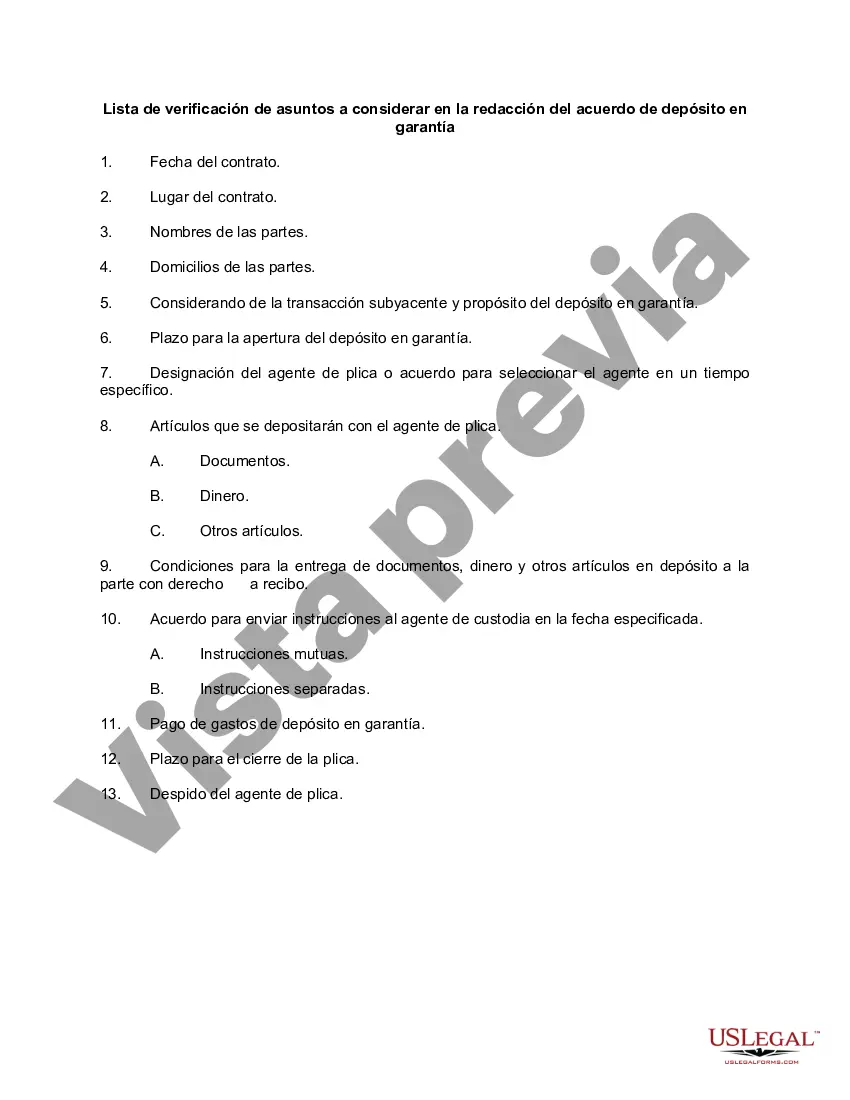

Fulton Georgia, also known as Fulton County in the state of Georgia, is a prominent area situated in the north-central part of the state. Known for its vibrant communities and thriving economy, Fulton Georgia is home to several cities including Atlanta, Sandy Springs, and Alpharetta. When it comes to drafting an escrow agreement in Fulton Georgia, there are various crucial matters that need to be considered. These matters ensure that the agreement aligns with the legal requirements and meets the needs of all parties involved. Here is a checklist of the key points to consider when drafting an escrow agreement in Fulton Georgia: 1. Identification: Clearly identify the parties involved in the escrow agreement, including the buyer, seller, and escrow agent. 2. Purpose: Define the purpose of the escrow agreement and specify the type of transaction it pertains to — such as real estate, legal disputes, or financial agreements. 3. Property or Funds: If the escrow agreement involves holding property or funds, provide detailed descriptions and the exact amounts involved, including any relevant account numbers. 4. Escrow Agent Duties: Outline the responsibilities and obligations of the escrow agent, including the handling and safekeeping of funds or property, disbursements, and record-keeping. 5. Terms and Conditions: Clearly state the terms and conditions of the escrow agreement, including the duration of the escrow period and any specific milestones or events that trigger actions or releases. 6. Conditions Precedent: Specify any conditions that must be met before the escrow agreement can be executed or funds or property can be released, such as satisfactory inspections or clear title. 7. Dispute Resolution: Define the procedure for resolving any disputes that may arise during the escrow period, including mediation, arbitration, or litigation. 8. Termination or Default: Include provisions for terminating the escrow agreement by mutual consent or in cases of non-performance or breach of the agreement by any party. 9. Confidentiality: Address the confidentiality of the escrow agreement and any sensitive information exchanged during the process. 10. Governing Law: Choose and specify the governing laws of Fulton Georgia that will apply to the escrow agreement. Different types of Fulton Georgia checklist of matters to be considered in drafting an escrow agreement may include specific industry-related agreements such as real estate escrow agreements, business acquisition escrow agreements, or even legal dispute settlement escrow agreements. Each type may have unique considerations based on the nature and purpose of the transaction involved. In conclusion, drafting an escrow agreement in Fulton Georgia requires careful attention to detail and consideration of various matters. By following a comprehensive checklist like the one provided, individuals can ensure that their escrow agreements are legally sound and meet the requirements of the parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Lista de verificación de asuntos a considerar en la redacción del acuerdo de depósito en garantía - Checklist of Matters to be Considered in Drafting Escrow Agreement

Description

How to fill out Fulton Georgia Lista De Verificación De Asuntos A Considerar En La Redacción Del Acuerdo De Depósito En Garantía?

Preparing legal documentation can be difficult. In addition, if you decide to ask an attorney to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Fulton Checklist of Matters to be Considered in Drafting Escrow Agreement, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario gathered all in one place. Therefore, if you need the latest version of the Fulton Checklist of Matters to be Considered in Drafting Escrow Agreement, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Fulton Checklist of Matters to be Considered in Drafting Escrow Agreement:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Fulton Checklist of Matters to be Considered in Drafting Escrow Agreement and download it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!