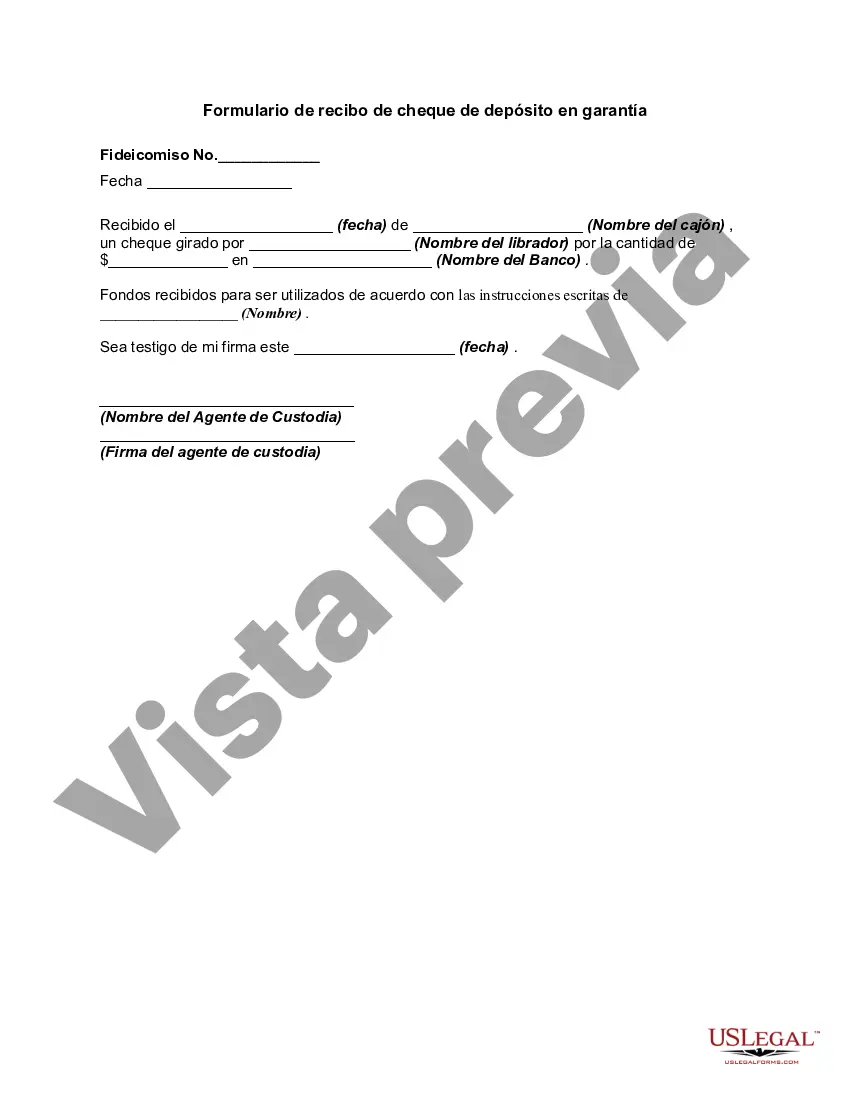

The Alameda California Escrow Check Receipt Form is a legal document used in the real estate industry to acknowledge the receipt of funds during an escrow transaction within the city of Alameda, California. This detailed description will shed light on the purpose, components, and variations of this form. Escrow refers to a process where a neutral third party, such as a title company, holds funds and documents on behalf of the buyer and seller during a real estate transaction. The Alameda California Escrow Check Receipt Form is specifically designed for recording the receipt of checks and other monetary instruments exchanged during this process. The main purpose of this form is to maintain a clear record of all financial transactions related to the escrow process. It provides transparency, accountability, and legal protection for both the parties involved. This form acts as evidence that the specified funds have been received and are securely held by the escrow officer. The Alameda California Escrow Check Receipt Form typically includes the following essential components: 1. Escrow Information: Identifies the escrow company's name, address, and contact information. This section may also include the escrow number, date, and parties involved in the transaction. 2. Check Details: Lists the details of the check(s) received, such as the check number, date, issuer's name, and amount. If multiple checks are involved, they are listed separately for better clarity. 3. Payee Information: Specifies the name, address, and contact details of the payee or recipient of the check(s). This could be the buyer, seller, or any other relevant party. 4. Signature and Date: Includes spaces for the payee's signature, date of receipt, and the escrow officer's signature upon the verification of the funds. While there may not be different types of Alameda California Escrow Check Receipt Forms per se, slight variations may exist depending on the escrow company or the specific requirements of the transaction. However, their core purpose and content remain consistent: to document the receipt of funds during the Alameda escrow process. In conclusion, the Alameda California Escrow Check Receipt Form serves as a crucial documentation tool in real estate transactions. It ensures transparency and legal protection by confirming the receipt of funds exchanged during the escrow process. Both buyers and sellers can rely on this form to maintain a clear record of financial transactions and meet legal obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Formulario de recibo de cheque de depósito en garantía - Escrow Check Receipt Form

Description

How to fill out Alameda California Formulario De Recibo De Cheque De Depósito En Garantía?

Whether you intend to open your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Alameda Escrow Check Receipt Form is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few more steps to obtain the Alameda Escrow Check Receipt Form. Follow the guidelines below:

- Make certain the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample when you find the correct one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Alameda Escrow Check Receipt Form in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!