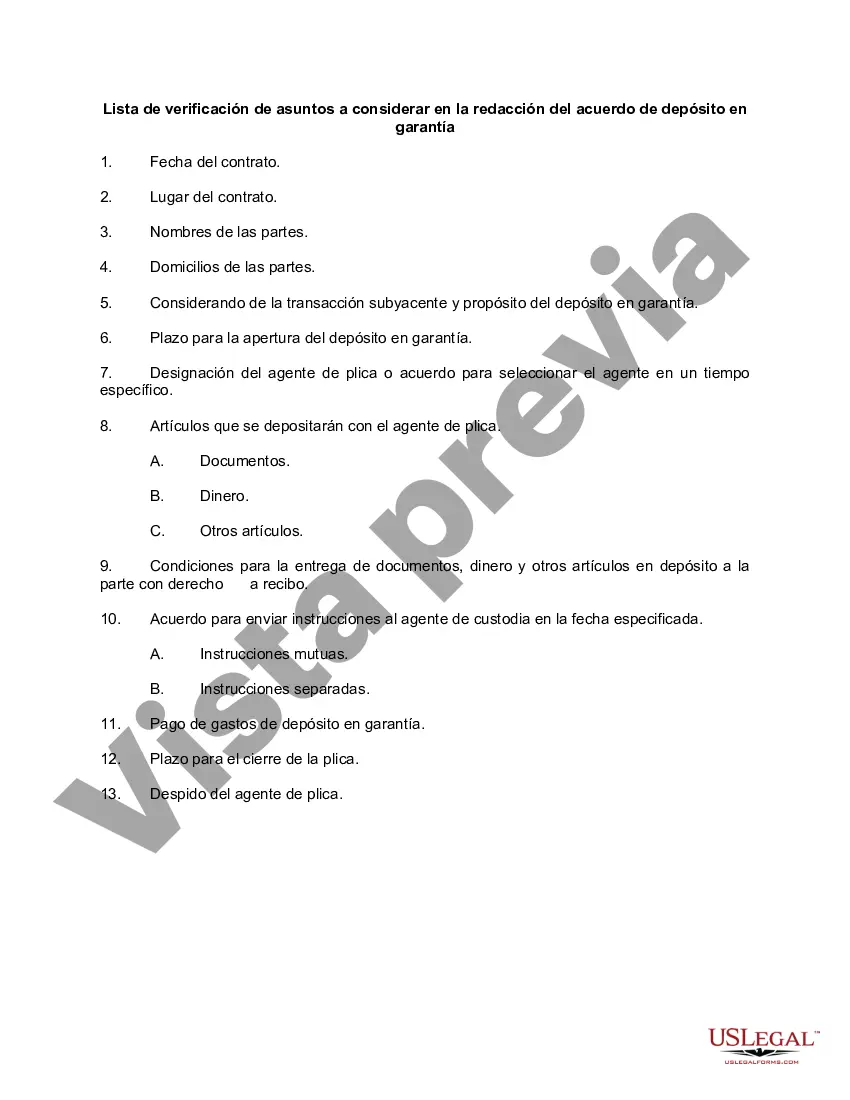

Chicago, Illinois is a bustling city known for its vibrant culture, diverse communities, and stunning architecture. As one of the largest cities in the United States, Chicago offers a wide range of activities, attractions, and opportunities for residents and visitors alike. When drafting an escrow agreement specific to Chicago, there are several matters to be considered to ensure a comprehensive and effective agreement. 1. Identification of Parties: Clearly outline the names and contact information of all parties involved in the escrow agreement, including the buyer, seller, escrow agent, and any other relevant parties. 2. Description of Es crowed Property: Provide a detailed description of the property or asset that is being held in escrow, including its address, legal description, and any other pertinent details. 3. Deposit Amount: Specify the amount of money or other assets that will be deposited into the escrow account, ensuring that it aligns with the terms of the underlying transaction. 4. Escrow Agent and Responsibilities: Clearly identify the chosen escrow agent and outline their roles and responsibilities in managing the escrow account, including the handling of funds, documentation, and communication with all parties involved. 5. Escrow Period: Define the duration of the escrow period, ensuring it allows sufficient time for all necessary inspections, approvals, and contingencies to be satisfied under the main agreement. 6. Conditions for Release of Funds: Establish the specific conditions or events that must occur for the funds or assets held in escrow to be released, such as the completion of inspections, satisfactory title search, or fulfillment of any agreed-upon conditions. 7. Dispute Resolution: Include provisions on how disputes related to the escrow agreement will be resolved, such as through mediation, arbitration, or litigation, with reference to the appropriate laws and regulations of the state of Illinois. 8. Escrow Fees and Expenses: Clearly state how the fees and expenses related to the escrow account, including the escrow agent's charges, will be handled and allocated among the parties involved. 9. Governing Law: Specify that the escrow agreement shall be governed by and interpreted in accordance with the laws of the state of Illinois. 10. Execution and Notarization: Outline the requirements for the proper execution and notarization of the escrow agreement, ensuring compliance with the laws of Illinois. It is worth noting that while the checklist above covers the essential matters to consider in drafting a Chicago, Illinois escrow agreement, there may be additional considerations based on the specific circumstances or requirements of the underlying transaction. Therefore, it is advisable to seek legal advice or consult with an experienced escrow professional to ensure all relevant details are adequately covered.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Lista de verificación de asuntos a considerar en la redacción del acuerdo de depósito en garantía - Checklist of Matters to be Considered in Drafting Escrow Agreement

Description

How to fill out Chicago Illinois Lista De Verificación De Asuntos A Considerar En La Redacción Del Acuerdo De Depósito En Garantía?

Do you need to quickly create a legally-binding Chicago Checklist of Matters to be Considered in Drafting Escrow Agreement or probably any other document to handle your personal or corporate matters? You can go with two options: contact a professional to write a valid document for you or draft it completely on your own. The good news is, there's another solution - US Legal Forms. It will help you receive professionally written legal documents without having to pay unreasonable prices for legal services.

US Legal Forms provides a huge collection of over 85,000 state-compliant document templates, including Chicago Checklist of Matters to be Considered in Drafting Escrow Agreement and form packages. We provide templates for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary document without extra hassles.

- To start with, carefully verify if the Chicago Checklist of Matters to be Considered in Drafting Escrow Agreement is adapted to your state's or county's regulations.

- In case the document includes a desciption, make sure to check what it's intended for.

- Start the search again if the form isn’t what you were seeking by using the search box in the header.

- Choose the subscription that best fits your needs and move forward to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Chicago Checklist of Matters to be Considered in Drafting Escrow Agreement template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Additionally, the templates we provide are reviewed by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!