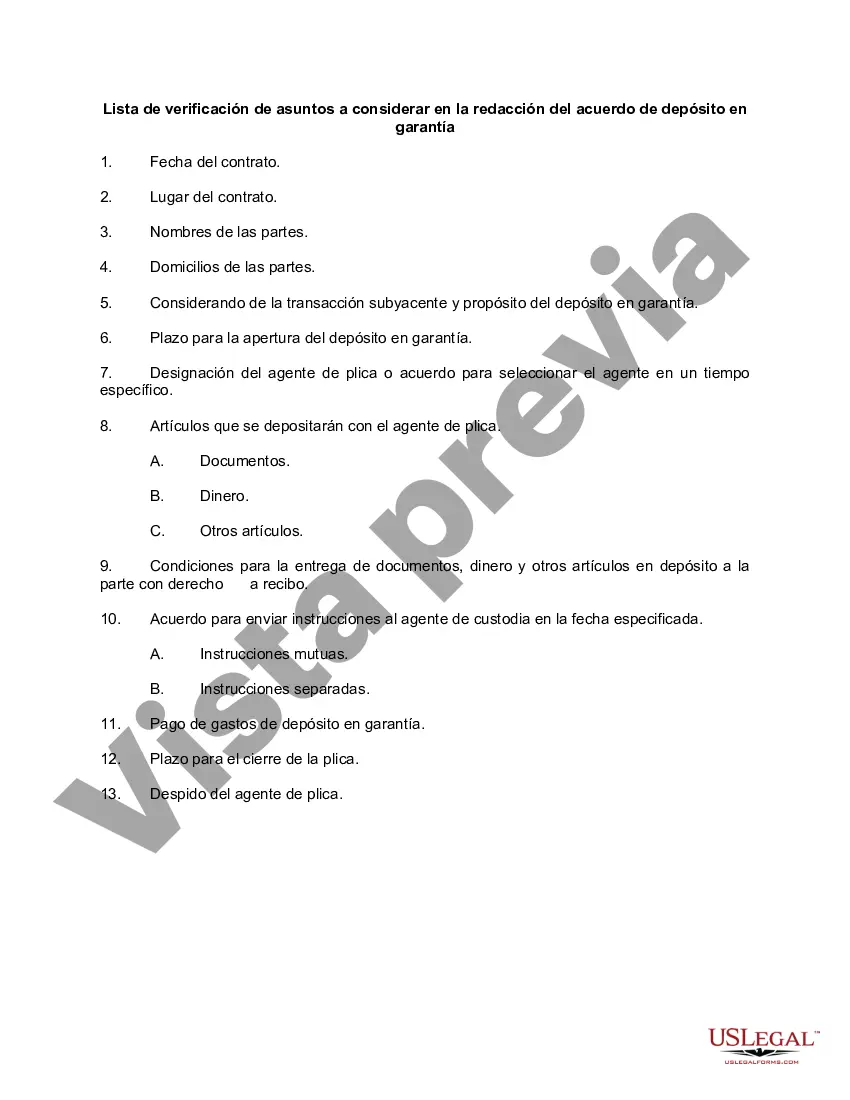

Bronx, New York is a vibrant borough recognized for its rich cultural heritage, diverse communities, and numerous attractions. Located north of Manhattan, it offers a unique blend of urban living and suburban charm. Its checklist of matters to be considered in drafting an escrow agreement should encompass key aspects to ensure a well-structured and secure transaction. Here are relevant keywords and categories to include in the checklist: 1. Parties involved: — Identify the names and contact details of the buyer, seller, and escrow agent. — Determine if any additional parties, such as attorneys or brokers, need to be included. 2. Transaction details: — Clearly define the underlying transaction, such as the sale of a property, transfer of funds, or fulfillment of contractual obligations. — Specify the purchase price, deposit amount, and any relevant contingencies. — Determine the timeline for completing the transaction. 3. Escrow agent duties: — Outline the responsibilities and obligations of the escrow agent. — Ensure compliance with applicable laws and regulations. — Specify the handling of funds, including the collection, retention, and disbursement process. — Detairecordrkeepingng and reporting requirements. 4. Escrow account: — Decide on the type of escrow account to be used (e.g., interest-bearing or non-interest-bearing). — Specify the financial institution where the funds will be held. — Set the minimum balance required in the account and address any fees or charges associated with it. 5. Conditions for release: — Clearly define the conditions that must be met before the funds can be released from escrow. — Include requirements related to inspections, appraisals, title searches, permits, and any necessary approvals. — Address the resolution of disputes or disagreements between the parties. 6. Termination of agreement: — Outline the circumstances under which the escrow agreement can be terminated and the process for doing so. — Determine how the funds will be distributed or returned if the agreement is terminated prematurely. 7. Governing law and jurisdiction: — Specify the jurisdiction (Bronx, New York) that will govern the escrow agreement. — Determine the applicable laws and regulations that will apply. — Address the resolution of any legal disputes that may arise. Different types of Bronx, New York checklist of matters to be considered in drafting an escrow agreement may include variations specific to different industries or transactions. For instance, real estate escrow agreements may have additional clauses related to property inspections, title insurance, closing costs, and mortgage contingencies. On the other hand, financial transactions may focus more on specific regulatory requirements and compliance procedures. Overall, it is crucial to tailor the checklist to the nature of the transaction, ensuring that all relevant aspects are addressed to protect the interests of the involved parties and facilitate a smooth and secure process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bronx New York Lista de verificación de asuntos a considerar en la redacción del acuerdo de depósito en garantía - Checklist of Matters to be Considered in Drafting Escrow Agreement

Description

How to fill out Bronx New York Lista De Verificación De Asuntos A Considerar En La Redacción Del Acuerdo De Depósito En Garantía?

Draftwing paperwork, like Bronx Checklist of Matters to be Considered in Drafting Escrow Agreement, to manage your legal affairs is a difficult and time-consumming task. A lot of situations require an attorney’s participation, which also makes this task expensive. Nevertheless, you can consider your legal affairs into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents intended for various scenarios and life circumstances. We make sure each document is in adherence with the laws of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Bronx Checklist of Matters to be Considered in Drafting Escrow Agreement form. Simply log in to your account, download the template, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before getting Bronx Checklist of Matters to be Considered in Drafting Escrow Agreement:

- Make sure that your form is compliant with your state/county since the rules for writing legal documents may vary from one state another.

- Find out more about the form by previewing it or going through a quick description. If the Bronx Checklist of Matters to be Considered in Drafting Escrow Agreement isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to begin utilizing our website and download the document.

- Everything looks good on your end? Click the Buy now button and select the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your template is all set. You can try and download it.

It’s easy to find and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!