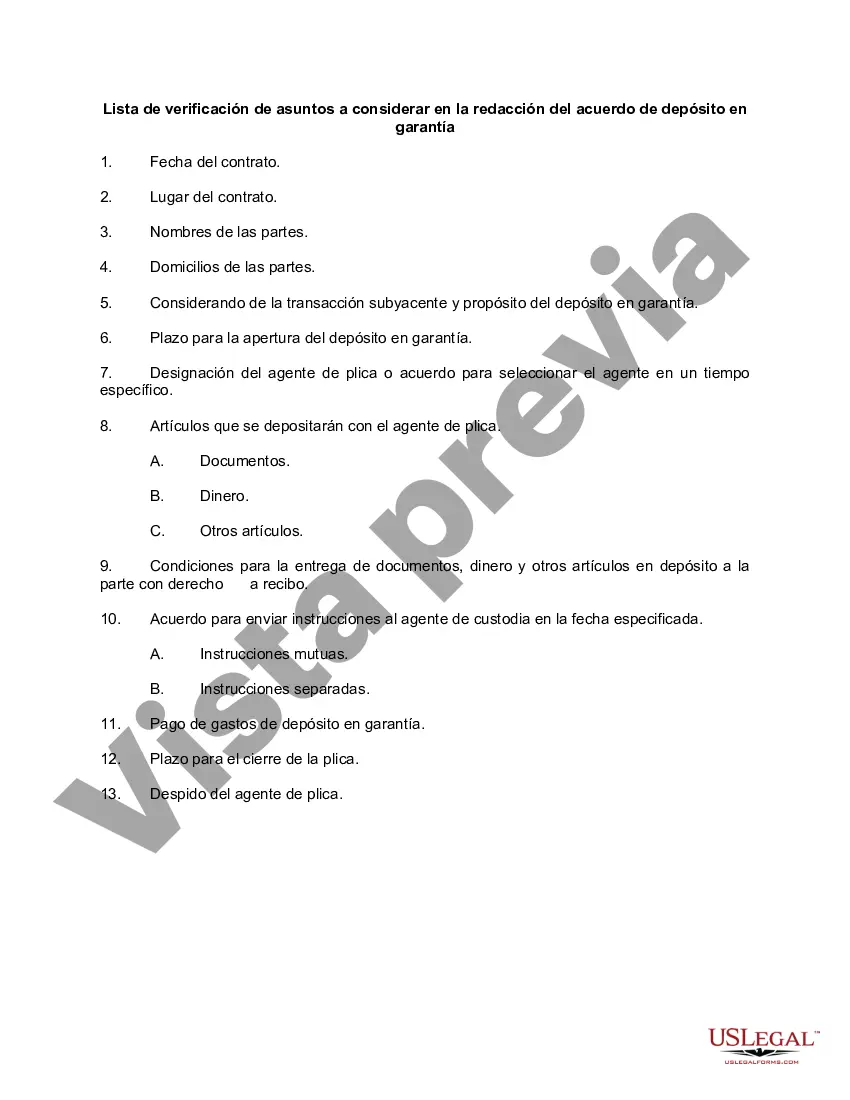

Title: Houston, Texas: A Comprehensive Checklist for Drafting an Escrow Agreement Introduction: Houston, Texas, known as the "Space City" or the "Energy Capital of the World," is a vibrant metropolis and a significant economic hub. When it comes to real estate transactions, mergers, or other financial dealings, an escrow agreement serves as a vital tool to ensure a smooth and secure process. This checklist outlines key matters to consider when drafting a Houston, Texas escrow agreement. 1. Identification of Parties: — Clearly define the parties involved: the depositor, beneficiary, and escrow agent. — Include their full legal names, addresses, and contact information. 2. Detailed Description of the Transaction: — Explain the nature and purpose of the escrow agreement concisely. — Specify the terms, conditions, and timeline of the transaction. — Clarify any contingencies or special provisions. 3. Es crowed Property: — Provide a comprehensive description of the property, product, or documents to be held in escrow. — Include any relevant identification numbers, such as purchase agreement or contract details. 4. Escrow Agent's Duties and Responsibilities: — Clearly outline the role and responsibilities of the escrow agent. — Specify any reporting requirements, including financial statements or updates during the escrow period. — Define the scope of disbursements and the agent's decision-making authority. 5. Escrow Funding: — Clearly state the amount of funds, if applicable, to be held in escrow. — Specify the method of initial funding and subsequent disbursement instructions. — Establish clear guidelines regarding interest, if any, to be earned on the funds. 6. Escrow Termination: — Define the conditions under which the escrow agreement can be terminated. — Establish the process for the release or return of BS crowed property or funds. — Discuss any provisions for dispute resolution or mediation. 7. Confidentiality and Data Protection: — Address the handling of sensitive or confidential information. — Ensure compliance with relevant federal, state, and local data protection laws. — Consider additional measures to safeguard personal or proprietary information. 8. Governing Law and Jurisdiction: — Specify the governing law of the escrow agreement, which is typically Texas state law. — Determine the jurisdiction where any conflicts or disputes regarding the escrow agreement will be resolved. 9. Indemnification and Liability: — Establish the limits, liabilities, and responsibilities of each party in case of breaches or damages. — Define the indemnification obligations of the escrow agent in case of errors or omissions. Types of Houston, Texas Escrow Agreements: 1. Real Estate Escrow Agreement: — Involves the purchase or sale of residential or commercial property in Houston, Texas. — Additional considerations may include property inspections, loan disbursements, and title transfers. 2. M&A Escrow Agreement: — Relates to merger and acquisition transactions involving Houston-based businesses. — Unique considerations may include post-closing adjustments, earn-outs, and dispute resolution. 3. Construction Escrow Agreement: — Pertains to construction projects in Houston, Texas, ensuring funds are disbursed according to contractual milestones. — Additional considerations may include release of liens, change orders, and retain age amounts. Closing Remarks: Drafting an escrow agreement in Houston, Texas requires careful attention to detail to protect the interests of all parties involved. By addressing the checklist above and considering the specific type of escrow agreement required, you can lay a solid foundation for a successful transaction in the dynamic city of Houston.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Lista de verificación de asuntos a considerar en la redacción del acuerdo de depósito en garantía - Checklist of Matters to be Considered in Drafting Escrow Agreement

Description

How to fill out Houston Texas Lista De Verificación De Asuntos A Considerar En La Redacción Del Acuerdo De Depósito En Garantía?

Draftwing forms, like Houston Checklist of Matters to be Considered in Drafting Escrow Agreement, to manage your legal matters is a tough and time-consumming task. A lot of situations require an attorney’s participation, which also makes this task expensive. Nevertheless, you can take your legal issues into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents intended for various cases and life situations. We ensure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Houston Checklist of Matters to be Considered in Drafting Escrow Agreement form. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before getting Houston Checklist of Matters to be Considered in Drafting Escrow Agreement:

- Ensure that your form is compliant with your state/county since the regulations for writing legal paperwork may vary from one state another.

- Find out more about the form by previewing it or going through a quick intro. If the Houston Checklist of Matters to be Considered in Drafting Escrow Agreement isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to begin using our service and download the form.

- Everything looks great on your side? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment information.

- Your form is good to go. You can try and download it.

It’s easy to locate and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!