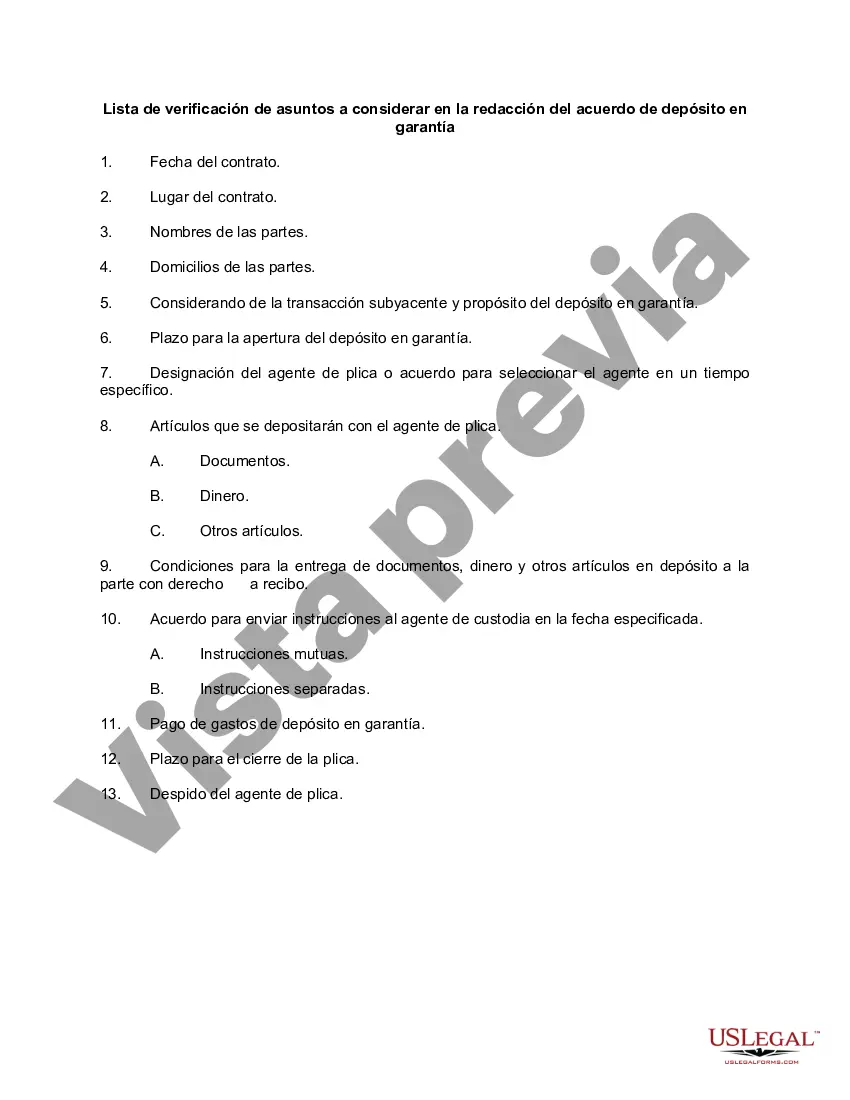

San Jose California Lista de verificación de asuntos a considerar en la redacción del acuerdo de depósito en garantía - Checklist of Matters to be Considered in Drafting Escrow Agreement

Description

How to fill out Lista De Verificación De Asuntos A Considerar En La Redacción Del Acuerdo De Depósito En Garantía?

Navigating legal documents is essential in the current era.

However, seeking professional assistance to create some from scratch, such as the San Jose Checklist of Considerations for Composing an Escrow Agreement, isn't always necessary with a service like US Legal Forms.

US Legal Forms offers over 85,000 documents in diverse categories, from living wills and property agreements to divorce forms. All documents are sorted by their applicable state, simplifying the search process.

For current subscribers of US Legal Forms, you can find the correct San Jose Checklist of Considerations for Composing an Escrow Agreement, Log In to your account, and download it. Naturally, our platform shouldn't replace a lawyer entirely. If faced with a particularly complex situation, we recommend seeking a lawyer's service to review your document prior to filing or executing it.

With over 25 years in the industry, US Legal Forms has become a reliable source for a variety of legal documents for millions of clients. Join today and easily obtain your state-compliant forms!

- Review the document's preview and description (if provided) to gain a basic understanding of what you will receive post-download.

- Verify that the selected document pertains to your state/county/region, as state regulations can influence the legal effectiveness of certain documents.

- Investigate related forms or restart the search to find the correct file.

- Click Buy now and create your account. If you have an existing account, proceed to Log In.

- Select the appropriate option, then a compatible payment method, and acquire the San Jose Checklist of Considerations for Composing an Escrow Agreement.

- Opt to save the form template in any supported file type.

- Navigate to the My documents section to re-download the document.