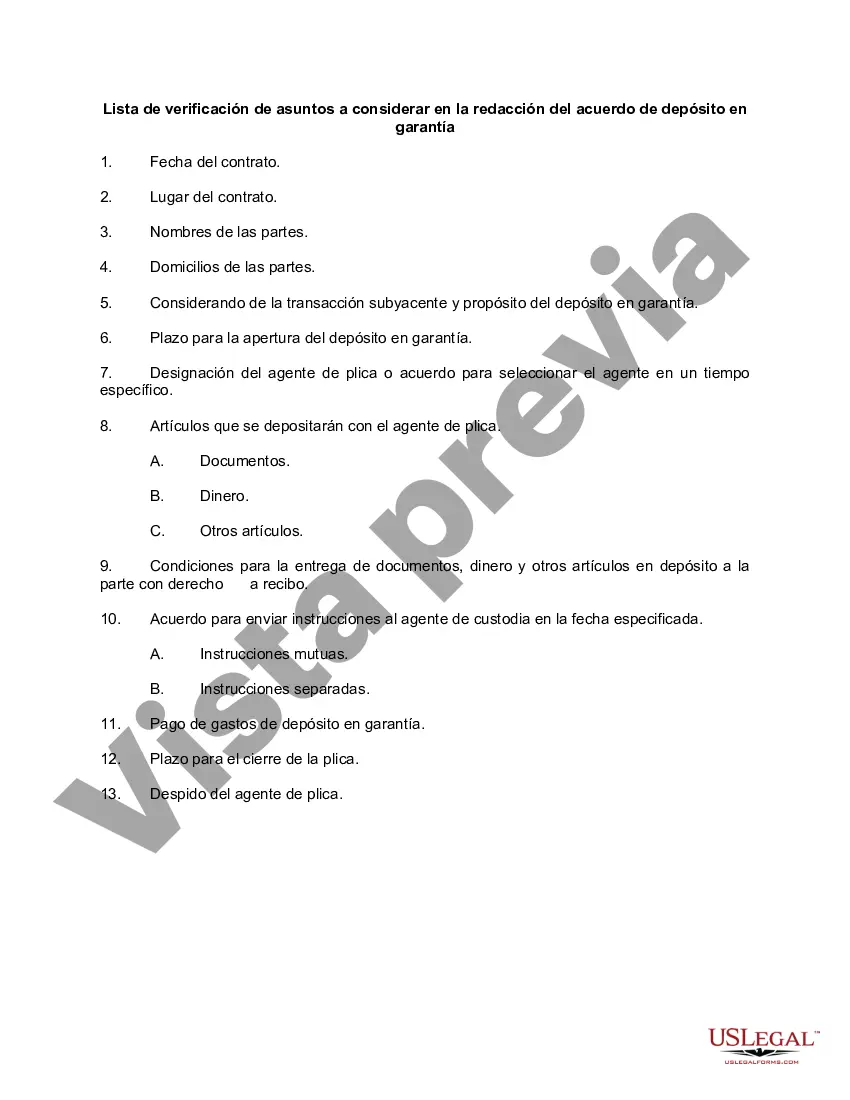

Oakland County, Michigan is a vibrant region located in the southeastern part of the state. Known for its diverse communities and natural beauty, Oakland County offers a range of attractions, businesses, and recreational opportunities. When drafting an escrow agreement within Oakland County, certain matters need to be considered to ensure a smooth and secure transaction. Here is a checklist of key factors to address when creating an Oakland, Michigan escrow agreement: 1. Parties involved: Clearly identify the buyer, seller, and escrow holder, including their names, contact details, and roles in the transaction. 2. Property details: Provide an accurate description of the property, including its address, legal description, and any additional information necessary for identification. 3. Purchase price and payment terms: Specify the agreed-upon purchase price, deposit amount, installment payments (if applicable), and any conditions for releasing funds from escrow. 4. Contingencies and conditions: Outline any contingencies, such as inspection, appraisal, financing, or title-related issues, and the timelines associated with each contingency. 5. Escrow agent duties: Define the responsibilities and obligations of the escrow agent, including the receipt and safekeeping of funds, compliance with applicable laws, and the proper handling of documents. 6. Escrow timeline: Establish the timeframe for the escrow period, including the opening date, scheduled events, and the anticipated closing date. 7. Title and closing: Address the requirements for obtaining title insurance, closing documents, and the distribution of funds upon successful completion of the transaction. 8. Dispute resolution: Specify a process for resolving any disputes that may arise during the escrow period, such as mediation, arbitration, or litigation, and which jurisdiction's laws will apply. 9. Termination or cancellation: Define the conditions under which the escrow agreement can be terminated, including the refund of any deposits or fees paid, and the circumstances that would result in a forfeit of funds. 10. Confidentiality and data protection: Discuss the privacy measures and protection of confidential information during the escrow process. 11. Governing law: Determine the applicable laws governing the escrow agreement and clarify any specific legal requirements for escrow transactions in Oakland County, Michigan. It is important to note that while Oakland County, Michigan does not have multiple types of checklists for drafting an escrow agreement, these considerations should be addressed when creating any escrow agreement within the county's jurisdiction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Lista de verificación de asuntos a considerar en la redacción del acuerdo de depósito en garantía - Checklist of Matters to be Considered in Drafting Escrow Agreement

Description

How to fill out Oakland Michigan Lista De Verificación De Asuntos A Considerar En La Redacción Del Acuerdo De Depósito En Garantía?

Do you need to quickly create a legally-binding Oakland Checklist of Matters to be Considered in Drafting Escrow Agreement or probably any other document to take control of your personal or business affairs? You can select one of the two options: contact a legal advisor to write a legal paper for you or create it completely on your own. Luckily, there's another solution - US Legal Forms. It will help you receive professionally written legal papers without paying unreasonable fees for legal services.

US Legal Forms offers a rich collection of more than 85,000 state-specific document templates, including Oakland Checklist of Matters to be Considered in Drafting Escrow Agreement and form packages. We offer templates for a myriad of use cases: from divorce papers to real estate documents. We've been on the market for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the needed template without extra troubles.

- First and foremost, double-check if the Oakland Checklist of Matters to be Considered in Drafting Escrow Agreement is tailored to your state's or county's laws.

- In case the document comes with a desciption, make sure to check what it's suitable for.

- Start the searching process over if the form isn’t what you were looking for by using the search bar in the header.

- Choose the plan that is best suited for your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Oakland Checklist of Matters to be Considered in Drafting Escrow Agreement template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to find and download legal forms if you use our services. Moreover, the paperwork we offer are updated by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!