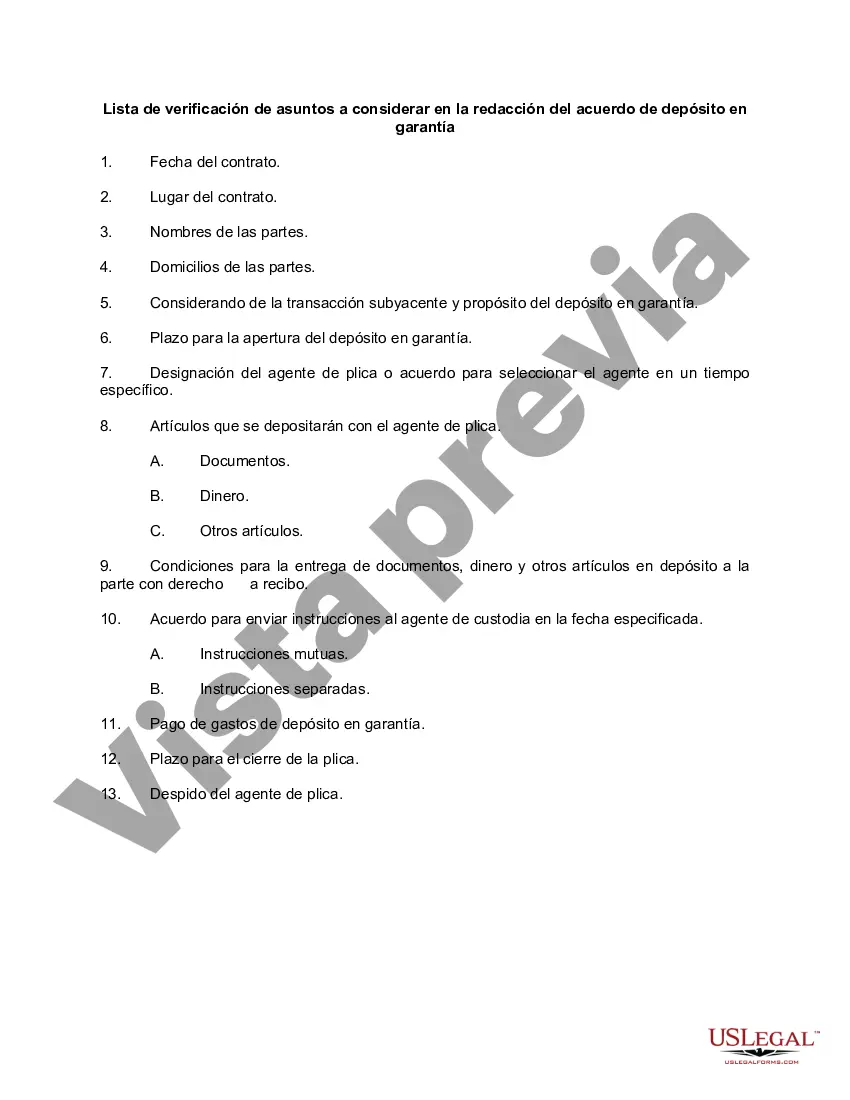

Title: A Detailed Description of Fairfax, Virginia: Checklist of Matters to be Considered in Drafting Escrow Agreements Introduction: Fairfax, Virginia is a well-known and vibrant city located in the heart of Northern Virginia. It offers a rich history, diverse communities, and a thriving economy. This article aims to provide a comprehensive checklist of matters to be considered when drafting an escrow agreement in Fairfax, Virginia. By adhering to these important considerations, individuals can ensure smooth and secure transactions within the state. 1. Parties Involved: — Clearly identify all parties involved in the escrow agreement (buyer, seller, and escrow agent) and their contact information. — Determine whether the escrow agent is a neutral third party or a designated individual/entity. 2. Escrow Funds: — Clearly state the amount of funds to be placed in the escrow account and the timeframe for depositing the funds. — Specify the terms for the disbursement or return of funds based on predetermined conditions. 3. Escrow Property/Assets: — Describe the property/assets that will be subject to the escrow agreement, such as real estate, intellectual property, or other tangible assets. — Determine the necessary documentation and proof of ownership required for successful escrow. 4. Escrow Period: — Define the duration of the escrow period, which may vary depending on the complexity of the transaction. — Determine any extensions or terminations allowed, along with respective penalties or consequences. 5. Terms and Conditions: — Clearly outline the terms and conditions agreed upon by all parties, such as obligations, warranties, representations, and restrictions. — Specify the consequences of non-compliance or any breach by any party. 6. Dispute Resolution: — Establish a dispute resolution mechanism, such as mediation, arbitration, or litigation, in case any conflicts arise during the escrow period. — Determine the jurisdiction for resolving disputes and applicable laws. 7. Record-Keeping and Confidentiality: — Outline the procedures for record-keeping, ensuring that all relevant documents are properly maintained and accessible by authorized parties. — Establish confidentiality rules with respect to sensitive information shared during the escrow process. 8. Closing and Release: — Clearly state the conditions and requirements that need to be fulfilled for the escrow to be considered closed. — Detail the process for releasing funds, assets, or other items held in escrow upon fulfillment of the agreed-upon terms. Types of Fairfax, Virginia Checklist for Drafting Escrow Agreements: 1. Real Estate Escrow Agreement Checklist: Focuses on matters specific to real estate transactions within Fairfax, Virginia, including property titles, mortgages, and zoning regulations. 2. Business Acquisition Escrow Agreement Checklist: Covers aspects related to the acquisition or merger of businesses operating in Fairfax, including financial disclosures, due diligence, and legal requirements. 3. Intellectual Property Escrow Agreement Checklist: Concentrates on safeguarding intellectual property assets within Fairfax, Virginia, involving patents, trademarks, copyrights, and trade secrets. Conclusion: Drafting an escrow agreement requires careful consideration of various factors unique to Fairfax, Virginia. By utilizing the checklist above, individuals can ensure compliance with relevant laws, protect their interests, and facilitate secure transactions in the dynamic and thriving city of Fairfax.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Lista de verificación de asuntos a considerar en la redacción del acuerdo de depósito en garantía - Checklist of Matters to be Considered in Drafting Escrow Agreement

Description

How to fill out Fairfax Virginia Lista De Verificación De Asuntos A Considerar En La Redacción Del Acuerdo De Depósito En Garantía?

Whether you plan to open your company, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Fairfax Checklist of Matters to be Considered in Drafting Escrow Agreement is fast and easy.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several more steps to get the Fairfax Checklist of Matters to be Considered in Drafting Escrow Agreement. Follow the instructions below:

- Make certain the sample fulfills your individual needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the correct one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Fairfax Checklist of Matters to be Considered in Drafting Escrow Agreement in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!