Hennepin County, Minnesota, is the most populous county in the state and home to the city of Minneapolis. It is known for its vibrant urban culture, stunning lakes, and diverse communities. When drafting an escrow agreement in Hennepin County, several important matters must be considered to ensure a legally binding and fair agreement. Here is a checklist of key factors to contemplate: 1. Parties Involved: Identify and provide accurate information about the parties involved in the escrow agreement, including the buyer, seller, and escrow agent. 2. Property Description: Clearly describe the property involved in the agreement, including its location, legal description, and any relevant details such as improvements or restrictions. 3. Purchase Price and Deposits: Specify the purchase price of the property and the amount of the initial deposit to be held in escrow. Consider issues like earnest money, down payments, and subsequent deposit schedules. 4. Inspection and Due Diligence: Define the timeframe and procedures for the buyer's inspection and due diligence activities, including property inspections, title search, and any necessary permits or approvals. 5. Contingencies: Determine any contingencies that must be met by either party before the escrow can be completed, such as financing or satisfactory property appraisal. 6. Escrow Instructions: Provide detailed instructions to the escrow agent regarding the disbursement of funds, transfer of title, and any specific conditions to be met before releasing funds or documents. 7. Prorations and Adjustments: Address prorations of property taxes, homeowner association fees, rent, or any other applicable expenses payable at closing, ensuring accuracy and fairness for both parties. 8. Timeframe and Termination Clause: Establish a reasonable timeframe for completing the escrow process and include provisions for terminating the agreement if specific conditions are not met or if parties wish to cancel. 9. Dispute Resolution: Specify the preferred method for resolving disputes, such as mediation or arbitration, to avoid costly litigation. 10. Governing Law and Jurisdiction: Clearly state the governing law (e.g., Minnesota state law) and select the appropriate jurisdiction (e.g., Hennepin County) for any legal actions related to the escrow agreement. When it comes to different types of Hennepin Minnesota Checklist of Matters to be Considered in Drafting Escrow Agreements, there may not be distinct categories, as the factors mentioned above generally apply to most escrow agreements. However, specific types of real estate transactions, such as residential, commercial, or land acquisitions, may require additional considerations based on the complexity and unique aspects of the transaction. Therefore, it's essential to tailor the checklist to the specific circumstances of the escrow agreement being drafted.

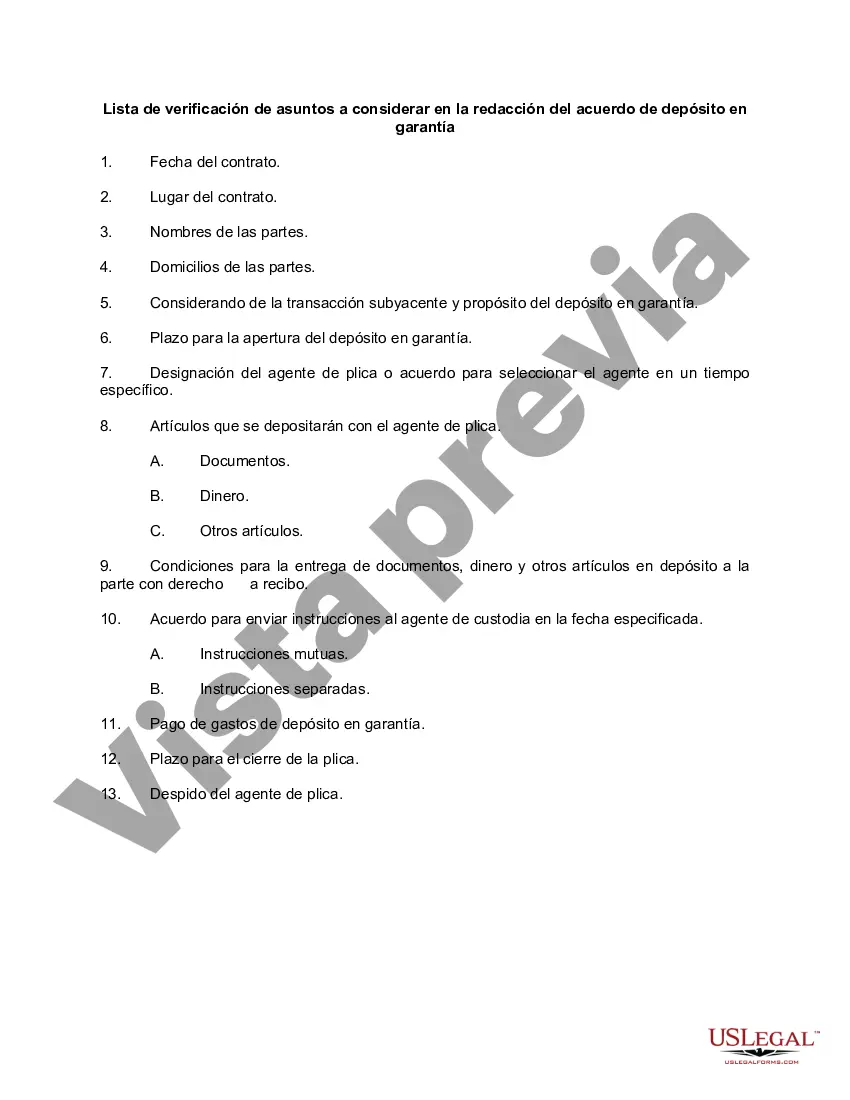

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Lista de verificación de asuntos a considerar en la redacción del acuerdo de depósito en garantía - Checklist of Matters to be Considered in Drafting Escrow Agreement

Description

How to fill out Hennepin Minnesota Lista De Verificación De Asuntos A Considerar En La Redacción Del Acuerdo De Depósito En Garantía?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to create some of them from the ground up, including Hennepin Checklist of Matters to be Considered in Drafting Escrow Agreement, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in various categories ranging from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find information materials and guides on the website to make any tasks related to document completion straightforward.

Here's how you can purchase and download Hennepin Checklist of Matters to be Considered in Drafting Escrow Agreement.

- Take a look at the document's preview and outline (if provided) to get a basic information on what you’ll get after getting the form.

- Ensure that the document of your choosing is specific to your state/county/area since state laws can impact the validity of some documents.

- Examine the related forms or start the search over to locate the appropriate document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and buy Hennepin Checklist of Matters to be Considered in Drafting Escrow Agreement.

- Select to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Hennepin Checklist of Matters to be Considered in Drafting Escrow Agreement, log in to your account, and download it. Of course, our website can’t take the place of a lawyer completely. If you have to deal with an exceptionally complicated situation, we advise getting a lawyer to review your document before executing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Become one of them today and purchase your state-compliant paperwork with ease!