Lima, Arizona, is a vibrant and rapidly-growing community located in Graham County. When it comes to drafting an Escrow Agreement for transactions in Lima, there are several crucial matters to be considered. This checklist ensures that all the necessary elements are included to protect the interests of all parties involved. 1. Identification and Contact Information: Begin the Escrow Agreement by clearly stating the names, addresses, and contact details of all parties involved, including the buyer, seller, and escrow agent. 2. Nature of the Transaction: Describe the purpose of the escrow agreement, whether it is for the sale of real estate, a business transaction, or any other specific transaction. Clearly state the intended outcome and goals. 3. Escrow Agent's Duties and Obligations: Specify the responsibilities of the escrow agent, including the handling and safeguarding of funds, documents, and any other assets involved in the transaction. Clearly outline the timelines and conditions under which the escrow agent becomes responsible and accountable. 4. Escrow Instructions: Include detailed escrow instructions, which serve as guidelines for the escrow agent's actions throughout the transaction. These instructions should cover all essential aspects such as the disbursement of funds, conditions for release, and any necessary notifications. 5. Title Conditions and Requirements: If the escrow agreement involves real estate, provide comprehensive details about title commitments, title insurance, and any other relevant conditions or requirements related to the transfer of property ownership. 6. Inspection and Due Diligence: Specify any inspection or due diligence requirements that need to be completed before the transaction can proceed. This may include property appraisals, environmental assessments, or any other assessments required by law or agreed upon by the parties involved. 7. Contingencies and Termination: Outline any contingencies that may affect the escrow agreement and the conditions under which it can be terminated. Specify the actions required by each party in case of termination and any associated penalties or costs. 8. Dispute Resolution: Define the process for resolving any disputes or disagreements that may arise during the transaction. Include provisions for mediation, arbitration, or any other alternatives to litigation, if desired. 9. Confidentiality: Highlight the importance of maintaining confidentiality throughout the escrow process. Emphasize the confidentiality of all parties' financial information, trade secrets, and any other sensitive details. 10. Additional Provisions: Include any additional provisions specific to the transaction or as required by law. These may include tax obligations, insurance requirements, or any other relevant legal or regulatory obligations. Different types of Lima Arizona Checklist of Matters to be Considered in Drafting Escrow Agreements may include variations that pertain to specific industries or transactions. For example, there could be a separate checklist for real estate transactions, business acquisitions, or even intellectual property transfers. These specific checklists would address industry-specific considerations and requirements while incorporating the general matters outlined above.

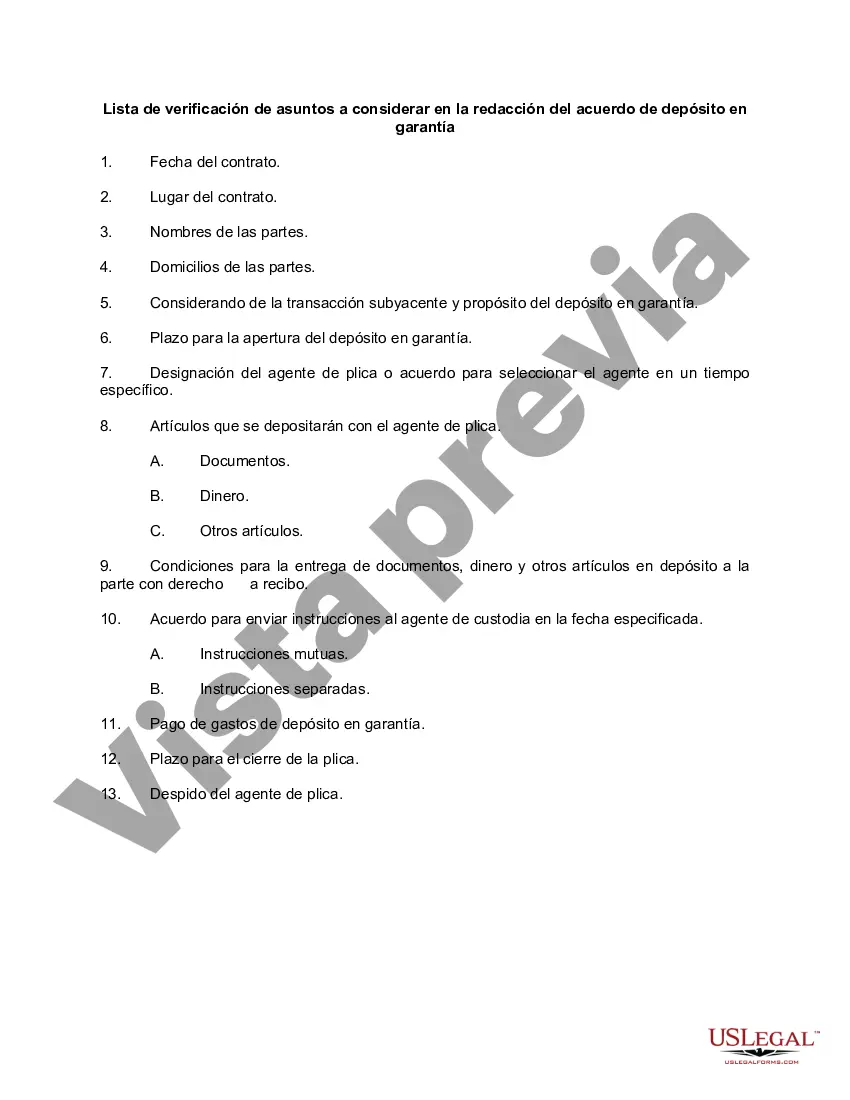

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Lista de verificación de asuntos a considerar en la redacción del acuerdo de depósito en garantía - Checklist of Matters to be Considered in Drafting Escrow Agreement

Description

How to fill out Pima Arizona Lista De Verificación De Asuntos A Considerar En La Redacción Del Acuerdo De Depósito En Garantía?

Drafting documents for the business or individual demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to create Pima Checklist of Matters to be Considered in Drafting Escrow Agreement without professional assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Pima Checklist of Matters to be Considered in Drafting Escrow Agreement on your own, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the Pima Checklist of Matters to be Considered in Drafting Escrow Agreement:

- Look through the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that suits your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any use case with just a couple of clicks!