San Bernardino, California is a city located in the Inland Empire region of Southern California. It is the county seat of San Bernardino County and is known for its scenic beauty, diverse culture, and significant historical heritage. Major keywords that may be useful in writing a detailed description of San Bernardino, California, and creating a checklist of matters to be considered in drafting an escrow agreement in this area include: 1. Location: San Bernardino is situated approximately 60 miles east of Los Angeles, making it easily accessible by major highways, such as the I-10 and I-215. This factor should be considered while drafting an escrow agreement for a property within the city. 2. Demographics: San Bernardino has a population of over 200,000 people, representing a diverse mix of different ethnicities and cultures. It is crucial to acknowledge this diversity and ensure that the escrow agreement caters to the specific needs and requirements of the individuals involved. 3. Real Estate Market: The real estate market in San Bernardino, like many other parts of California, can be highly competitive and subject to fluctuating trends. The checklist should include considerations for property appraisals, inspections, title searches, insurance, and compliance with local regulations or restrictions. 4. Escrow Agent: It is essential to select a reputable and licensed escrow agent to handle the transaction. The checklist should specify the qualifications, licensing, and credentials required for the escrow agent, along with their responsibilities and obligations throughout the agreement. 5. Purchase Price and Deposits: The agreement should outline the purchase price of the property and include provisions regarding the handling and release of deposits to protect both parties' interests. 6. Clear Title: The checklist should incorporate checks for clear title, including the requirement for a preliminary title report or title insurance to ensure that there are no outstanding liens, encumbrances, or legal issues related to the property. 7. Contingencies: Consider including contingencies in the escrow agreement to provide protection for both the buyer and the seller. These may include contingencies related to financing, inspections, repairs, or any other specified terms. 8. Timeframes: The agreement should establish clear timelines for the various milestones in the escrow process, such as the provision of disclosures, completion of inspections, obtaining financing, and finalizing the transaction. 9. Taxes and Fees: Include a checklist of relevant taxes and fees associated with the purchase and escrow process, such as transfer taxes, escrow fees, recording fees, and any other local or state-specific charges. 10. Termination and Dispute Resolution: Consider including provisions for termination of the escrow agreement if necessary and outline the method of resolving disputes, either through mediation, arbitration, or in a court of law. Different types of San Bernardino, California, Checklist of Matters to be Considered in Drafting Escrow Agreements may include residential property escrow agreements, commercial property escrow agreements, vacant land escrow agreements, and investment property escrow agreements, each having specific considerations depending on the nature of the property and transaction involved.

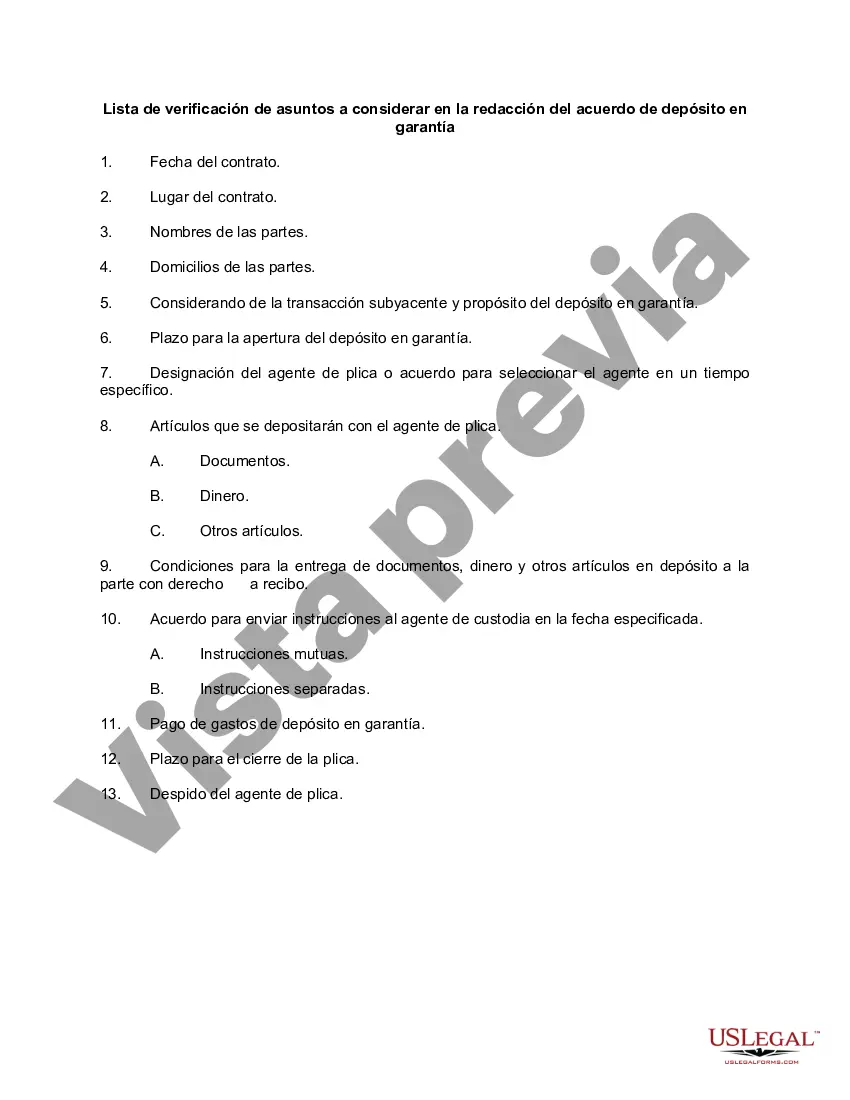

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Bernardino California Lista de verificación de asuntos a considerar en la redacción del acuerdo de depósito en garantía - Checklist of Matters to be Considered in Drafting Escrow Agreement

Description

How to fill out San Bernardino California Lista De Verificación De Asuntos A Considerar En La Redacción Del Acuerdo De Depósito En Garantía?

Creating paperwork, like San Bernardino Checklist of Matters to be Considered in Drafting Escrow Agreement, to take care of your legal matters is a tough and time-consumming task. A lot of cases require an attorney’s participation, which also makes this task expensive. Nevertheless, you can acquire your legal matters into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents created for various cases and life circumstances. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the San Bernardino Checklist of Matters to be Considered in Drafting Escrow Agreement form. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your document? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before downloading San Bernardino Checklist of Matters to be Considered in Drafting Escrow Agreement:

- Ensure that your document is compliant with your state/county since the regulations for writing legal documents may differ from one state another.

- Discover more information about the form by previewing it or going through a brief intro. If the San Bernardino Checklist of Matters to be Considered in Drafting Escrow Agreement isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin using our service and get the form.

- Everything looks great on your end? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment information.

- Your form is good to go. You can go ahead and download it.

It’s easy to locate and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!